November 29, 2021

Golden Deeps Limited (“Golden Deeps” or “Company”) is very pleased to announce very high-grade copper-lead-silver and vanadium intersections from the first diamond drillhole at the Nosib Block (“Nosib”) Prospect, located in the Otavi Mountain Land of northern Namibia (see location Figure 3).

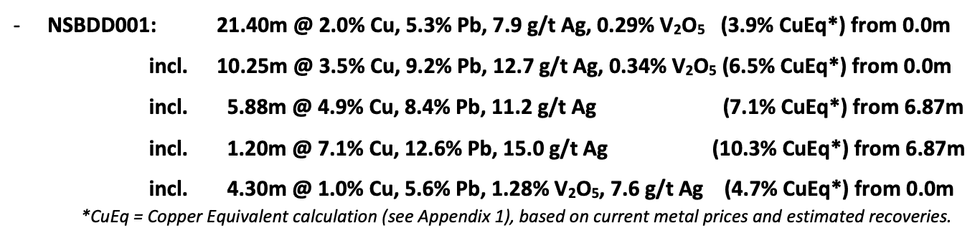

Diamond drill hole, NSBDD001, intersected a thick, stratabound, conglomerate/arenite hosted zone of mineralisation from surface to approximately 46m downhole depth that included a strongly mineralised zone of oxide/supergene mineralisation from surface that produced the following very high-grade intersections (see cross section, Figure 1):

Golden Deeps CEO, Jon Dugdale, commented:

“The Nosib diamond hole intersection, NSBDD001, confirms the discovery of very-high-grade copper, lead, silver and vanadium mineralisation from surface and that mineralisation extends across the entire, 45m thick, conglomerate-arenite host unit.

“Deeper drillhole, NSBDD003, has intersected similar thicknesses of sulphide mineralisation, which appears to be strengthening at depth, with up to 6 percent copper in spot XRF readings on drillcore.

“We see potential here to not only define a shallow, open-pitable, resource of copper, lead and vanadium but also an opportunity to discover a high-grade copper - silver ore-body at depth.

“Copper, lead and vanadium are key battery metals and Golden Deeps has the opportunity to become a key player in the supply of battery pre-cursors for the rapidly growing EV and renewables markets.”

Click here for the full ASX release

This article includes content from Golden Deeps, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GED:AU

The Conversation (0)

18h

Faraday Copper Signs LOI to Acquire BHP’s San Manuel Property in Arizona

Faraday Copper (TSX:FDY,OTCQX:CPPKF) has signed a letter of intent (LOI) to acquire BHP's (ASX:BHP,NYSE:BHP,LSE:BHP) San Manuel property, which sits next to its Copper Creek project in Arizona. The company says the move will combine the two adjacent assets into a single US-focused copper... Keep Reading...

23 February

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

23 February

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00