November 30, 2022

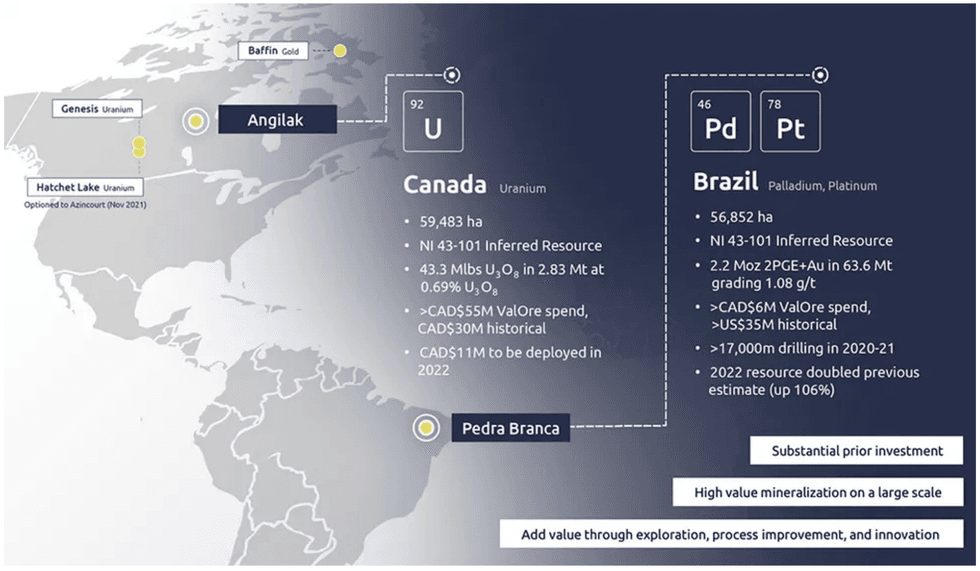

ValOre Metals (TSX:VO) focuses on high-quality metals and projects. The company's flagship uranium asset Angilak is located in Nunavut, Canada, covers 59,583 hectares, and has district-scale potential for uranium along with precious and base metals. The company is also exploring its Brazilian project targeting PGEs and gold.

The Angilak project has significant upside potential due to its land area and deposits. The area represents Canada’s highest grade uranium resource outside Saskatchewan and one of the highest grade uranium resources on a global basis, according to ValOre VP of exploration Colin Smith.

ValOre Metals is also exploring its Pedra Branca PGE project in northeastern Brazil. As another district-scale mining project, the asset covers 56,852 hectares with multiple PGE and gold deposits. Ownership of the asset gives ValOre control of an entire PGE belt. The company has three additional projects for future exploration: Hatchet Lake, Baffin Gold and Genesis.

The company a member of the Discovery Group, an alliance of nine publicly traded companies with a track record of successfully increasing shareholder value, often through tactful exits via mergers and acquisitions.

Company Highlights

- ValOre Metals is a Canadian exploration mining company focusing on district-scale, high-grade assets with uranium, PGE and gold deposits.

- The company is a member of the Discovery Group, an alliance of publicly traded companies striving to improve shareholder value through mergers and acquisitions.

- The Discovery Group has a track record of successful mergers and acquisitions that directly increase shareholder value. ValOre’s management team was involved in many of the Discovery Group’s notable transactions.

- The Angilak uranium project in Canada includes one of the highest-grade uranium deposits on a global scale. In addition, the project includes multiple notable uranium deposits, many of which reach the surface for straightforward extraction.

- ValOre’s Pedra Branca PGE-gold project in Brazil represents another district-scale opportunity and gives the company complete control over an entire PGE belt.

- An experienced management team with expertise in all aspects of the mining industry leads the company toward its goal of improving shareholder value.

This ValOre Metals profile is part of a paid investor education campaign.*

Click here to connect with ValOre Metals (TSX:VO) to receive an Investor Presentation

VO:TCM

The Conversation (0)

29 November 2022

Valore Metals

Exploring District-Scale Uranium, PGE & Gold Projects

Exploring District-Scale Uranium, PGE & Gold Projects Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00