November 30, 2022

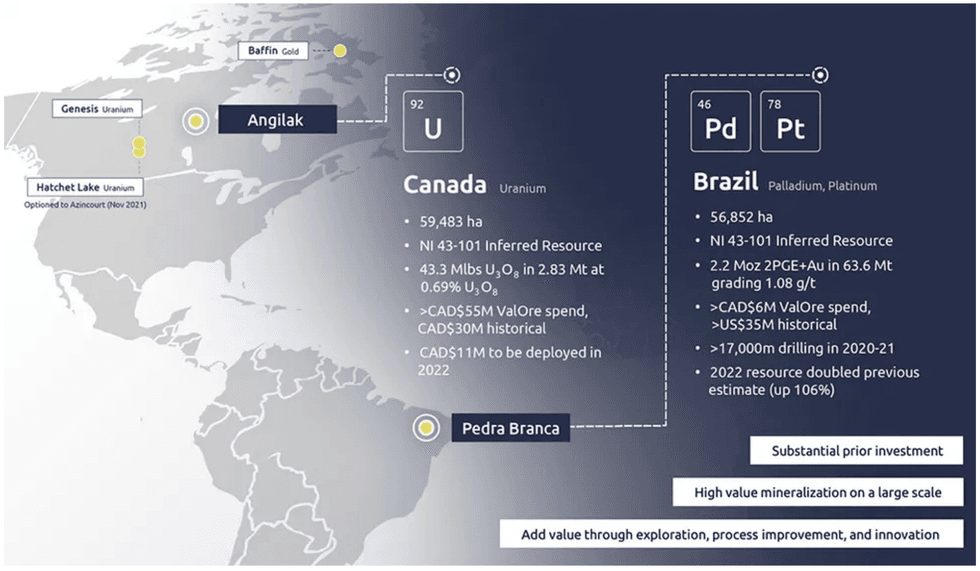

ValOre Metals (TSX:VO) focuses on high-quality metals and projects. The company's flagship uranium asset Angilak is located in Nunavut, Canada, covers 59,583 hectares, and has district-scale potential for uranium along with precious and base metals. The company is also exploring its Brazilian project targeting PGEs and gold.

The Angilak project has significant upside potential due to its land area and deposits. The area represents Canada’s highest grade uranium resource outside Saskatchewan and one of the highest grade uranium resources on a global basis, according to ValOre VP of exploration Colin Smith.

ValOre Metals is also exploring its Pedra Branca PGE project in northeastern Brazil. As another district-scale mining project, the asset covers 56,852 hectares with multiple PGE and gold deposits. Ownership of the asset gives ValOre control of an entire PGE belt. The company has three additional projects for future exploration: Hatchet Lake, Baffin Gold and Genesis.

The company a member of the Discovery Group, an alliance of nine publicly traded companies with a track record of successfully increasing shareholder value, often through tactful exits via mergers and acquisitions.

Company Highlights

- ValOre Metals is a Canadian exploration mining company focusing on district-scale, high-grade assets with uranium, PGE and gold deposits.

- The company is a member of the Discovery Group, an alliance of publicly traded companies striving to improve shareholder value through mergers and acquisitions.

- The Discovery Group has a track record of successful mergers and acquisitions that directly increase shareholder value. ValOre’s management team was involved in many of the Discovery Group’s notable transactions.

- The Angilak uranium project in Canada includes one of the highest-grade uranium deposits on a global scale. In addition, the project includes multiple notable uranium deposits, many of which reach the surface for straightforward extraction.

- ValOre’s Pedra Branca PGE-gold project in Brazil represents another district-scale opportunity and gives the company complete control over an entire PGE belt.

- An experienced management team with expertise in all aspects of the mining industry leads the company toward its goal of improving shareholder value.

This ValOre Metals profile is part of a paid investor education campaign.*

Click here to connect with ValOre Metals (TSX:VO) to receive an Investor Presentation

VO:TCM

The Conversation (0)

29 November 2022

Valore Metals

Exploring District-Scale Uranium, PGE & Gold Projects

Exploring District-Scale Uranium, PGE & Gold Projects Keep Reading...

12h

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00