May 22, 2022

Global Oil & Gas Limited is pleased to announce that Western Gas (“WGC”) has provided an operational update on the drilling of the Sasanof-1 exploration well.

Highlights

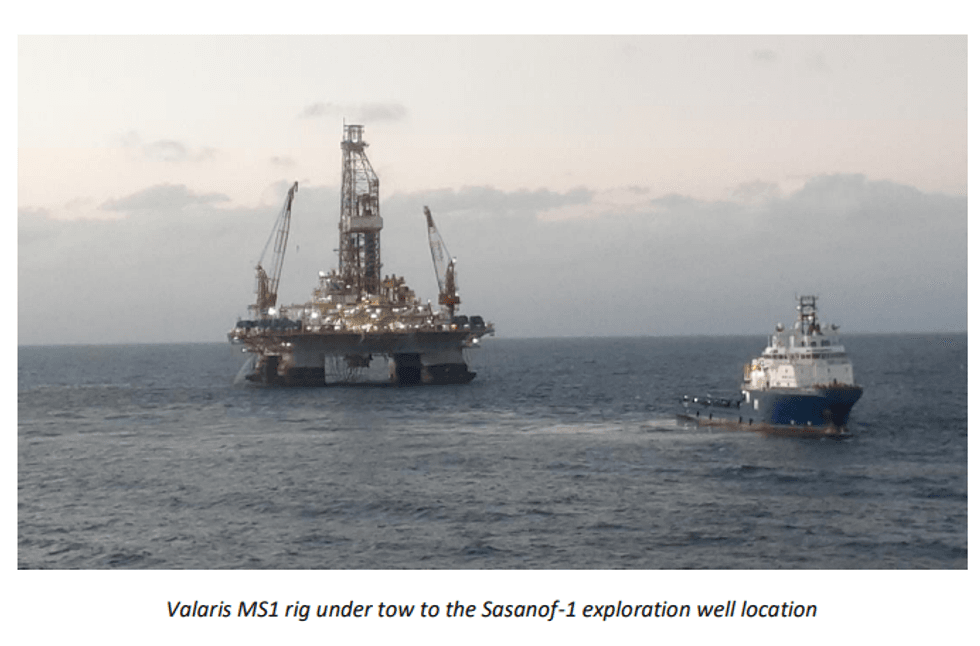

- Valaris MS-1 rig has arrived at the Sasanof-1 exploration well location on the North West Shelf.

- The MS-1 semi-submersible drilling rig completed the 190 NM mobilisation safely and efficiently under tow from the support vessel, GO Spica.

- While under tow the support vessel, Far Senator, continued logistical support operations, mobilising drilling mud, bulks and supplies from the Port of Dampier.

- Primary anchors are now being run and will be followed by deployment of the secondary and tertiary anchors, a total of 12 anchors will be set.

- Once anchoring is complete, spudding of the multi Tcf Sasanof-1 well will commence with jetting of the 36” conductor.

- This will be followed by drilling the 17-1/2” intermediate hole section.

ABOUT SASANOF

The Sasanof Prospect covers an area of up to 400 km2 and is on trend and updip of Western Gas’ liquids rich, low C02 Mentorc Field.

Sasanof is a large, seismic amplitude supported, structural-stratigraphic trap in the high-quality reservoir sands at the top of the Cretaceous top Lower Barrow Group formation on the Barrow Delta within the Exmouth Plateau.

Sasanof-1 will be Western Gas’ first well drilled from its extensive exploration portfolio surrounding the existing Equus Gas Project that contains a discovered resource of 2 Tcf and 42 MMbbl (2C Gaffney Cline2). The Equus Gas Project has a historic exploration drilling success rate of 88%, with 15 discoveries from 17 wells.

Authorised by the Board of Global Oil & Gas Limited.

For further information please contact:

Patric Glovac

Director

This article includes content from Global Oil & Gas Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

30 January

Angkor Resources Announces AGM Results and Appointment of New Director

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - (January 30, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the voting results from its Annual General Meeting of Shareholders (the "Meeting"), held on Thursday, January 29, 2026, including the... Keep Reading...

30 January

Syntholene Energy Announces Co-Listing in the United States on OTCQB Market Under Symbol SYNTF

Co-Listing Expands U.S. Investor Access and Visibility in World's Largest Aviation and Capital MarketsSyntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces that its common shares have been approved for quotation and have commenced... Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Kinetiko Energy (KKO:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Is Now a Good Time to Invest in Oil Stocks?

Investing in oil stocks can be a lucrative endeavor, but determining the right time to enter a sector known for volatile swings can be tricky.Over the past five years, the oil market’s inherent volatility has been on clear display. Major declines in consumption brought on by the COVID-19... Keep Reading...

28 January

Quarterly Activities/Appendix 4C Cash Flow Report

MEC Resources (MMR:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

December 2025 Quarterly Report and Appendix 4C

BPH Energy (BPH:AU) has announced December 2025 Quarterly Report and Appendix 4CDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00