- Project consolidated land package now encompasses 7,053 acres with this addition of 54 new claims.

- New claims expected to provide sufficient land for all facilities in a future mine site.

US Copper Corp., (TSXV: USCU,OTC:USCUF) (FSE: C73) ("US Copper" or the "Company") is pleased to announce that it has staked 54 new federal claims totalling 1,104 acres adjacent to its existing federal and patented claims at its Moonlight-Superior Copper Project, located in Plumas County, California.

The new claims will increase the total land package at Moonlight Superior to 7,053 acres. These new claims are intended to provide the additional acreage necessary to support the anticipated development and operations plan for the Moonlight-Superior Copper Project, including plant infrastructure, water treatment and waste rock stockpiles.

Stephen Dunn, CEO of US Copper, commented, "We are pleased to have secured these additional claims for the future mine surface facilities - an essential component to our overall mine plan as we prepare for our Pre Feasibility Study in fall 2026 and and the launch of the permitting process. The Moonlight-Superior Copper Project would become a cornerstone of economic growth, prosperity, and community development in the Plumas County region for more than two decades, providing career opportunities and family-supporting employment for years to come."

"Copper is a key element in a wide range of energy technologies and is designated as a Critical Mineral by the government the United States.The recent National Security Strategy released on December 4 by the Whitehouse states:

"The United States must never be dependent on any outside power for core components—from raw materials to parts to finished products—necessary to the nation's defense or economy. We must re-secure our own independent and reliable access to the goods we need to defend ourselves and preserve our way of life. This will require expanding American access to critical minerals and materials…"

Moonlight would become an integral supplier of copper metal to the U.S. domestic market with average annual production of 60 million pounds of copper and 1.7 billion pounds over the life of mine. Copper is a critical material for an extensive range of important applications ranging from renewable power generation to electric vehicles. As such, it is vital that the US has a strong and viable domestic source of copper supply."

The Company would also like to report that the Metallurgical studies previously announced (see news release of September 4, 2025) have begun and are scheduled to wrap up by April 2026 with partial results to be released beginning in February, 2026. These results will be used to design a drill program to provide additional metallurgical samples necessary for the planned Pre Feasibility Study.

In addition, the Company is pleased to announce that it has entered into a marketing agreement (the "Agreement") with Epstein Research ("ER"), led by Peter Epstein, pursuant to which Mr. Epstein will provide investor relations services to the Company in consideration for an aggregate of US$6,000 at a rate of US$2,000 per month for an initial term of three (3) months from November 1, 2025 to January 31, 2026, subject to approval by the TSXV.

In accordance with the Agreement's terms, ER will work with the Company on posting on social media and producing monthly articles and commentary designed to develop a positive and productive profile for the Company.

Mr. Epstein beneficially owns 200,000 shares of the Company (approximately 0.13% of the outstanding shares of US Copper Corp.) and does not have any rights to acquire additional securities of the Company. Mr. Epstein operates the www.epsteinresearch.com, is an arm's-length party to the Company, and has over 20 years in buy-side analyst roles.

About US Copper Corp.

US Copper controls approximately 10 square miles of patented and unpatented federal mining claims in the Light's Creek Copper District in Plumas County, NE California; essentially, the entire District. The District contains substantial copper sulfide and copper oxide resources in three company-owned deposits - Moonlight, Superior and Engels, as well as several partially tested and untested exploration targets.

The Superior and Engels Mines operated from about 1915 to 1930 producing over 161 million pounds of copper with silver and gold credits. from over 4 million tons of rock containing 2.2% copper.

The Moonlight deposit was discovered by Placer Amex during the 1960s and a resource was calculated after the drilling of over 400 holes. A development decision was made but then put on hold in 1972 when copper prices were weak.

US Copper has owned the Moonlight-Superior Project since 2013 and has advanced it with three different drill programs and a number of engineering studies.

US Copper recently reported an after-tax NPV of US$1.075 billion in a Preliminary Economic Assessment ("PEA") prepared by Global Resource Engineering Ltd ("GRE") dated Dec 16, 2024 with a life of mine production of 1.8 billion pounds of copper (See news release dated Jan 6, 2025).

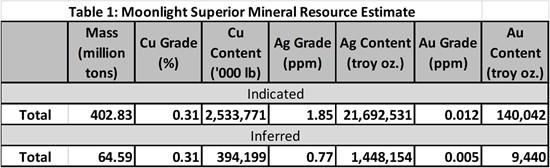

GRE calculated a new mineral resource for the purposes of this PEA that included all recent drill programs on the property. This resource is summarized below:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1768/278046_uscopper1en.jpg

Notes:

- The effective date of the Mineral Resource is December 16, 2024.

- The Qualified Person for the Mineral Resource Estimate is Terre Lane of GRE.

- Mineral resources are reported at a 0.16% Cu cutoff for oxide and transition material and at a $10.45 NSR cutoff for sulfide material. The oxide and transition cutoff is calculated based on a long-term copper price of US$4.00/lb; assumed combined operating costs of US$7.50/ton (process and G&A); metallurgical recovery of 75% for copper. The sulfide cutoff is calculated as the breakeven NSR, which is equal to the combined process and G&A costs for the sulfide material.

Further details of this Resource, and the Preliminary Economic Assessment NI43-101 Technical Report on the Moonlight-Superior Project, Plumas County, California, USA with an effective date of December 16, 2024 can be found on Sedar+ at sedarplus.ca or at the Company's website at www.uscoppercorp.com.

The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves under CIM Definition Standards. Readers are advised that there is no certainty that the results projected in this preliminary economic assessment will be realized.

For Further Information Contact:

Mr. Stephen Dunn, President, CEO and Director, US Copper Corp. (416) 361-2827 or email info@uscoppercorp.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This press release contains forward-looking statements within the meaning of applicable Canadian and U.S. securities laws and regulations, including statements regarding the future activities of the Company. Forward-looking statements reflect the current beliefs and expectations of management and are identified by the use of words including "will", "hopes", "anticipates", "expected to", "plans", "planned" and other similar words. Actual results may differ significantly. The achievement of the results expressed in forward-looking statements is subject to a number of risks, including those described in the Company's management discussion and analysis as filed with the Canadian securities regulatory authorities which are available at www.sedarplus.ca. Investors are cautioned not to place undue reliance upon forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278046