July 14, 2024

Piche Resources Limited (ASX: PR2) (“Piche” or the “Company”), a mineral exploration company focussed on uranium and gold in Western Australia (WA) and Argentina, is pleased to announce its upcoming listing on the Australian Securities Exchange (ASX) at 10:00am Perth AWST time on Monday 15 July 2024 under the ticker code PR2.

HIGHLIGHTS

- Piche Resources Limited shares to commence trading on the ASX today (Monday 15 July 2024) at 10:00am AWST (ASX: PR2)

- The IPO raised a total of $10.0 million (before costs) at A$0.20 per share with an excellent register of international & Australian funds, and high net worth and retail investors

- Capital raised will be used to advance drill ready tier 1 exploration targets in Australia and Argentina, and working capital

- Pre-IPO funds have been applied to progress land tenure, community engagement, land access agreements and prepare for the imminent drilling campaign at Sierra Cuadrada and Ashburton projects (uranium) and Cerro Chacon (gold)

Euroz Hartleys acted as Lead Manager to the IPO and introduced investor participation from a number of international & Australian funds combined with high net worth, retail investors and Piche directors and management.

Funds raised will be used to advance the Company’s drill ready exploration targets, including the Australian Ashburton project, the two Argentina projects Sierra Cuadrada & Cerro Chacon and working capital requirements. Importantly, the majority of funds raised will be allocated to exploration of the key uranium and gold projects.

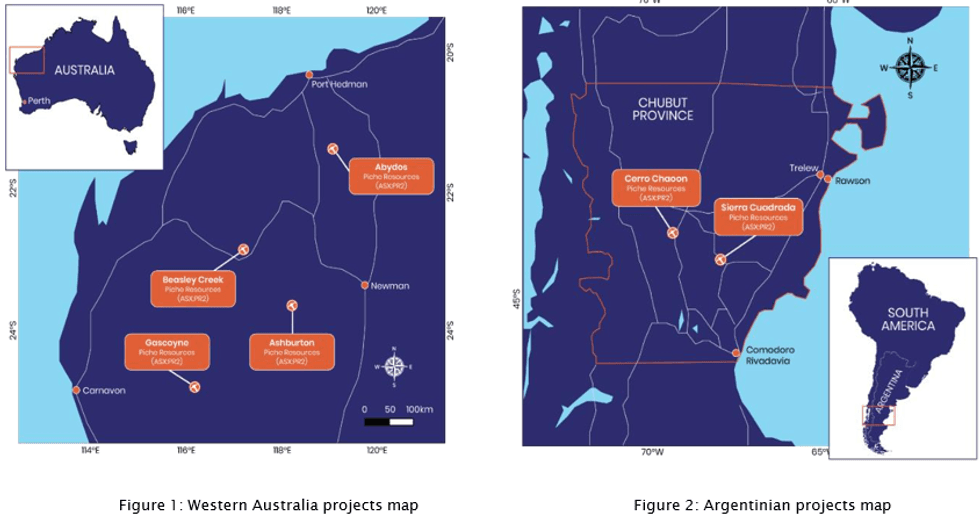

Project Portfolio – Western Australia and Argentina

KEY FOCUS

With the ASX IPO now completed, Piche intends to accelerate exploration activities on three targets at the Ashburton Project in Western Australia, and at Sierra Cuadrada and Cerro Chacon in Argentina.

Piche’s immediate attention will be at the Ashburton Project in WA, where previous drilling in the 1980’S delivered high grade uranium from the Angelo River Prospect. Piche will be seeking to replicate historical drilling results to assist in driving a JORC Resource estimate at Angelo River.

Longer term, Piche aims to build a significant mining group with separate uranium, gold, and base metal companies under its banner, capitalising on an improving commodity market.

Click here for the full ASX Release

This article includes content from Piche Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

3h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

12h

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

23h

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

Steve Barton: Gold, Silver, Oil — Key Price Levels to Watch Now

Steve Barton, host of In It To Win It, shares key price levels for silver and gold.He also explains his current approach to the oil and copper markets, and outlines an emerging opportunity in nickel as Indonesia loosens its hold on the space. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00