July 14, 2024

Piche Resources Limited (ASX: PR2) (“Piche” or the “Company”), a mineral exploration company focussed on uranium and gold in Western Australia (WA) and Argentina, is pleased to announce its upcoming listing on the Australian Securities Exchange (ASX) at 10:00am Perth AWST time on Monday 15 July 2024 under the ticker code PR2.

HIGHLIGHTS

- Piche Resources Limited shares to commence trading on the ASX today (Monday 15 July 2024) at 10:00am AWST (ASX: PR2)

- The IPO raised a total of $10.0 million (before costs) at A$0.20 per share with an excellent register of international & Australian funds, and high net worth and retail investors

- Capital raised will be used to advance drill ready tier 1 exploration targets in Australia and Argentina, and working capital

- Pre-IPO funds have been applied to progress land tenure, community engagement, land access agreements and prepare for the imminent drilling campaign at Sierra Cuadrada and Ashburton projects (uranium) and Cerro Chacon (gold)

Euroz Hartleys acted as Lead Manager to the IPO and introduced investor participation from a number of international & Australian funds combined with high net worth, retail investors and Piche directors and management.

Funds raised will be used to advance the Company’s drill ready exploration targets, including the Australian Ashburton project, the two Argentina projects Sierra Cuadrada & Cerro Chacon and working capital requirements. Importantly, the majority of funds raised will be allocated to exploration of the key uranium and gold projects.

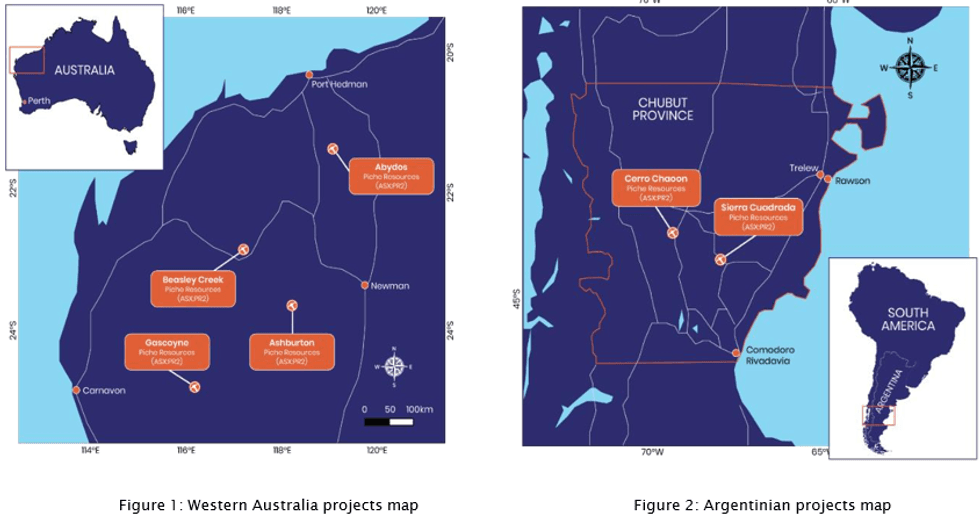

Project Portfolio – Western Australia and Argentina

KEY FOCUS

With the ASX IPO now completed, Piche intends to accelerate exploration activities on three targets at the Ashburton Project in Western Australia, and at Sierra Cuadrada and Cerro Chacon in Argentina.

Piche’s immediate attention will be at the Ashburton Project in WA, where previous drilling in the 1980’S delivered high grade uranium from the Angelo River Prospect. Piche will be seeking to replicate historical drilling results to assist in driving a JORC Resource estimate at Angelo River.

Longer term, Piche aims to build a significant mining group with separate uranium, gold, and base metal companies under its banner, capitalising on an improving commodity market.

Click here for the full ASX Release

This article includes content from Piche Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

20m

Visible Gold Intersected at Roy, Sunbeam

First Class Metals PLC ("First Class Metals", "FCM" or the "Company") the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to provide an update on the ongoing drilling programme at the Roy prospect on the... Keep Reading...

8h

Peruvian Metals Announces Private Placement

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that it has arranged a non-brokered private placement for gross proceeds of up to $750,000 which will be used to make improvements and additions for expansion to its Aguila Norte processing... Keep Reading...

12h

Additional Strong Assays Results Extend High-Grade Antimony Mineralisation at Oaky Creek

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”) a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce that it has received continued strong assay results... Keep Reading...

20h

Jeffrey Christian: Gold, Silver Prices to Rise, Risk Highest Since WWII

Jeffrey Christian, managing partner at CPM Group, sees gold and silver prices continuing to rise as global political and economic risks persist. "We look at the world right now and we see a world where the risks and uncertainties are greater now than at any time since Pearl Harbor. December... Keep Reading...

21h

Precious Metals Price Update: Gold, Silver, PGMs Volatile on Oil Spike, Fed Rates

Precious metals prices are responding to the impact of the US-Iran war, as well as inflation data.The war has weighed on the precious metals market for much of this past week. An oil price surge past US$100 per barrel increased the threat of inflation and strengthened the US dollar, softening... Keep Reading...

11 March

Pan African To Acquire Emmerson Resources in US$218 Million Gold Deal

South African gold producer Pan African Resources (LSE:PAF) has agreed to acquire Australian explorer Emmerson (LSE:EML) in an all-share transaction valued at approximately US$218 million.The acquisition will be carried out through a scheme of arrangement under which Pan African will acquire 100... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00