February 23, 2025

American Rare Earths (ASX: ARR | OTCQX: ARRNF and AMRRY) (“ARR” or the “Company”) is pleased to announce the results of its Updated Halleck Creek Scoping Study, confirming the project’s strong economics, scalability, and strategic importance.

HIGHLIGHTS

- Strong economics, scalable growth: 3 Mtpa base case offers NPV10% of US$558M, IRR 24%, with a low-risk CAPEX of US$456M.

- Billion-dollar potential: 6 Mtpa case delivers NPV10% of US$1.17B, IRR 28.4%, and CAPEX of US$737M.

- First-mover advantage: State land tenure accelerates permitting, positioning ARR as a leading U.S.- based rare earths developer independent of tariffs and reliance on foreign processing.

- Vast Scalability & Growth: The 3 Mtpa Phase 1 will mine ~62.3Mt of ore over 20 years, utilising just ~2.4% of the 2.63Bt JORC resource2. With further studies underway, Halleck Creek could support a larger, long-term operation, with potential for extended mine life and increased production capacity.

- Deposit remains open at depth and along strike, with the current JORC resource of 2.63Bt covering only ~16% of the greater Halleck Creek surface area, highlighting significant expansion potential.

Compiled by independent engineering firm Stantec Consulting Services Inc., the Study highlights Halleck Creek’s strong economic potential, strategic advantages, and clear pathway to development as a U.S.-based rare earths project. Located in Wyoming, a Tier 1 mining jurisdiction, Halleck Creek benefits from state land tenure, allowing for accelerated permitting and development.

Compelling Economics & Scalable Growth

The Updated Scoping Study confirms Halleck Creek as a world-class rare earths project with robust financials and long-term scalability:

- 3 Mtpa Base Case:

- NPV10% of US$558 million, IRR of 24%

- CAPEX of US$456 million, with a 2.7-year payback period

- Annual production: ~4,169 metric tons of TREO, including 1,833 metric tons of NdPr oxide

- 6 Mtpa Case:

- NPV10% of US$1.171 billion, IRR of 28.4%

- CAPEX of US$737 million, with a 1.8-year payback period

- Annual production: ~7,661 metric tons of TREO, including 3,344 metric tons of NdPr oxide

First-Mover Advantage & U.S. Supply Chain Security

As the only large-scale rare earths project in the U.S. with a clear path to production, ARR is positioned to secure a domestic, tariff-free supply of critical minerals for U.S. and allied markets.

- China controls over 90% of global rare earth refining. With the U.S. prioritizing supply chain security, ARR is uniquely positioned as a credible U.S.-based developer to deliver a fully integrated solution— from mining to refining.

- State land tenure accelerates permitting, avoiding the lengthy delays often associated with projects on federal land.

- Halleck Creek's 100% U.S.-based production and refining will ensure a secure, domestic supply of rare earth oxide metals—eliminating reliance on foreign supply chains and reinforcing the 'Made in America' commitment.

- Deposit remains open at depth and along strike, with the current JORC resource of 2.63Bt covering only ~16% of the greater Halleck Creek project area, highlighting significant expansion potential.

Clear Development Pathway & Future Growth

Halleck Creek’s staged development approach ensures financial and operational flexibility, allowing ARR to scale production in alignment with market demand:

- Base Case: 3 Mtpa – Low-risk entry to production to produce an average of 4,169 mt of TREO per annum, including 1,833 mt of NdPr Oxide.

- Alternate Case: Scalable to 6 Mtpa – Enhancing project economics, producing an average of 7,661 mt TREO per annum, including 3,334 mt of NdPr Oxide

- Future Expansion Potential: The Cowboy State Mine (“CSM”) represents only Phase 1 of Halleck Creek’s development, benefiting from a strategic permitting advantage. The 20-year CSM LOM plan includes mining approximately 62.3 Mt of ore—just ~2.4% of the total 2,627 Mt JORC Mineral Resource—highlighting the vast potential for extended mine life and increased production in future phases. Given the increasing demand for rare earths, ARR is evaluating further studies, as Halleck Creek could support a much larger, long-term operation, with potential for extended mine life and increased production capacity that could position ARR among the top rare earth producers outside China.

CEO Commentary

Chris Gibbs, CEO of American Rare Earths, commented:

"The Updated Scoping Study reinforces Halleck Creek strong economic potential, strategic permitting advantage and clear pathway to development. With a large-scale resource and favourable economics, we are uniquely positioned to help secure America’s rare earth supply and reduce dependence on foreign sources.

"The 6 Mtpa case highlights Halleck Creek’s billion-dollar potential, delivering an NPV10% of US$1.17B and an IRR of 28%, showcasing the project’s scalability. The 3 Mtpa base case offers a low-risk entry point, producing 1,833 metric tonnes of NdPr oxide annually, with an NPV10% of US$558M, an IRR of 24%, and a 2.7-year payback period.

"With a scalable development pathway under evaluation, Halleck Creek has the potential to become a major supplier to U.S. and allied markets. Future production scenarios could position ARR among the top rare earth producers outside China, reinforcing America’s supply chain security for decades to come.

"And we’re not just mining—we are developing a fully integrated U.S. supply chain, refining and producing high- purity rare earth oxides for American manufacturers. Halleck Creek aligns with the growing push for Made-in- America critical minerals, securing a domestic supply for defense, aerospace, and high-tech manufacturing.”

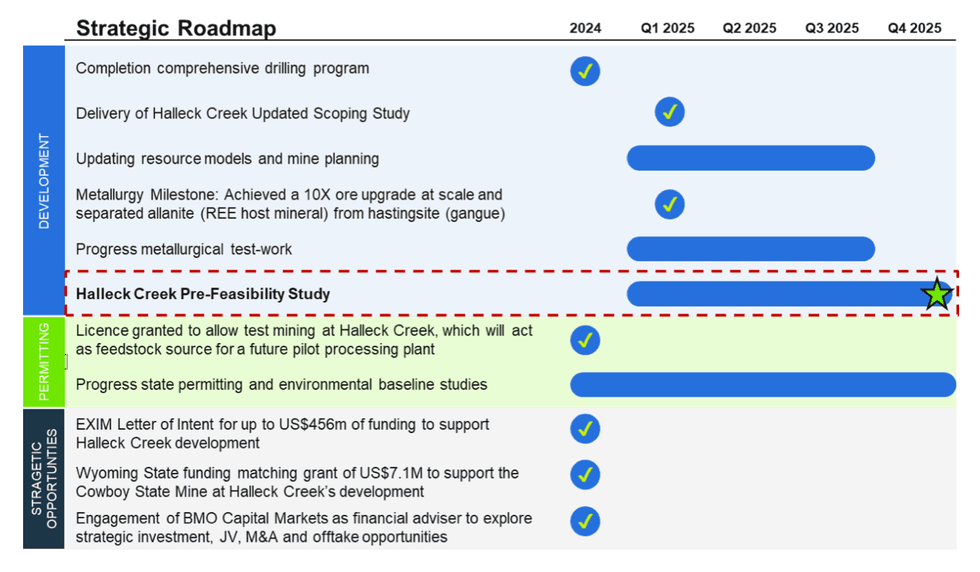

Next Steps & Milestones

Building on strong execution in 2024, ARR is advancing key milestones to further de-risk and develop Halleck Creek, as outlined in the Updated Scoping Study and supported by recent metallurgy results. These developments reinforce the project's scalability and strategic importance as a leading U.S. rare earths asset. With a staged development approach, first production could be as early as 2029, subject to ongoing technical and economic assessments. The Company is looking at ways to fast-track development, including plans to commence Phase One of a pilot plant for the beneficiation process. The roadmap ahead highlights key next steps for 2025 and the next major stage gate in the project’s development.

Click here for the full ASX Release

This article includes content from American Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ARR:AU

Sign up to get your FREE

American Rare Earths Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 February 2025

American Rare Earths Limited

Advancing one of the largest REE deposits in North America

Advancing one of the largest REE deposits in North America Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

American Rare Earths Limited (ARR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

09 November 2025

Optimisation Update

American Rare Earths Limited (ARR:AU) has announced Optimisation UpdateDownload the PDF here. Keep Reading...

16 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

American Rare Earths Limited (ARR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 October 2025

Successful Completion-Impurity Removal Neutralization Tests

American Rare Earths Limited (ARR:AU) has announced Successful Completion-Impurity Removal Neutralization TestsDownload the PDF here. Keep Reading...

02 October 2025

COB: Repayment of Promissory Note

American Rare Earths Limited (ARR:AU) has announced COB: Repayment of Promissory NoteDownload the PDF here. Keep Reading...

26 February

Top Australian Mining Stocks This Week: European Resources Soars on Rare Earth Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Gold, lithium and copper companies continue to dominate our top ASX stocks of the week. This week, the Northern Territory's Minister... Keep Reading...

25 February

China's Rare Earths Export Ban Hits Japanese Defense Sector

China has moved to freeze exports of rare earth magnets and other critical materials to dozens of major Japanese companies, with the measures to take effect immediately.China’s commerce ministry said Tuesday (February 24) that it will suspend shipments of so-called “dual-use” goods — referring... Keep Reading...

24 February

Application to Trade on OTCQB Market

Altona Rare Earths plc (LSE: REE), the critical raw materials exploration and development company focused on Africa, is pleased to announce that it has applied for its ordinary shares to be admitted to trading on the OTCQB Venture Market in the United States ( "OTCQB").The Company has submitted... Keep Reading...

24 February

Brazil, India Ink Rare Earths Pact to Expand Supply Chain Cooperation

Brazil and India have signed a new agreement to deepen cooperation on rare earths and critical minerals as both countries seek to strengthen supply chains and reduce reliance on trading partners.The non-binding memorandum of understanding, sealed on February 21 during Brazilian President Luiz... Keep Reading...

22 February

LKY Commences Diamond Drilling at Desert Antimony Mine

Locksley Resources (LKY:AU) has announced LKY Commences Diamond Drilling at Desert Antimony MineDownload the PDF here. Keep Reading...

20 February

Cellulose Breakthrough Could Simplify Rare Earths Separation

A team of researchers at Penn State have developed a plant-based nanomaterial capable of selectively extracting dysprosium from rare earth mixtures, according to a recent report.The findings published in the study detail how the team engineered a modified form of cellulose capable of isolating... Keep Reading...

Latest News

Sign up to get your FREE

American Rare Earths Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00