- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

July 05, 2022

Cyprium Metals Limited (ASX: CYM) (Company) provides an update in relation to its one (1) for eight (8) pro rata non-renounceable entitlement offer at an issue price of 11.5 cents (being the same issue price as the Placement) to raise up to $10 million (EntitlementOffer), which was announced to ASX on 30 June 2022.

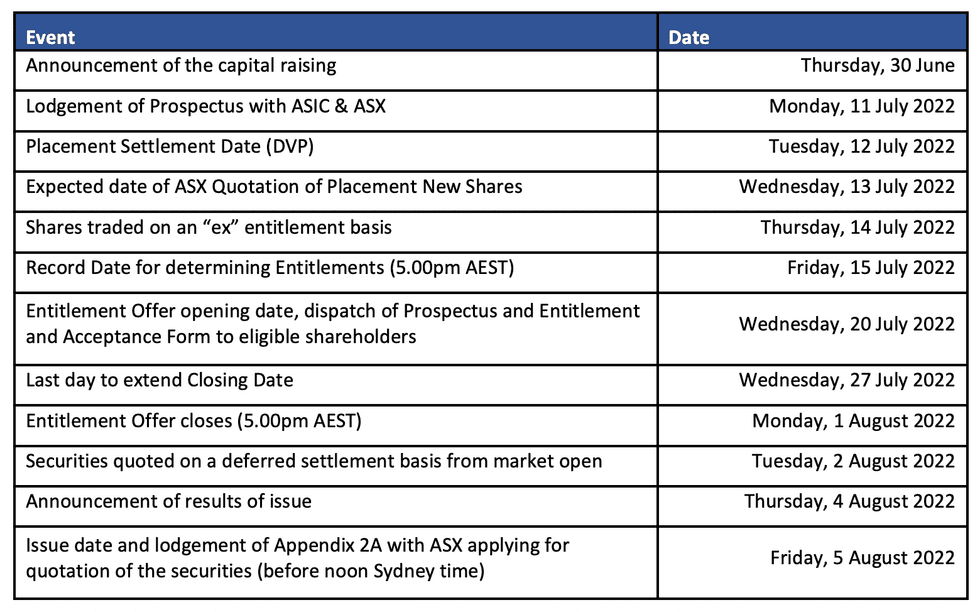

The timetable in respect to the Entitlement Offer has been updated and Shareholders are advised to disregard the previous timetable (detailed in the Company’s announcement dated 30 June 2022). The Company has delayed the timetable of the Entitlement Offer until after its application in relation to the Company’s inadvertent administrative error to lodge a cleansing notice on 11 December 2020 has been determined by the Supreme Court of Western Australia (Court). The updated timetable is as follows:

All dates are indicative only, subject to change and conditional upon receipt of curative orders from the Court on 11 July 2022. All times and dates refer to Australian Eastern Standard Time. Cyprium reserves the right to amend any or all of these dates and times, subject to the Corporations Act 2001 (Cth), the ASX Listing Rules and other applicable laws and regulations. In particular, Cyprium reserves the right to extend the closing date of the Entitlement Offer, to accept late applications (either generally or in particular cases) and to withdraw the Entitlement Offer without prior notice. Any extension of the closing date may have a consequential impact on the date that new shares are issued. Applicants are encouraged to submit their acceptance forms as soon as possible after the Entitlement Offer opens. The information in this announcement does not constitute financial product advice and does not take into account the financial objectives, personal situation or circumstances of any shareholder. If you are in any doubt as to how to proceed, please contact your financial, tax or other professional adviser.

Click here for the full ASX Release

This article includes content from Cyprium Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CYM:AU

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 March 2025

Cyprium Metals

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth Keep Reading...

23 January

Capital Raise Presentation

Cyprium Metals (CYM:AU) has announced Capital Raise PresentationDownload the PDF here. Keep Reading...

22 January

A$41M Capital Raise via Placement & Entitlement Offer

Cyprium Metals (CYM:AU) has announced A$41M Capital Raise via Placement & Entitlement OfferDownload the PDF here. Keep Reading...

19 January

Paterson Exploration Review Update

Cyprium Metals (CYM:AU) has announced Paterson Exploration Review UpdateDownload the PDF here. Keep Reading...

19 November 2025

Cathode Restart Approved by Cyprium Board

Cyprium Metals (CYM:AU) has announced Cathode Restart Approved by Cyprium BoardDownload the PDF here. Keep Reading...

13 November 2025

Senior Loan Facility Refinanced with Nebari

Cyprium Metals (CYM:AU) has announced Senior Loan Facility Refinanced with NebariDownload the PDF here. Keep Reading...

5h

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drilling Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia is taking part in a ministerial meeting hosted by the US aimed at exploring a strategic critical minerals... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

Latest News

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00