Trilogy Metals Inc. (TSX: TMQ) (NYSE: TMQ) ("Trilogy" or the "Company") is pleased to announce the fourth set of drilling results from the 2021 summer field season at the Arctic Project, part of the Upper Kobuk Mineral Projects ("UKMP") located in Northwestern Alaska managed by Ambler Metals LLC ("Ambler Metals"), the joint venture operating company equally owned by wholly owned subsidiaries of Trilogy and South32 Limited (ASX: S32) (LSE: S32) (JSE: S32) (ADR: SOUHY) ("South32").

The 2021 Arctic drill program included 4,131 meters of diamond drilling, comprising 18 holes, that were designed to convert part of the resources from the Indicated category to the Measured category, and provide material for metallurgical testing and geotechnical information. The assay results detailed here are for additional infill/metallurgical drill holes from the 2021 summer field season.

Highlights from the latest metallurgical/infill drill holes from the 2021 drill program

Based on a cut-off grade of 0.5% copper equivalent, significant zones of high-grade copper, zinc, lead, gold, and silver mineralization were intersected, including:

- Hole AR21-0181 intersected six mineralized intervals, including

- 25.43 meters of 2.35% copper, 4.56% zinc, 1.09% lead, 0.11 g/t gold and 20.49 g/t silver for a copper equivalent grade of 4.64%;

- 22.56 meters of 2.60% copper, 5.60% zinc, 1.19% lead, 0.81 g/t gold and 89.15 g/t silver for a copper equivalent grade of 6.36%; and

- 13.10 meters of 4.42% copper, 7.91% zinc, 1.13% lead, 0.70 g/t gold and 72.37 g/t silver for a copper equivalent grade of 8.79%.

- Hole AR21-0179 intersected one mineralized interval of 6.25 meters of 2.02% copper, 3.19% zinc, 1.03% lead, 1.17 g/t gold and 41.41 g/t silver for a copper equivalent grade of 4.64%.

- Hole AR21-0188 intersected four mineralized intervals, including 9.45 meters of 3.00% copper, 0.91% zinc, 0.16% lead, 0.05 g/t gold and 18.90 g/t silver for a copper equivalent grade of 3.59%.

- Hole AR21-0177 intersected two mineralized intervals, including 5.49 meters of 0.75% copper, 0.61% zinc, 0.15% lead, 0.28 g/t gold and 9.02 g/t silver for a copper equivalent grade of 1.28% .

- All reported intervals are thought to be close to the true width and therefore represent the actual thickness of mineralization.

The Company is also providing an update in the progress of the Ambler Access Project ("AAP"). On February 22, 2022 , the United States Department of the Interior ("DOI") filed a motion to remand the Final Environmental Impact Statement ("FEIS") and suspend the right-of-way permits issued to the Alaska Industrial Development and Export Authority ("AIDEA") for the AAP. The DOI has stated that the suspension of the road permits will allow it to carry out additional supplemental work on the FEIS. Please see Trilogy's press release dated February 23, 2022 for more information.

Last week, Ambler Metals, jointly with NANA Regional Corporation ("NANA"), filed a motion with the court requesting a two-week extension of time to file its responses to the DOI's motion for voluntary remand. This filing will allow Ambler Metals, NANA, the State of Alaska and AIDEA, as intervening defendants, time to confer with the DOI and work toward finding a workable arrangement to manage the remand process. The Company intends to provide an update on the AAP permitting situation when it has more clarity on the scope and timing of the proposed supplemental work.

Tony Giardini , President and CEO of Trilogy, commented, "These drilling results continue to confirm that the Arctic Project has some of the most compelling copper grades in the mining industry. The planned 2022 summer field season at the UKMP currently includes a 10,000-meter drilling campaign focused on further infill drilling at Arctic and on exploring priority prospects and other targets within our expansive land package. I also want to reaffirm our commitment with South32 to advance the UKMP while balancing the timeline for the State of Alaska to provide infrastructure access to the Ambler Mining District."

Richard Gosse , Trilogy's Vice President, Exploration stated, "Again, as with some of the previously announced infill holes, the drill core gives us a glimpse of the scale of this remarkable world-class volcanogenic massive sulphide ("VMS") deposit. Hole AR21-0181, with polymetallic massive sulphides grading 3% to 8% copper equivalent in six intervals with an accumulated true thickness of about 78 metres (255 feet) over a core length of 110 metres (360 feet), is outstanding but not unexpected. Along strike from Arctic, VMS-like prospects, airborne EM targets and geochemical anomalies occur for over the 97-kilometre (60-mile) Ambler Belt, most of which is held by Ambler Metals. We look forward to announcing the results of last year's exploration activities in the belt as well as the remaining drill results from Arctic in the coming weeks."

On November 22, 2021 , the Company released the assay results for two geotechnical drill holes AR21-0173 and AR21-0175 that intersected high-grade mineralization beyond the currently designed pit at Arctic. Subsequently on November 29, 2021 , the Company released additional drilling results from two infill/metallurgical holes drilled early in the 2021 field season. Of note is drill hole AR21-0176 which intersected 19.91 meters of almost 12% copper equivalent. On January 25, 2022 , the Company released the results for two additional metallurgical/infill drill holes from Arctic. For more information on these drilling results, please visit the Company's website at https://trilogymetals.com/news-and-media/news/ .

The results of the remaining eight holes are expected to be announced over the next few weeks.

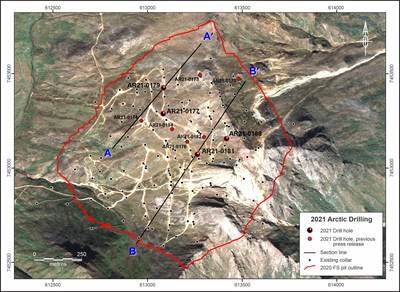

These latest drilling results from the 2021 program contain mineralized intervals consistent with previous drilling conducted within the resource area on the property. Significant mineralized intervals of high-grade mineralization at a cut-off of 0.5% copper equivalent are reported in Table 1 . The locations of the holes are shown in Figure 1 and Table 2 .

Of the 18 holes drilled at Arctic last summer, eight holes were for the geotechnical program. The 10 remaining drill holes were part of the infill/metallurgical program, with three of the 10 drill holes also being used for the hydrology program.

Table 1. Drill Intercepts from the 2021 Arctic Infill Drilling Program

| Hole | From (m) | To (m) | Length (m) | CuEq (%) | Cu (%) | Zn (%) | Pb (%) | Ag (g/t) | Au (g/t) | Zone |

| AR21-0177 | 89.80 | 92.25 | 2.45 | 0.63 | 0.08 | 0.85 | 0.30 | 10.35 | 0.07 | 7a |

| 94.60 | 100.09 | 5.49 | 1.28 | 0.75 | 0.61 | 0.15 | 9.02 | 0.28 | 5 | |

| AR21-0179 | 56.48 | 62.73 | 6.25 | 4.64 | 2.02 | 3.19 | 1.03 | 41.41 | 1.17 | 5 |

| AR21-0181 | 113.74 | 121.85 | 8.11 | 3.16 | 1.95 | 1.82 | 0.36 | 32.28 | 0.21 | 5 |

| 131.67 | 144.77 | 13.10 | 8.79 | 4.42 | 7.91 | 1.13 | 72.37 | 0.70 | 4 | |

| 147.83 | 150.95 | 3.12 | 6.96 | 3.35 | 5.07 | 1.27 | 78.78 | 0.98 | 4 | |

| 154.95 | 180.38 | 25.43 | 4.64 | 2.35 | 4.56 | 1.09 | 20.49 | 0.11 | 3 | |

| 187.14 | 193.52 | 6.38 | 6.20 | 2.77 | 7.14 | 0.94 | 43.29 | 0.18 | 2 | |

| 201.30 | 223.86 | 22.56 | 6.36 | 2.60 | 5.60 | 1.19 | 89.15 | 0.81 | 1 | |

| AR21-0188 | 89.87 | 102.17 | 12.30 | 1.68 | 0.91 | 0.91 | 0.15 | 16.30 | 0.37 | 5 |

| 133.20 | 142.65 | 9.45 | 3.59 | 3.00 | 0.91 | 0.16 | 18.90 | 0.05 | 3 | |

| 219.28 | 226.45 | 7.17 | 2.76 | 1.61 | 2.26 | 0.17 | 16.44 | 0.17 | 2 | |

| 230.29 | 239.16 | 8.87 | 1.39 | 1.02 | 0.46 | 0.07 | 13.32 | 0.10 | 1 |

Notes:

- Copper equivalent (CuEq) calculations use metal prices assumptions of US$3.00 /lb for copper, US$1.10 /lb for zinc, US$1.00 /lb for lead, US$1,300 /oz for gold, and US$18.00 /oz for silver.

- Results are core intervals and not true thickness; true widths have not been determined for the above intercepts but are believed to be representative of actual drill thicknesses.

- Significant interval defined as a minimum of 1.0-meter copper interval with average grade >0.5% CuEq.

- Cut-off grade of 0.5% CuEq.

- Internal dilution up to three meters of

- Intervals of

- Core recovery averaged 96%.

- Minimum sample length was 0.17m , average sample length was 2.4m overall and 1.7m within mineralized zones.

- Some rounding errors may occur.

The reported intervals are based on a copper-equivalent grade of 0.5% using metal prices from Trilogy's 2020 Arctic feasibility study ( US$3.00 /lb copper, US$1.10 /lb zinc, US$1.00 /lb lead, US$1,300 /oz gold, and US$18.00 /oz silver) and a maximum of 3-meters internal dilution. All drill hole intercepts are close to true width.

Table 2. Drill Hole Locations at the Arctic Project

| Hole | East (m) | North (m) | Elevation (m) | Azimuth | Dip | Length (m) |

| AR21-0177 | 613081 | 7453287 | 868 | 35 | -70 | 144.2 |

| AR21-0179 | 613092 | 7453435 | 872 | 35 | -70 | 96.6 |

| AR21-0181 | 613266 | 7453078 | 893 | 32 | -71 | 229.2 |

| AR21-0188 | 613427 | 7453158 | 965 | 35 | -70 | 258.5 |

| Coordinates are in UTM Zone 4N (meters) coordinate system, NAD83 Datum. |

Drill holes AR21-0177, AR21-0179, and AR21-0181 which are sized PQ3 (83 mm diameter), were designed to provided metallurgical test material as well as upgrade confidence in the resource model.

AR21-0188 which is sized HQ3 (61 mm diameter), was designed to provided metallurgical test material, upgrade confidence in the resource model and allow for hydrology monitoring instruments to be installed down hole.

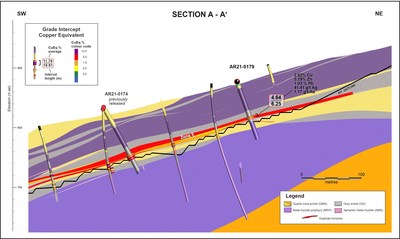

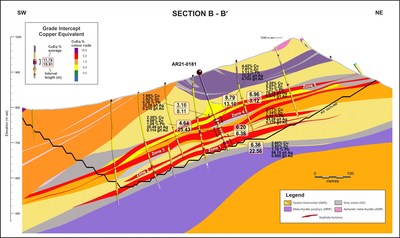

Cross sections showing the drill holes AR21-0179 and AR21-0181 can be seen in Figures 2 and 3 below.

At hole AR21-0177, mineralization within Zone 7a consists of 3% pyrite, 0.5% chalcopyrite and 1% sphalerite. Zone 5 consists of 3% to 40% pyrite, 0.1% to 5% chalcopyrite, 0.1% to 1% galena, and 0.1% to 7% sphalerite.

Within hole AR21-0179, mineralization in Zone 5 consists of 0.1% to 40% pyrite, 0.1% to 15% chalcopyrite and up to 35% sphalerite.

At hole AR21-0181, mineralization within Zone 5 consists of 1% to 12% pyrite, 1% to 20% chalcopyrite and trace-1% pyrrhotite. Zone 4 consists of 0.1% to 25% pyrite, 0.1% to 35% chalcopyrite and trace-30% sphalerite. Zone 3 consists of 0.1% to 25% pyrite, 0.1% to 40% chalcopyrite and trace-30% sphalerite with patches of trace pyrrhotite. Zone 2 consists of 0.1% to 40% pyrite, 0.1% to 35% chalcopyrite and up to 30% sphalerite. Zone 1 consists of up to 50% pyrite, 3% to 80% chalcopyrite and up to 40% sphalerite with patches of trace galena.

Within hole AR21-0188, mineralization in Zone 5 consists of 0.25% to 35% pyrite, 0.1% to 7% chalcopyrite, up to 0.5% sphalerite and patches of trace pyrrhotite. Zone 3 consists of 0.1% to 20% pyrite, up to 35% chalcopyrite and up to 1% sphalerite. Zone 2 consists of 0.1% to 35% pyrite, up to 10% chalcopyrite, up to 20% sphalerite, patches of galena and patches of up to 4% pyrrhotite. Zone 1 consists of 0.5% to 30% pyrite, up to 10% chalcopyrite, up to 25% sphalerite, and patches of trace pyrrhotite.

All percentages of sulphide mineralization are based off the visual estimations in the core.

Within the Arctic deposit, mineralization occurs as stratiform semi-massive sulphide to massive sulphide beds within primarily chlorite schists and fine-grained quartz schists. The sulphide beds average 4 meters in thickness but vary from less than 1 meter up to as much as 20 meters in thickness.

QA/QC Program

The drilling program, sampling and assaying protocol, and data verification were managed by qualified persons (QPs) employed by Ambler Metals. The diamond drill holes were completed using PQ3 or HQ3 diameter core, and recoveries averaged 95%. Drill core was cut lengthwise into halves using a diamond saw, with one-half used to construct composites for metallurgical testing and one-half cut lengthwise to provide quarter core for sampling. The remainder of the core was retained in core trays and archived at site.

Samples were collected through mineralized zones using a 0.17 m minimum length and 2.5 m maximum length; average sample length is 1.70 m . Weights of the drill core samples range from 0.64 to 17.91 kg, depending on the size of core, rock type, and recovery.

Each core sample was placed into a bag with a numbered tag and quality control samples were inserted between core samples using the same numbering sequence. Then, samples were grouped into batches for shipping and laboratory submissions. Each batch of 20 samples contains three quality control (QC) samples that comprise one certified reference material (CRM), one core blank (BLK), and one core or crushed duplicate (DUP). Chain-of-custody records are maintained for sample shipments and the custody is transferred from Ambler Metals' expeditor to the laboratory upon delivery.

Samples were shipped initially to ALS Minerals' laboratory in Fairbanks, Alaska , USA, then on to ALS Minerals' laboratory in Hermosillo, Mexico , for sample preparation. ALS Minerals Fairbanks and Hermosillo are satellite sample preparation facilities accredited under ALS Minerals. After preparation at ALS Minerals Hermosillo, split pulp samples were shipped to ALS Minerals in North Vancouver, B.C. , Canada , for assaying. ALS Minerals North Vancouver is an independent laboratory certified under ISO 9001:2008 and accredited under ISO/IEC 17025:2005 by the Standards Council of Canada . ALS Minerals includes its own internal quality control samples comprising certified reference materials, blanks, and pulp duplicates.

Drill core samples were weighed (WEI-21), dried if excessively wet (DRY-21), coarse jaw crushed to 70% passing 6 mm (CRU-21), fine jaw crushed to 70% passing 2 mm (CRU-31), riffle split to 250 g subsamples (SPL-21) and pulverized to 85% passing 75 μm (PUL-31). Crushed duplicates were created by riffle splitting crushed samples into two parts.

Gold analyses were completed using a 30 g lead fire assay and AAS finish (Au-AA23). Multi-element analyses for 48 elements were completed using a geochemical four-acid digestion and ICP-ES/MS finish (ME-MS61). Over-range assays for silver, copper, zinc and sulfur were completed using an ore grade four-acid digestion and ICP-ES finish (ME-OG62). Additional analyses were completed for barium and mercury.

Gold, silver, copper, lead and zinc assays for QC samples were reviewed to ensure that CRMs are within tolerance limits specified on supplier certificates, BLKs are below acceptable thresholds, and DUPs display statistical patterns normally expected for sample types, methods, and elements. CRMs that returned assays outside of tolerance limits and BLKs with assays above thresholds were deemed to have failed. Sample batches containing failed QC samples were re-assayed to ensure that the QC samples returned acceptable results before release. All QC monitoring data are reviewed and signed off by an independent QA/QC geologist.

There is no known relationship between core sample recoveries and assay grades. Ambler Metals will submit 5% of the assay intervals from prospective lithologies to a laboratory independent of ALS Minerals for check assaying.

Qualified Person

Richard Gosse , P.Geo., Vice President, Exploration for Trilogy, is a Qualified Person as defined by National Instrument 43-101. Mr. Gosse has reviewed the scientific and technical information in this news release and approves the disclosure contained herein.

About Trilogy Metals

Trilogy Metals Inc. is a metal exploration and development company which holds a 50 percent interest in Ambler Metals LLC which has a 100 percent interest in the Upper Kobuk Mineral Projects ("UKMP") in Northwestern Alaska . On December 19, 2019 , South32, a globally diversified mining and metals company, exercised its option to form a 50/50 joint venture with Trilogy. The UKMP is located within the Ambler Mining District which is one of the richest and most-prospective known copper-dominant districts in the world. It hosts world-class polymetallic volcanogenic massive sulphide ("VMS") deposits that contain copper, zinc, lead, gold and silver, and carbonate replacement deposits which have been found to host high-grade copper and cobalt mineralization. Exploration efforts have been focused on two deposits in the Ambler Mining District – the Arctic VMS deposit and the Bornite carbonate replacement deposit. Both deposits are located within a land package that spans approximately 181,387 hectares. Ambler Metals has an agreement with NANA Regional Corporation, Inc., an Alaska Native Corporation that provides a framework for the exploration and potential development of the Ambler Mining District in cooperation with local communities. Trilogy's vision is to develop the Ambler Mining District into a premier North American copper producer.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein, including, without limitation, statements relating to interpretation of drill results; the Company's beliefs regarding the potential of the Arctic Project; the planned 2022 summer field season; the timing of results from the 2021 exploration program and the remaining eight drill holes; and expectations regarding future drill results; are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include the uncertainties involving impact of the COVID-19 pandemic; success of exploration activities, permitting timelines, requirements for additional capital, government regulation of mining operations, environmental risks, prices for energy inputs, labour, materials, supplies and services, uncertainties involved in the interpretation of drilling results and geological tests, unexpected cost increases and other risks and uncertainties disclosed in the Company's Annual Report on Form 10-K for the year ended November 30, 2021 filed with Canadian securities regulatory authorities and with the United States Securities and Exchange Commission and in other Company reports and documents filed with applicable securities regulatory authorities from time to time. The Company's forward-looking statements reflect the beliefs, opinions, and projections on the date the statements are made. The Company assumes no obligation to update the forward-looking statements or beliefs, opinions, projections, or other factors, should they change, except as required by law.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/trilogy-announces-additional-results-from-the-2021-infill-drill-program-at-the-arctic-project-and-update-on-the-ambler-access-project-301504872.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/trilogy-announces-additional-results-from-the-2021-infill-drill-program-at-the-arctic-project-and-update-on-the-ambler-access-project-301504872.html

SOURCE Trilogy Metals Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/March2022/17/c1358.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/March2022/17/c1358.html