November 08, 2022

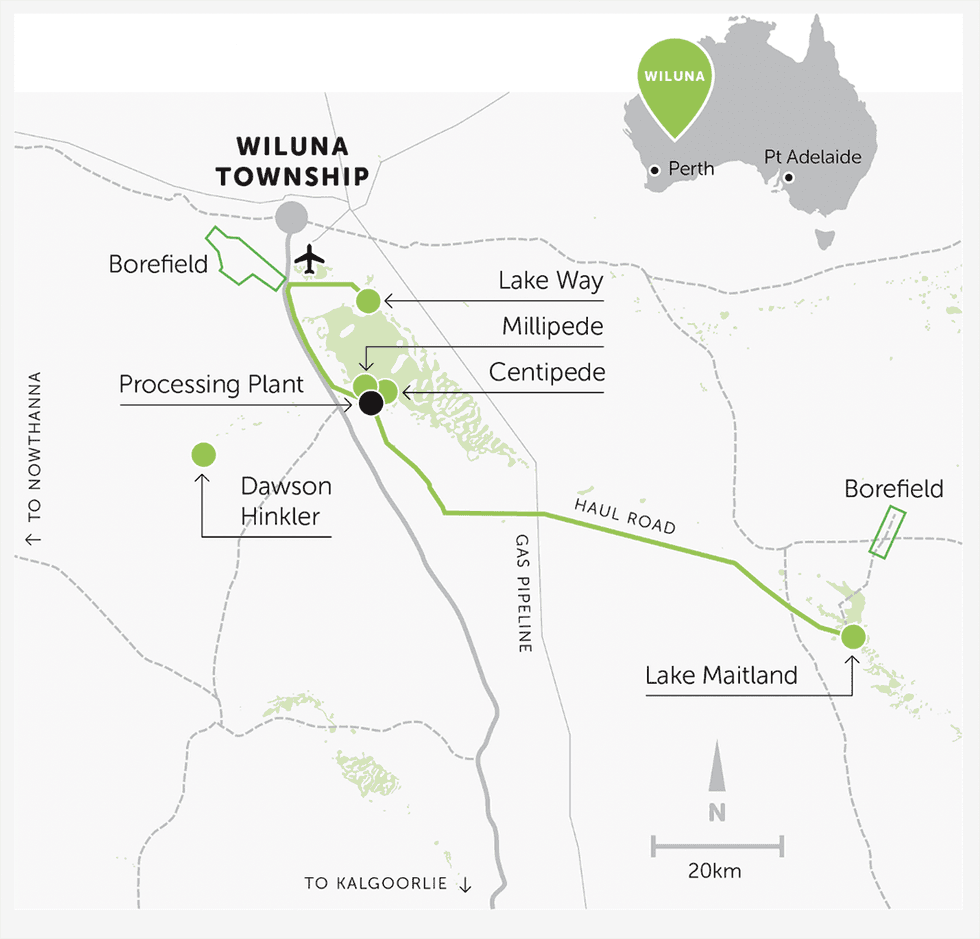

Toro Energy Limited (ASX:TOE) advances a portfolio of assets prospective for nickel, gold and base metals. The company's flagship Wiluna Uranium Project includes four key deposits: Lake Maitland, Centipede, Millipede and Lake Way. The Lake Maitland deposit is amenable to a beneficiation process, which maximises yield with simple screening and de-sliming before ore proceeds to the leach phase. The Lake Maitland deposit is subject to a joint venture partnership with two Japanese corporations, Japan Australia Uranium Resource Development Co. Ltd. (JAURD) and Itochu.

With unique challenges and risks associated with uranium projects that can delay development, Toro Energy has worked to address key risk areas for the Wiluna Uranium Project. To date, the project has received state and federal approval and been granted mining leases, allowing Toro Energy to focus on process design and project costs.

Company Highlights

- Toro Energy is a uranium exploration and development company with promising assets in Western Australia.

- The company is led by a management team and board of directors with direct experience in the uranium mining industry.

- The Wiluna Uranium Project has been de-risked and optimised to include vanadium as a by-product.

- The Lake Maitland deposit within the Wiluna Uranium Project has been optimised with a beneficiation process, which was introduced to maximise yield by refining raw ore before it proceeds to the leach phase.

- Scoping study for proposed stand-alone Lake Maitland Uranium-Vanadium operation shows potential for strong financial returns.

- Lake Maitland is subject to a joint venture with two Japanese companies, JAURD and Itochu. The partnership allows these companies to earn interest on the asset after reaching an investment threshold.

- Toro Energy also owns 100 percent of the Dusty Nickel Project, confirmed to contain a 15-kilometre strike of massive nickel sulphides. The asset also includes suspected gold targets to be confirmed with future exploration.

This Toro Energy profile is part of a paid investor education campaign.*

Click here to connect with Toro Energy Limited (ASX:TOE) to receive an Investor Presentation

TOE:AU

The Conversation (0)

12 October 2025

IsoEnergy to Acquire Toro Energy

Toro Energy (TOE:AU) has announced IsoEnergy to Acquire Toro EnergyDownload the PDF here. Keep Reading...

12 October 2025

Joint Investor Presentation

Toro Energy (TOE:AU) has announced Joint Investor PresentationDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities and Cashflow Report June 2025

Toro Energy (TOE:AU) has announced Quarterly Activities and Cashflow Report June 2025Download the PDF here. Keep Reading...

27 May 2025

Updated Scoping Study Results Lake Maitland Uranium Project

Toro Energy (TOE:AU) has announced Updated Scoping Study Results Lake Maitland Uranium ProjectDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities and Cashflow Report March 2025

Toro Energy (TOE:AU) has announced Quarterly Activities and Cashflow Report March 2025Download the PDF here. Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

2h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00