October 22, 2023

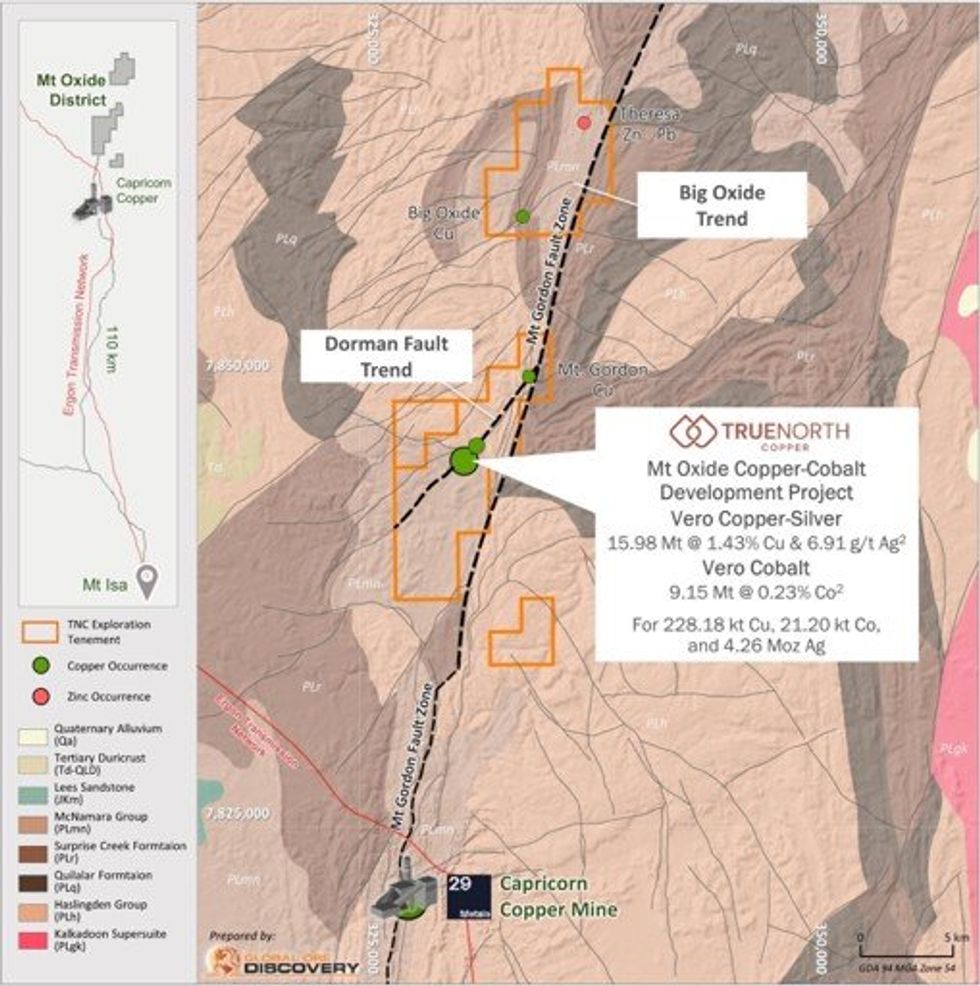

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to announce it has intersected exceptional visual copper mineralisation in the final two drillholes of the Company’s initial diamond drilling program at the 100% owned Vero copper-silver-cobalt resource at its Mt Oxide Project, Queensland.

HIGHLIGHTS

- Holes MOXD225 and MOXD226A both intercepted wide zones with high visual estimates of copper sulphide mineralisation.

- MOXD225include:

- 18.33m* from 259.67m with vis. est. of 3-4% chalcocite, 1% covellite, 0.5% chalcopyrite and 4% pyrite

- 57.33m* from 349.87m consisting of three visually strong mineralised sub domains (Figure 1).

- 7.48m* from 349.87m with vis. est. 5% chalcocite, 2% covellite, 1-2% chalcopyrite and 8% pyrite

- 8.65m* from 357.35m with vis. est. 2% chalcocite, 0.5% covellite, 0.5% chalcopyrite and 8% pyrite

- 41.20m* from 366.00m with vis. est. 2-3% chalcopyrite, 0.5% chalcocite, 9% pyrite and trace covellite

- MOXD226A include:

- 70.75m* from 224.55m consisting of four sub domains highlights (Table 1) include:

- 19.60m* from 224.55m with vis. est. of 2-3% chalcocite, 0.3% covellite and 6% pyrite

- 21.15m* from 244.15m with vis. est. of 1-2% chalcopyrite, 1% bornite, 0.5% chalcocite, 0.5% covellite and 4% pyrite

- 18.95m* from 276.35m with vis. est. of 2% chalcocite, 2% covellite, and 13% pyrite

- 8.15m* from 343.15m with vis. est. 4% chalcocite, 1% covellite, 1-2% pyrite

- 70.75m* from 224.55m consisting of four sub domains highlights (Table 1) include:

- Vero Resource next steps:

- Q4 2023 – Assay results for the remaining Vero Resource drillholes are expected November 2023.

- Q1 2024 Re-estimation of Vero Resource.

COMMENT

True North Copper Managing Director, Marty Costello said:

“We are incredibly excited by these stunning intercepts of visual copper mineralisation and associated drillcore data.

Our drilling program continues to confirm the phenomenal mineralisation of the Vero Resource and is providing substantial insight into zonation and what we believe to be the principal feeder system of the Vero Resource.

We look forward to updating the market in November on the remaining assay results from the Vero Resource drilling program and we remain on track to deliver an updated Mineral Resource Estimate for the Vero Resource in Q1 2024.”

Visual Estimates Summary

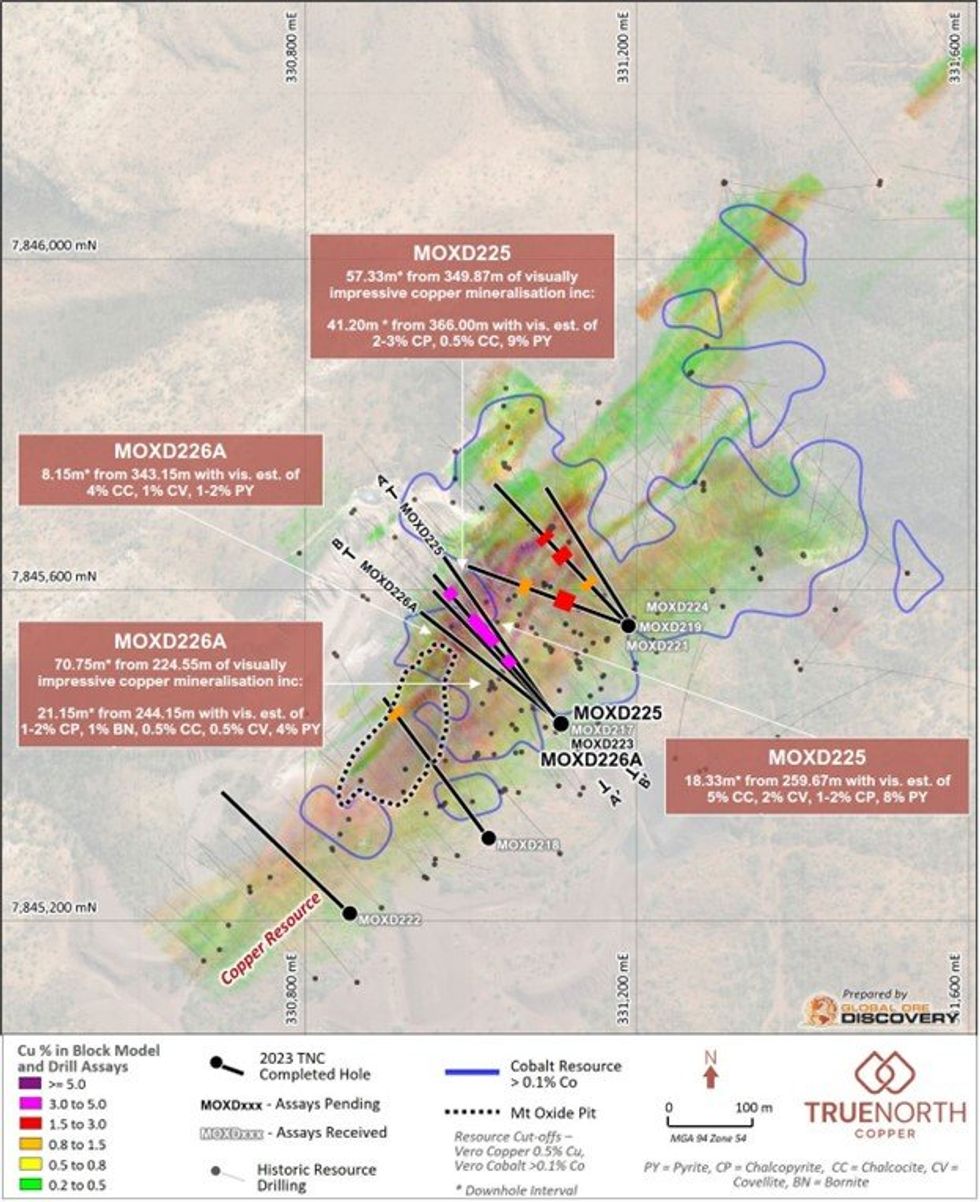

Drillholes MOXD225 and MOXD226A represent the culmination of TNC’s highly successful resource infill and extension drill program at its 100% owned Vero copper-silver-cobalt resource (Figures 2 & 3). Both drillholes successfully intercepted extensions to the high-grade mineralisation in TNC’s first drillhole MOXD217 that returned 66.50m* (48.00m ETW) @ 4.95% Cu, 32.7 g/t Ag and 685 ppm Co from 234.00m downhole1.

MOXD225

MOXD225 targeted a 25m northern extension of MOXD217, and further downhole a 20m strike extension to high-grade mineralisation in historic hole MOXD089. Highlights from MOXD225 include (Table 1 & Figure 4):

- 18.33m* from 259.67m with vis. est. of 3-4% chalcocite, 1% covellite, 0.5% chalcopyrite and 4% pyrite

- 57.33m* from 349.87m consisting of three visually strong mineralised sub domains

- 7.48m* from 349.87m with vis. est. 5% chalcocite, 2% covellite, 1-2% chalcopyrite and 8% pyrite (Figures 1 & 6)

- 8.65m* from 357.35m with vis. est. 2% chalcocite, 0.5% covellite, 0.5% chalcopyrite and 8% pyrite

- 41.20m* from 366.00m with vis. est. 2-3% chalcopyrite, 0.5% chalcocite, 9% pyrite and trace covellite

25m north of MOXD217, MOXD225 intersected an 18.33m* interval between 259.67m and 278.00m of brecciated sediments with variably developed, sulphide fill, crackle, and mosaic breccias. Sulphides transition with depth from chalcocite (3-4%), to covellite (1%), then chalcopyrite (0.5%) – pyrite (4%). From 278.00m brecciation and mineralisation intensity decreases with moderately developed, pyrite rich (5-15%) crackle brecciation and variable quantities of chalcocite (trace-3%) and chalcopyrite (trace-1%) (Table 1).

At the base of the resource, MOXD225 intercepted a 57.33m* interval of copper mineralisation comprising of three sub domains with varying proportions of chalcocite, covellite, chalcopyrite and pyrite (Table 1 & Figure 4). This interval extends the high-grade mineralisation intercepted in MOXD089 (22m* @ 6.3%Cu & 0.31% Co from 258m3) 20m to the south.

MOXD226A

MOXD226A targeted 25m south of MOXD217, and 30m down dip of historic hole S200 drilled by Gunpowder Copper in the late 1960’s early 1970’s. Highlight intercepts from MOXD226A include (Table 1 & Figure 5):

- 70.75m* from 224.55m consisting of four sub domains highlights (Table 1) include:

- 19.60m* from 224.55m with vis. est. of 2-3% chalcocite, 0.3% covellite and 6% pyrite

- 21.15m from 244.15m with vis. est. of 1-2% chalcopyrite, 1% bornite, 0.5% chalcocite, 0.5% covellite and 4% pyrite

- 18.95m* from 276.35m with vis. est. of 2% chalcocite, 2% covellite, and 13% pyrite (Figure 7)

- 8.15m* from 343.15m with vis. est. 4% chalcocite, 1% covellite, 1-2% pyrite

At 224.55m MOXD226A intercepted a 70.75m* interval of crackle brecciation, vein breccias and disseminated copper mineralisation, 25m south of MOXD217 and 30m down dip of S200. Visual estimates of copper mineral percentages vary over the interval and copper mineralogy transitions through chalcocite à chalcocite-covellite àchalcopyrite-pyrite back to chalcocite-covellite over the interval.

At final target depth, the hole intercepted a 45.58m* interval of copper-pyrite mineralisation, confirming mineralisation 15m up dip from historic hole MOXD105.4 The upper 8.15m* of the interval is strongly brecciated with sulphide fill including chalcocite (4%) and covellite (1%). From 351.30 brecciation intensity decreases and copper minerals transition to chalcopyrite dominant (1%) with high visual estimates of pyrite (10%).

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00