February 09, 2024

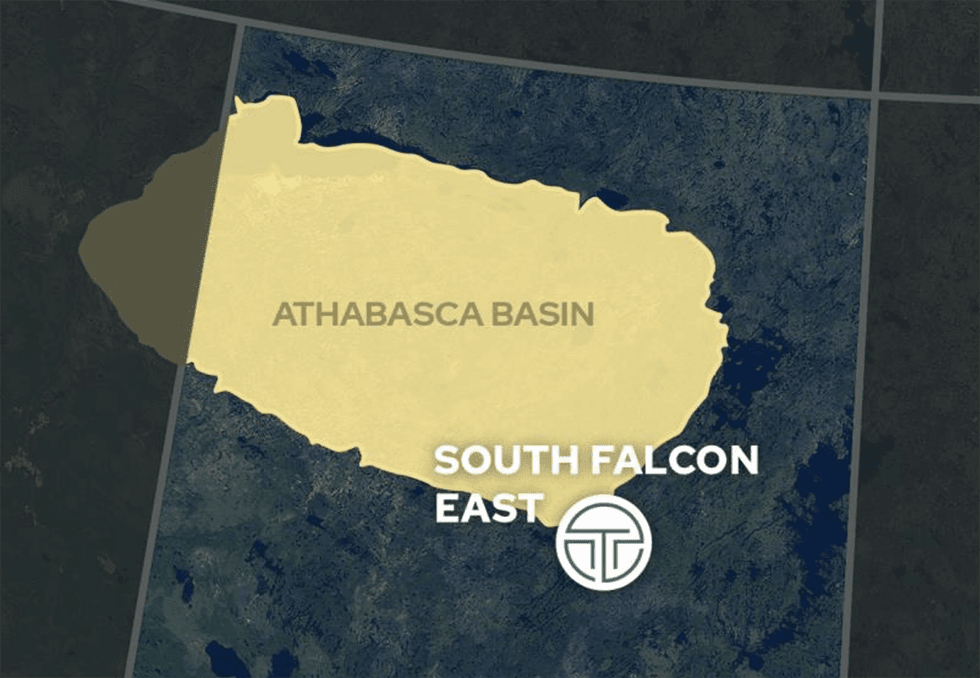

Tisdale Clean Energy (CSE:TCEC) focuses on uranium exploration and development by exploring the South Falcon East uranium project that spans over 12,000 hectares in the Athabasca Basin in Saskatchewan, Canada, and is home to the Fraser Lakes B uranium and thorium deposits.

In October 2022, Tisdale entered into an agreement with Skyharbour Resources (TSXV:SYH,OTCQX:SYHBF, FWB:SC1P) to acquire up to 75 percent interest in the South Falcon East project.

he South Falcon East is the company’s flagship uranium project where outcrop grab samples from 2008 to 2011 returned between 0.04 percent and 0.45 percent triuranium octoxide, and drill core samples returned mineralized sections with values from 0.01 percent to 0.55 percent triuranium octoxide. The Fraser Lakes Zone B deposit comprises multiple-stacked uranium, thorium and REE mineralization with an NI 43-101 mineral resource estimate of 6.9 Mlb triuranium octoxide at 0.03, and 5.3 Mlb thorium oxide at 0.023 percent within 10.3 million tons (Mt) of material using a cut-off grade of 0.01 percent triuranium octoxide.

Company Highlights

- Tisdale Clean Energy is a Canadian company focused on uranium exploration and development.

- The company’s flagship South Falcon East uranium project in the Athabasca Basin in Saskatchewan, Canada, contains the Fraser Lakes B uranium/thorium deposit.

- The South Falcon East project has a historic inferred mineral resource estimate of 6.9 million pounds (Mlbs) triuranium octoxide at a grade of 0.03 percent, and 5.3 Mlbs thorium oxide at 0.023 percent thorium oxide.

- The geological and geochemical characteristics of the project are similar to several other high-grade deposits in the basin, such as Eagle Point, Millennium, P-Patch and Roughrider.

- The Athabasca Basin is home to most of Canada’s high-grade uranium deposits and contributes over 20 percent of the world’s supply. Saskatchewan is a geopolitically stable, proven mining jurisdiction with significant infrastructure already in place.

- Uranium prices have crossed $100/lb, last seen in 2007, reflecting a tight market driven by an increased focus on nuclear energy as the world transitions to net zero.

This Tisdale Clean Energy profile is part of a paid investor education campaign.*

Click here to connect with Tisdale Clean Energy (CSE:TCEC) to receive an Investor Presentation

TCEC:CC

Sign up to get your FREE

Terra Clean Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 January

Terra Clean Energy

Advancing an expansive uranium landholding in the prolific Athabasca Basin and past-producing uranium districts in the United States

Advancing an expansive uranium landholding in the prolific Athabasca Basin and past-producing uranium districts in the United States Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Sign up to get your FREE

Terra Clean Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00