Tinka Resources Limited ("Tinka" or the "Company") (TSXV & BVL:TK)(OTCQB:TKRFF) is pleased to announce results for four drill holes from the ongoing resource expansion and exploration drill program at the Company's Ayawilca project in Peru. Highlights include a new intersection of high-grade silver mineralization from the "Silver Zone" in hole A23-220 located on the edge of the massive sulphide "Zinc Zone" at South Ayawilca. The Silver Zone has been reinterpreted with data from current and previous drill holes to have been emplaced along a northeast-trending sub-vertical fault bordering the massive sulphides. High-grade, structurally controlled, silver mineralization is confirmed along a strike length of approximately 250 metres, open along-strike in both directions and at depth

Key Highlights:

New "Silver Zone" drill hole intercepts:

Hole A23-220

- 29.5 metres at 182 g/t silver, 2.4% zinc & 0.8% lead from 289.65 metres depth, including

- 7.1 metres at 604 g/t silver, 2.7% zinc & 1.6% lead from 310.9 metres depth, including

- 0.65 metres at 2,565 g/t silver, 4.2% zinc & 5.7% lead from 313.7 metres depth.

- 7.1 metres at 604 g/t silver, 2.7% zinc & 1.6% lead from 310.9 metres depth, including

- The Silver Zone is interpreted as a northeast-trending structure on the edge of the Zinc Zone sulphides along a strike length of approximately 250 metres.

- A follow-up drill hole targeting a 100-metre extension of the Silver Zone is in progress.

- Mineralization is associated with a low abundance of sulphide minerals including ‘ruby silvers' with sphalerite and galena in a carbonate-rich vein matrix.

Hole A17-095

- 8.7 metres at 135g/t Ag, 1.1% Zn & 0.6% Pb from 307.3 metres depth.

Silver Zone intercepts previously released:

Hole A17-072

- 11.5 metres at 781 g/t silver, 2.9% zinc & 2.3% lead from 294.5 metres depth, including

- 2.0 metres at 3,167 g/t silver, 5.6% zinc & 5.5% lead from 302.0 metres depth.

Hole A19-167

- 29.6 metres at 152 g/t silver, 3.1% zinc & 0.4% lead from 412.7 metres depth in hole A19-167, including

- 7.3 metres at 366 g/t silver, 4.9% zinc & 0.5% lead from 412.7 metres depth, including

- 1.7 metres at 1,130 g/t silver, 14.5% zinc & 0.3% lead from 412.7 metres depth.

- 7.3 metres at 366 g/t silver, 4.9% zinc & 0.5% lead from 412.7 metres depth, including

True thicknesses of the intercepts in the Silver Zone are estimated to be 65-75% of the downhole thicknesses.

Dr. Graham Carman, Tinka's President and CEO, stated: "The Silver Zone intersection in hole A23-220 is important for the Ayawilca project as it highlights the potential for high-grade structurally-controlled silver mineralization hosted within a steeply-dipping northeast-trending fault on the edge of the massive sulphides at South Ayawilca that has seen limited past drilling. So far, silver mineralization is defined over 250 metres of the structure and remains open in both directions to the east and west. A follow-up drill hole is in progress, targeting a further 100 metre strike extension of the Silver Zone to the east as well as additional Zinc Zone mineralization."

Dr. Carman continued: "Seven infill drill holes targeting high-grade Zinc Zone mineralization predominantly at West Ayawilca remain to be reported. The drill hole information is currently being compiled and we expect to have final results reported in May."

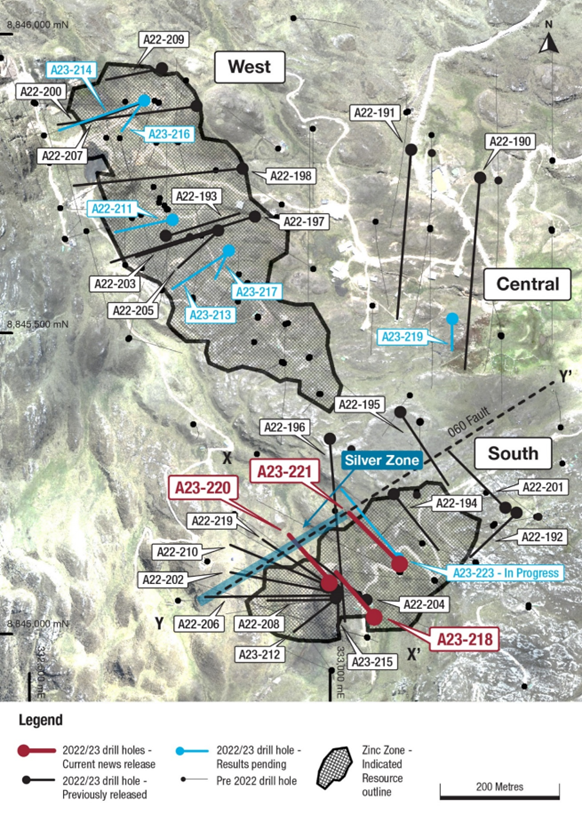

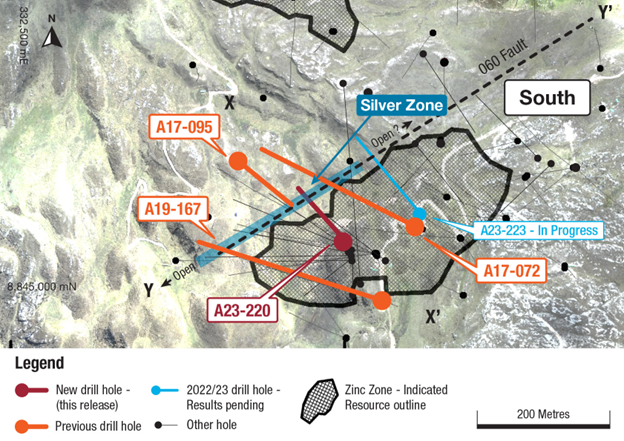

A total of 11,350 metres have now been drilled for 33 drill holes in the 2022-23 resource definition drill program at Ayawilca, mostly at the West and South Ayawilca areas. Two holes at Central were drilled for the dual purposes of exploration and hydrological studies. A drill hole map showing all holes in the 2022-23 drill program is shown in Figure 1. A map focussing on the Silver Zone intersection drill holes only is shown in Figure 2.

Geological discussion of the "Silver Zone"

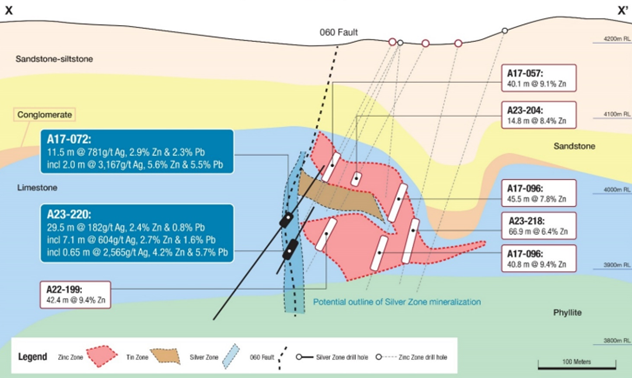

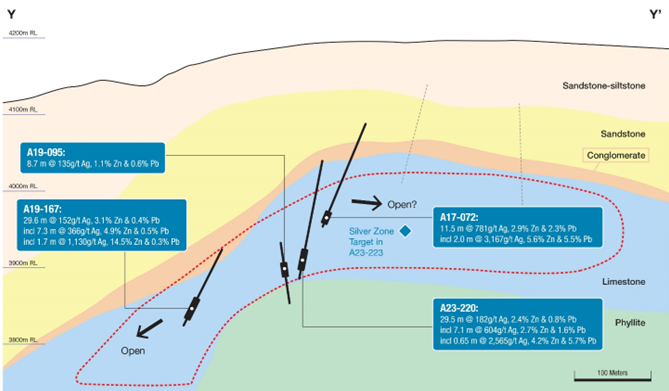

The new high-grade drill intercept in A23-220 has led to a reinterpretation of silver-rich intersections in several other holes at Ayawilca which have a low sulphur content with relatively minor sphalerite and galena but contain visible silver sulphides (including pyrargyrite also known as ‘ruby silver') and abundant hydrothermal carbonate. Following a detailed review of past drill holes, this style of mineralization is believed to be structurally controlled and emplaced along a northeast-trending fault zone (the "060 Fault") on the northern flank of the massive sulphide mineralization at South Ayawilca. Four drill holes are interpreted to have intersected the Silver Zone along the 060 Fault within the favourable Pucara limestone host. These Silver Zone drill intersections include:

- Hole A23-220: 29.5 metres at 182 g/t Ag, 2.4% Zn & 0.8% Pb from 289.65 metres (including 7.1 m at 604 g/t Ag 2.7% Zn & 1.6% Pb from 310.9 metres (new drill hole);

- Hole A17-095: 8.7 metres at 135 g/t Ag, 1.1% Zn & 0.6% Pb from 307.3 metres (new intercept in past hole);

- Hole 17-072: 11.5 metres at 781 g/t Ag, 2.9% Zn & 2.3% Pb from 294.5 metres (including 2.0 m at 3,167 g/t Ag, 5.6% Zn and 5.5% Pb from 302 metres); See previous news release dated July 17, 2017

- Hole A19-167: 29.6 metres at 152 g/t Ag, 3.1% Zn & 0.4% Pb from 412.7 metres (including 7.3 m at 366 g/t Ag, 4.9% Zn & 0.5% Pb from 412.7 metres). See previous news release dated October 8, 2019

True thicknesses of the Silver Zone intercepts are estimated to between 65-75% of the downhole thicknesses.

The Silver Zone mineralization has so far been identified along a 250 metres strike length of the northeast-trending structure. A follow-up hole to A23-220 is in progress to test a further 100 m strike extension of the silver mineralization in hole A23-223. A cross section of the Silver Zone mineralization intersected in hole A23-220 is shown in Figure 3. A longitudinal section along the 060 Fault highlights the along-strike potential of the Silver Zone in Figure 4.

The Silver Zone mineralization is interpreted to have occurred late-stage in the mineralization history at Ayawilca (i.e., post main-stage zinc). The silver-rich mineralization is relatively low in total sulphide content (Figure 5.

Other new Zinc Zone drill results from South Ayawilca include:

- Hole A23-218: 66.85 metres at 6.4% zinc from 229.0 metres depth, including

- 11.9 metres at 11.4% zinc from 231.4 metres depth; and

- 7.1 metres at 14.8% zinc from 272.9 metres depth.

- Hole A23-220: 10.55 metres at 9.6% zinc from 269.45 metres depth.

- Hole A23-221: 13.8 metres at 6.8% zinc from 290.0 metres depth.

True thicknesses of the mineralized intercepts are estimated to be between 65-75% of the downhole thicknesses.

Table 1. Summary of new drill hole results in this news release (all from South Ayawilca)

| Hole | From (m) | To (m) | Interval (m) | Zn % | Pb % | Ag g/t | In ppm | Comment |

| A23-218 | 229.05 | 295.90 | 66.85 | 6.41 | 0.04 | 11 | 199 | Zinc Zone |

incl | 231.40 | 243.30 | 11.90 | 11.42 | 0.05 | 16 | 295 | |

and | 272.90 | 280.00 | 7.10 | 14.79 | 0.08 | 27 | 795 | |

| A23-220 | 269.45 | 280.00 | 10.55 | 9.55 | 0.07 | 15 | 248 | Zinc Zone |

| and | 289.65 | 319.12 | 29.50 | 2.37 | 0.82 | 182 | 9 | Silver Zone |

incl | 310.90 | 318.00 | 7.10 | 2.74 | 1.61 | 604 | 6 | |

incl | 313.70 | 314.35 | 0.65 | 4.16 | 5.72 | 2565 | - | |

| A23-221 | 143.25 | 144.25 | 1.00 | 13.58 | 0.17 | 29 | 66 | |

| and | 290.20 | 304.00 | 13.80 | 6.77 | 0.03 | 11 | 119 | Zinc Zone |

| A17-095 | 307.30 | 316.00 | 8.70 | 1.10 | 0.60 | 135 | - | Silver Zone |

Note on sampling and assaying

Drill holes are diamond HQ size core holes with recoveries generally above 80% and often close to 100%. The drill core is marked up, logged, and photographed on site. The cores are cut in half at the Company's core storage facility, with half-cores stored as a future reference. Half-core was bagged on average over 1 to 2 metre composite intervals and sent to SGS laboratory in Lima for assay in batches. Standards and blanks were inserted by Tinka into each batch prior to departure from the core storage facilities. At the laboratory samples are dried, crushed to 100% passing 2mm, then 500 grams pulverized for multi-element analysis by ICPMS using multi-acid digestion. Samples assaying over 1% zinc, lead, or copper and over 100 g/t silver were re-assayed using precise ore-grade AAS techniques. Samples within massive sulphide zones were also assayed for tin using fusion and AAS finish.

The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

Readers are encouraged to read the NI 43-101 Technical Report entitled "Ayawilca Polymetallic Project, Central Peru, NI 43-101 Technical Report on Updated Preliminary Economic Assessment" available for download on Tinka's website at www.tinkaresources.com. The Technical Report was prepared by Mining Plus Peru S.A.C. ("Mining Plus") as principal consultant, Transmin Metallurgical Consultants ("Transmin"), Envis E.I.R.L ("Envis"), and SLR Consulting (Canada) Ltd ("SLR").

Figure 1. Drill hole map of all 2022-2023 holes at Ayawilca highlighting 2021 Indicated Zinc Zone Resources

Figure 2. Drill hole map of South Ayawilca highlighting Silver Zone intersection holes only

Figure 3. Cross section highlighting recent drill hole A23-220 (looking northeast)

Figure 4. Longitudinal section of the Silver Zone along the 060 Fault (looking northwest)

Figure 5. Silver Zone sulphide mineralization (sphalerite, galena, pyrargyrite) and textures in cores from A23-220 and A17-072

Table 2. Drill hole details for 2022-2023 drill program including drill collar coordinate information

| Drill hole | Easting | Northing | Elevation | Azimuth | Dip | Depth m | Area | Comment |

| A22-190 | 333281 | 8845755 | 4167 | 180 | -50 | 498.95 | Central | Results reported |

| A22-191 | 333169 | 8845799 | 4182 | 180 | -55 | 478.80 | Central | Results reported |

| A22-192 | 333345 | 8845195 | 4208 | 232 | -74 | 385.90 | South | Results reported |

| A22-193 | 332766 | 8845659 | 4237 | 68 | -65 | 365.40 | West | Results reported |

| A22-194 | 333143 | 8845231 | 4226 | 135 | -73 | 380.20 | South | Results reported |

| A22-195 | 333149 | 8845353 | 4221 | 148 | -65 | 426.90 | South | Results reported |

| A22-196 | 333035 | 8845307 | 4235 | 174 | -45 | 382.10 | South | Results reported |

| A22-197 | 332912 | 8845693 | 4220 | 264 | -55 | 412.60 | West | Results reported |

| A22-198 | 332900 | 8845768 | 4222 | 265 | -53 | 451.10 | West | Results reported |

| A22-199 | 333046 | 8845067 | 4195 | 303 | -66 | 344.10 | South | Results reported |

| A22-200 | 332821 | 8845889 | 4246 | 260 | -58 | 352.00 | West | Results reported |

| A22-201 | 333342 | 8845195 | 4208 | 310 | -73 | 58.90 | South (deepen-ing of A17-066) | Results reported |

| A22-202 | 333046 | 8845066 | 4197 | 283 | -52 | 270.15 | South | Results reported |

| A22-203 | 332839 | 8845685 | 4228 | 264 | -60 | 350.00 | West | Results reported |

| A22-204 | 333090 | 8845061 | 4196 | 307 | -60 | 334.30 | South | Results reported |

| A22-205 | 332839 | 8845685 | 4227 | 244 | -72 | 352.70 | West | Results reported |

| A22-206 | 333044 | 8845064 | 4197 | 270 | -58 | 217.30 | South | Results reported |

| A22-207 | 332710 | 8845883 | 4252 | 254 | -74 | 332.00 | West | Results reported |

| A22-208 | 333044 | 8845064 | 4197 | 270 | -70 | 282.55 | South | Results reported |

| A22-209 | 332738 | 8845927 | 4251 | 257 | -68 | 314.15 | West | Results reported |

| A22-210 | 333047 | 8845065 | 4197 | 297 | -48 | 259.80 | South | Results reported |

| A22-211 | 332785 | 8845707 | 4236 | 260 | -75 | 295.00 | West | Results pending |

| A23-212 | 333047 | 8845065 | 4197 | 228 | -79 | 324.30 | South | Results reported |

| A23-213 | 332853 | 8845650 | 4225 | 258 | -65 | 316.00 | West | Results pending |

| A23-214 | 332710 | 8845883 | 4252 | 255 | -67 | 287.10 | West | Results pending |

| A23-215 | 333047 | 8845065 | 4197 | 180 | -80 | 295.10 | South | Results reported |

| A23-216 | 332710 | 8845883 | 4252 | 220 | -73 | 310.00 | West | Results pending |

| A23-217 | 332853 | 8845650 | 4225 | 240 | -78 | 300.00 | West | Results pending |

| A23-218 | 333109 | 8845020 | 4190 | 330 | -75 | 323.70 | South | Results HERE |

| A23-219 | 333219 | 8845582 | 4182 | 180 | -85 | 336.80 | Central | Results pending |

| A23-220 | 333047 | 8845065 | 4197 | 308 | -62 | 328.10 | South | Results HERE |

| A23-221 | 333118 | 8845102 | 4207 | 332 | -69 | 400.60 | South | Results HERE |

| A23-222 | 333653 | 8845721 | 4119 | 180 | -90 | 349.90 | Central | Hydrology hole |

| A23-223 | 333118 | 8845102 | 4207 | 335 | -62 | 230.00 | South | In progress |

| TOTAL | 11,346.50 |

Notes: Datum for coordinates is WGS84 Zone 18S. Azimuth is true azimuth

| On behalf of the Board, "Graham Carman" Dr. Graham Carman, President & CEO | Further Information: Mariana Bermudez 1.604.685.9316 Stay up to date by subscribing for news alerts at Contact Tinka and by following Tinka on Twitter, LinkedIn and Facebook. |

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver-tin project in central Peru. The Zinc Zone deposit has an estimated Indicated Mineral Resource of 19.0 Mt @ 7.15% Zn, 16.8 g/t Ag & 0.2% Pb and Inferred Mineral Resource of 47.9 Mt @ 5.4% Zn, 20.0 g/t Ag & 0.4% Pb (dated August 30, 2021). The Ayawilca Tin Zone has an estimated Inferred Mineral Resource of 8.4 Mt grading 1.0% Sn. Tinka is currently completing an 11,500 metre resource definition drill program at West Ayawilca and South Ayawilca Zinc Zone.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; the Company's expectations regarding the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/752282/Tinka-Drills-71-Metres-At-604-gt-Silver-In-High-Grade-Silver-Zone-At-South-Ayawilca