Northern Lights Resources Corp. ("Northern Lights" or the "Company") (CSE:NLR)(OTCQB:NLRCF) is pleased to announce an update to the exploration plan for the Tin Cup prospect at the Company's 100% owned Secret Pass Gold Project in Mohave County, Arizona

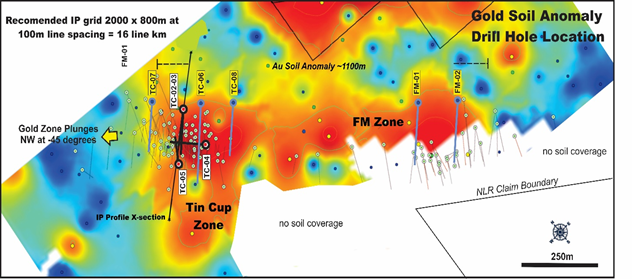

Following on from the success of the initial four holes completed, Northern Lights is planning to expand the exploration program at Secret Pass to include the drilling of three (3) additional holes at Tin Cup and two (2) drill holes at the FM Zone, which is located approximately 500 metres east of Tin Cup. All five (5) proposed drill holes are fully permitted. The drill holes statistics and significant intersections for the first four drill holes are sumarized on Table 1. The location of the recent drill holes and the planned drill holes for Tin Cup and the FM Zones are illlustrated on Figure 1.

Prior to initiating the second phase of drilling, Northern Lights is planning to complete a deep penetrating Induced Polarization (IP) survey over the claim area covering the Tin Cup and FM zones. This survey will explore to depths of ~400 metres and will assist in refining existing targets and identifying new drill targets associated with zones of high chargeability located along strike and to depth. With reference to Figure 1, the IP survey area will cover the gold anomay generated from the soil sampling program completed in 2021. This soil survey identified a significant gold soil anomaly approximately 1,100 metres in length and up to 400 metres wide as shown on Figure1.

Northern Lights CEO, Jason Bahnsen, commented "The initial drilling at Tin Cup has been very successful and has confirmed the presence of wide zones of gold mineralization. The next phase of drilling will test the Tin Cup mineralization at depth and further along strike. We also have two holes permitted to drill at the FM Zone where we are targeting vertical vein structrues similar to Tin cup. The proposed holes are fully permitted with drilling to commence pending financing and availability of drilling contractors."

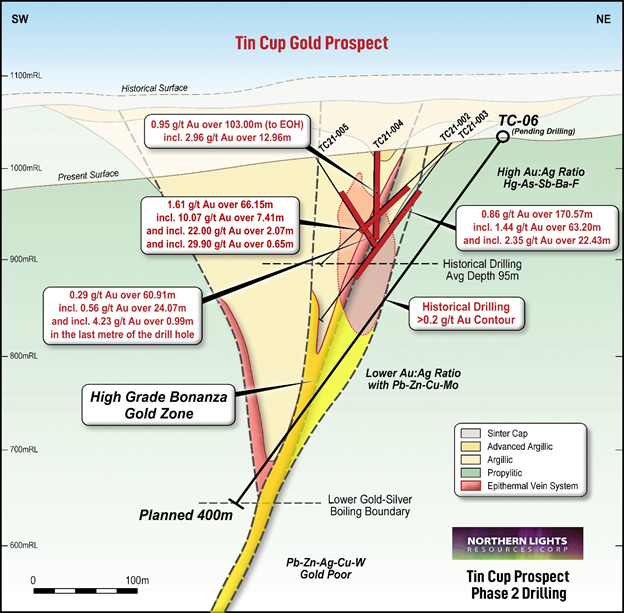

The first four drill holes completed at Tin Cup showed confirmation of gold mineralization from surface to a maximum depth of approximately 90 metres. The three additional holes planned have been fully permitted and will test the down plunge extension of the gold mineralization. With reference to Figure 2, drill hole TC21-06 is planned for 400 metres at a 55 degree dip to test the mineralizaton at depth. The other two drill holes TC22-07 and TC22-08 will test the mineralization along strike.

At the Tin Cup zone, drilling at depth will test the potential for an epithermal quartz vein system similar to the Oatman District. The geology of the Tin Cup zone shares similarities of the upper parts of the Oatman gold system. The Secret Pass drilling will target both the upper broad zone of stockwork veining and the deeper, more discreet ‘bonanza' veining.

The drilling at the FM zone will target near-vertical mineralized structures related to the FM fault zone similar to the Tin Cup zone.

Table 1: Tin Cup Phase 1 Drill Holes

Hole No. | Location | Azimuth (o) | Dip (o) | Length (m) | Significant Intersections |

TC21-01 | Tin Cup | - | - | - | Abandoned |

TC21-02 | Tin Cup | 220 | -45 | 175 |

|

TC21-03 | Tin Cup | 220 | -55 | 230 |

|

TC21-04 | Tin Cup | 310 | -50 | 103* |

|

TC21-05 | Tin Cup | 040 | -60 | 102* |

|

TC22-06 | Tin Cup | 220 | -65 | 400 | Fully Permitted - Pending Drilling |

TC22-07 | Tin Cup | 250 | -50 | 250 | Fully Permitted - Pending Drilling |

TC22-08 | Tin Cup | 200 | -50 | 150 | Fully Permitted - Pending Drilling |

FM22-01 | FM Zone | 220 | -50 | 150 | Fully Permitted - Pending Drilling |

FM22-02 | FM Zone | 220 | -50 | 150 | Fully Permitted - Pending Drilling |

| Total Completed and Planned | 1,710 | ||||

Note: all intersections have been previously announced and represent downhole widths as insufficient information is available to calculate true widths.

*Drill holes TC21-04 and TC21-05 were terminated early due to technical difficulties.

Figure 1: Drill Locations and Gold Soil Anomalies

Figure 2: Tin Cup Drilling Cross Section and Geological Model

QA/QC Statement

Diamond Core (HQ size) was drilled by Godbe Drilling LLC under the supervision of Mr. Lee Beasley, QP for Northern Lights Resources. The core was split with the half core transported to Skyline Assayers and Laboratories (Skyline) in Tucson, AZ. Field control QA/QC samples, including standards, blanks, and field duplicates, were inserted into the sample stream at a rate of one field control sample every 20 regular samples. Samples received by the lab are logged, weighted and assigned into batches. Sample preparation begins with crushing samples to 75% passing -10 mesh. From this sample, 250 grams of material is separated using a riffle splitter which is then further pulverized to at least 95% - 150 mesh resulting in a pulp that is ready for analysis. Gold was determined by fire assay fusion of a 30 gram sub-samples with atomic absorption spectroscopy (method FA-01). Overlimit samples of gold ( greater than 5 g/t) were assayed by gravimetric means (FA-02). Skyline Laboratories is accredited in accordance with ISO/IEC 17025:2017 and ISO 9001:2015.

Competent Persons Statement

Information in this report relating to Exploration Results is based on information reviewed by Mr. Lee R. Beasley, a Certified Professional Geologist who is a Member of the American Institute of Professional Geologists, and a consultant to Northern Lights Resources. Mr. Beasley has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Qualified Person for the purposes of NI43-101 Standards of Disclosure for Mineral Projects. Mr. Beasley consents to the inclusion of the data in the form and context in which it appears.

For further information, please contact:

Albert Timcke, Executive Chairman and President

Email: rtimcke@northernlightsresources.com

Tel: +1 604 608 6163

Jason Bahnsen, Chief Executive Officer

Email: Jason@northernlightsresources.com

Tel: +1 604 608 6163

Shawn Balaghi, Investor Relations

Email: shawn@northernlightsresources.com

Tel: +1 604 773 0242

About Northern Lights Resources Corp.

Northern Lights Resources Corp is a growth-oriented exploration and development company that is advancing two projects: The 100% owned, Secret Pass Gold Project located in Arizona; and the Medicine Springs silver-zinc-lead Project located in Elko County Nevada where Northern Lights, in joint venture with Reyna Silver are earning 100% ownership. Northern Lights Resources is a member of the Arizona Mining Association.

Northern Lights Resources trades under the ticker of "NLR" on the CSE and "NLRCF" on the OTCQB. This and other Northern Lights Resources news releases can be viewed at www.sedar.com and www.northernlightsresources.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to: the terms and conditions of the proposed private placement; use of funds; the business and operations of the Company after the proposed closing of the Offering. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; and the uncertainties surrounding the mineral exploration industry. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new inforAddmation, future events or otherwise, except as required by law.

SOURCE: Northern Lights Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/695306/Tin-Cup-Exploration-Update