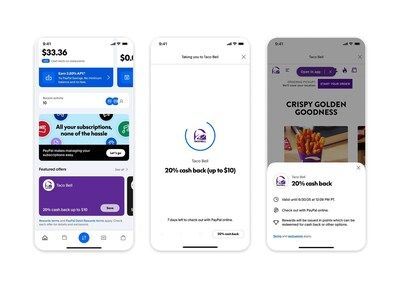

PayPal and Venmo can now be set as default payment options in the Taco Bell app and website and customers checking out with PayPal can earn 20% cash back 1 every week

SAN JOSE, Calif. , June 25, 2025 /PRNewswire/ -- Today, PayPal announced it has teamed up with Taco Bell to deliver a fast, secure, and deliciously rewarding way to pay in the Taco Bell app and website. Now, Taco Bell customers can choose to pay with PayPal or Venmo, giving them more choice and rewards while delivering a quick and easy checkout experience.

With Crunchwrap Supremes and cash back top of mind this summer, customers checking out with PayPal in the Taco Bell app can also receive 20% cash back on any purchase over $5 , $10 cash back maximum per purchase. Customers can simply tap to save the exclusive offer in the PayPal app, and the cash back will apply when they pay with PayPal for their order. The exclusive 20% cash back offer is available until July 31, 2025 for weekly redemption. Plus, PayPal Debit Mastercard 2 customers can earn an additional 5% cash back on top, if they choose restaurants as their monthly PayPal Debit Mastercard 2 cash back category 3 .

"Taco Bell has built one of the most iconic, loyal fan bases in the world, and this partnership is about showing up for them in the moments that matter," said Diego Scotti, General Manager, Consumer Group at PayPal. "With PayPal and Venmo, we're bringing more choice, more rewards, and a fast, flexible way to pay that fits how people live today. It's another step forward as we expand how and where people use PayPal and Venmo every day."

PayPal is helping customers pay their own way at Taco Bell, delivering choice and flexibility to select the payment option that works best for them. Whether it's credit, debit, or balance, customers can select PayPal or Venmo as their default payment option in the Taco Bell app for ease of use every time they place a Taco Bell order.

How It Works:

- Download the PayPal app and save the Taco Bell offer in the Deals tab

- Place order in the Taco Bell app or website and use PayPal to checkout

- Once the purchase is complete, cash back will be added to the customer's PayPal account

About PayPal

PayPal has been revolutionizing commerce globally for more than 25 years. Creating innovative experiences that make moving money, selling, and shopping simple, personalized, and secure, PayPal empowers consumers and businesses in approximately 200 markets to join and thrive in the global economy. For more information, visit https://www.paypal.com , https://about.pypl.com/ and https://investor.pypl.com/ .

About Taco Bell Corp.

For more than 62 years, Taco Bell has brought innovative, craveable Mexican-inspired food to the masses, and was recently recognized as one of Fast Company's World's Most Innovative Companies, one of TIME's Most Influential Companies, and Nation's Restaurant News' Brand Icon. For more information about Taco Bell, visit our website at www.TacoBell.com , our Newsroom at www.TacoBell.com/news , or check out www.TacoBell.com/popular-links . You can also stay up to date on all things Taco Bell by following us on LinkedIn , TikTok , X , Instagram , Facebook and by subscribing to our YouTube channel.

| | 1 Minimum purchase is $5. $10 cash back per transaction. Open to all customers. Offer valid until July 31, 2025. Redeem points for cash and other options. Terms and exclusions apply. Offer valid when checking out with PayPal only. |

CONTACT: Reema Nimkar , rnimkar@paypal.com

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/taco-bell-introduces-paypal-and-venmo-as-new-in-app-payment-options-with-exclusive-20-cash-back-summer-offer-302490739.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/taco-bell-introduces-paypal-and-venmo-as-new-in-app-payment-options-with-exclusive-20-cash-back-summer-offer-302490739.html

SOURCE PayPal Holdings, Inc.