- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

January 15, 2026

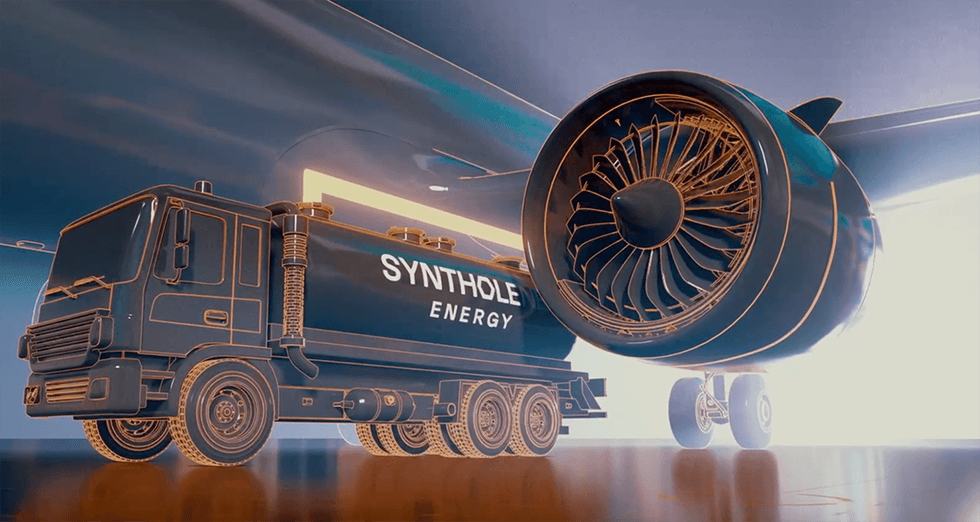

Syntholene Energy (TSXV:ESAF,FSE:3DD0) is a next-generation clean energy company developing high-performance, carbon-negative synthetic liquid fuels, with aviation as its initial target market. The company is commercializing its proprietary Hybrid Thermal Production System, a breakthrough technology designed to enable low-cost, large-scale production of ultrapure synthetic jet fuel (eSAF).

Syntholene targets production costs up to 70 percent lower than the nearest competing technologies, positioning its fuel to be cost-competitive with — and ultimately cheaper than — conventional fossil fuels. With a mission to deliver the world’s first truly high-performance, low-cost, and carbon-neutral eFuel at industrial scale, Syntholene aims to unlock a new era of affordable, sustainable aviation and clean energy solutions

Syntholene is progressing its Hybrid Thermal Production System from laboratory-scale validation toward a real-world demonstration facility in Iceland, leveraging abundant geothermal resources and long-term expansion potential.

Company Highlights

- Proprietary Production Technology – Synthetic fuel (eFuel) produced through a fully integrated, proprietary pathway designed for superior performance and materially lower cost than conventional power-to-liquid methods

- Low-Cost, High-Performance Fuel – Engineered to deliver high energy efficiency while significantly reducing production costs

- Sustainable Feedstocks – Manufactured using renewable electricity, green hydrogen, and captured carbon

- Ultra-Low Emissions – Delivers up to 90 percent lower lifecycle emissions compared to conventional jet fuel

- Drop-In Compatibility – Fully compatible with existing aircraft engines and global fueling infrastructure

- Scalable Clean Energy Solution – Designed for industrial-scale deployment to accelerate the transition to sustainable aviation fuel

This Syntholene Energy profile is part of a paid investor education campaign.*

Click here to connect with Syntholene Energy (TSXV:ESAF) to receive an Investor Presentation

ESAF:CC

Sign up to get your FREE

Syntholene Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 January

Syntholene Energy

High-performance, carbon-negative, low-cost – the promise of Syntholene eFuel.

High-performance, carbon-negative, low-cost – the promise of Syntholene eFuel. Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Syntholene Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00