May 17, 2022

Oversubscribed $8m capital raising completed

US focused uranium and lithium explorer, Aurora Energy Metals Limited (Aurora or the Company) (ASX:1AE) is pleased to announce the successful completion of its public offer to raise $8,000,000 via the issue of 40,000,000 Ordinary shares at $0.20 per share (Public Offer).

- Aurora Energy Metals shares commence trading at 11.00am AEST today on ASX under the code 1AE

- Company successfully raised $8m in its IPO, at an indicative market cap of $28m

- The Company holds 100% of the Aurora Energy Metals Project in south-eastern Oregon, USA

- Project has a defined uranium resource and known lithium mineralisation

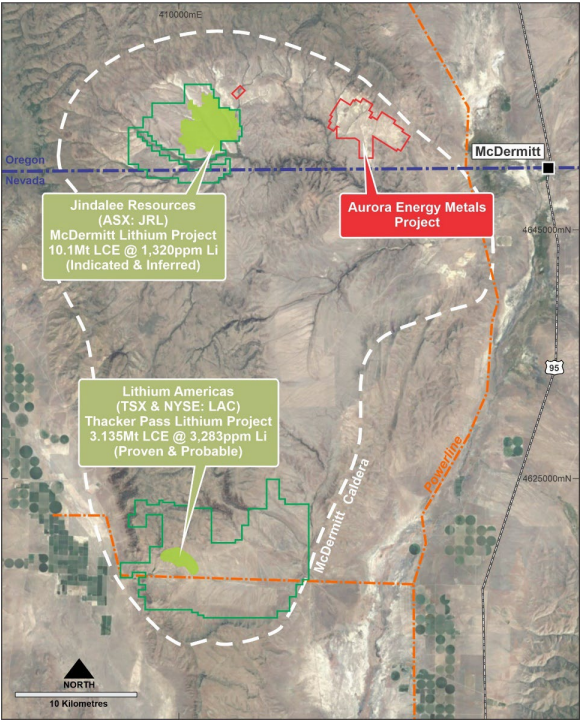

- Project located in the McDermitt Caldera, home to the USA’s two largest lithium deposits

Proceeds from the Public Offer will be used to fund exploration and development activities on the Company’s Aurora Energy Metals Project in south-eastern Oregon, USA. The program is aimed at growing the basement uranium mineral resource and progressing studies whilst also defining lithium mineral resources in the lakebed sediments surrounding and overlying the uranium resource.

The Company will commence trading today on the Australian Securities Exchange (ASX) at 11:00am AEST under the ticker 1AE.

Euroz Hartleys was Lead Manager to the capital raising.

Aurora’s Managing Director, Greg Cochran, commented:

“We are excited by the strong response that we had to the capital raising from both retail and institutional investors. We could not be happier with the performance of Euroz Hartleys in the process and the quality of the investors they introduced to the register.

“The Aurora Energy Metals Project offers investors two bites at the clean energy pie. We will look to grow the well-defined, shallow uranium resource hosted in the basement and conduct techno-economic studies, whilst following up the significant lakebed sediment-hosted lithium mineralisation that surrounds and overlies it.

“The McDermitt Caldera, which hosts our Aurora Energy Metals Project, is one of the most prospective lithium provinces in the USA. It is home to the two largest lithium resources in the USA and neighbouring peer companies have clearly demonstrated the region’s potential . We are looking forward to undertaking our planned work programs and keeping our shareholders updated on our progress.”

Figure 1: Location of Aurora Energy Metals Project in south-eastern Oregon, USA

Click here for the full ASX Release

This article includes content from [Company Name], licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

From Your Site Articles

ASX:1AE

Sign up to get your FREE

Tartisan Nickel Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

6h

Tartisan Nickel Corp.

Advancing a high-grade Nickel-Copper-Cobalt Project in Northwestern, Ontario

Advancing a high-grade Nickel-Copper-Cobalt Project in Northwestern, Ontario Keep Reading...

27 September 2022

Aurora Energy Metals Project Update

Uranium and lithium-focused advanced explorer, Aurora Energy Metals Limited (Aurora or the Company) (ASX:1AE) is pleased to provide a detailed update of project activities relating to the Company’s 100%- owned Aurora Energy Metals Project. These activities have been taking place in Oregon and in... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Sign up to get your FREE

Tartisan Nickel Corp. Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00