July 18, 2023

Balkan Mining and Minerals Ltd (“BMM” or “the Company”) (ASX: BMM) is pleased to announce all multi-element soil geochemistry results from recent systematic soil sampling completed at the Gorge Lithium Project located in Ontario, Canada (the "Gorge Lithium Project" or the "Project"), further demonstrating the strong potential of this Project.

HIGHLIGHTS

- Assay results from stepped out systematic soil sampling program return strong anomalous Li, Cs, and Ta results identifying ~2.6 km of trend strike prospective for lithium bearing pegmatites.

- In total, 651 soil samples taken across the enlarged area of 5 km2 analysed for full multielement suites at ALS Laboratory in Vancouver.

- Assays results return a positive correlation for Li, Cs and Ta and a negative correlation for ratios K/Rb and K/Cs indicating a fertile LCT pegmatite environment.

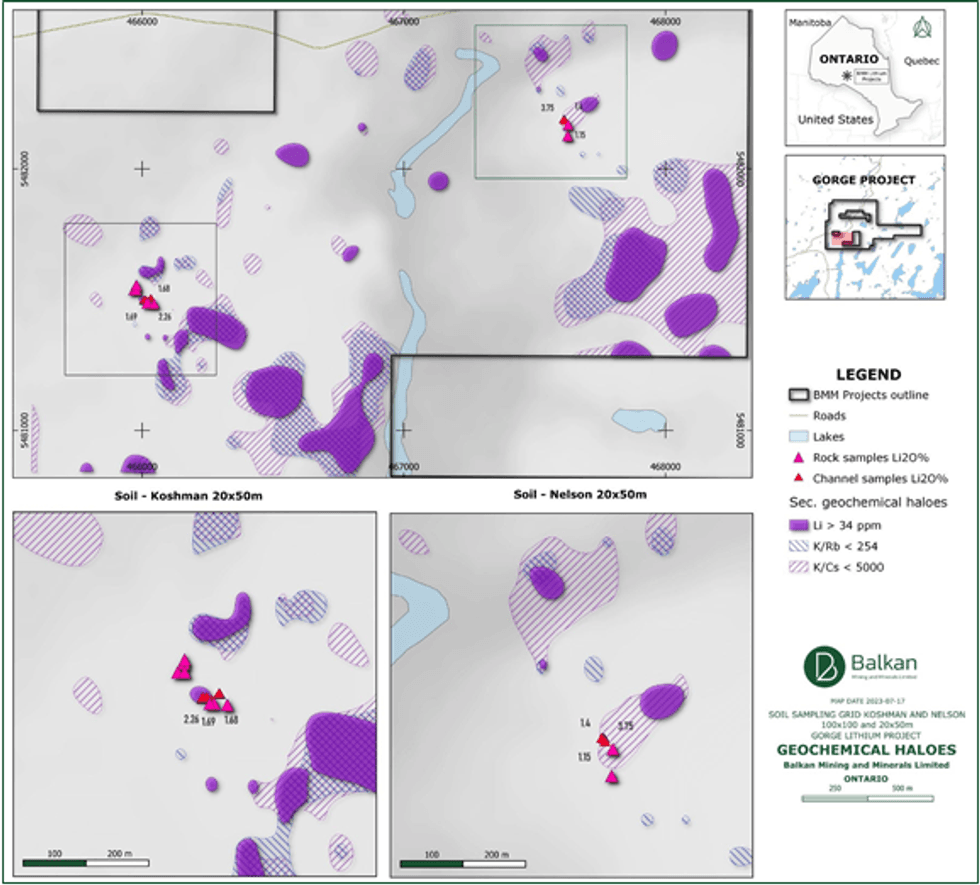

The structured programme was designed to enhance extensions of previously identified soil sample anomalies which focused on the immediate vicinity of outcropping high-grade lithium–bearing pegmatites at the Koshman and Nelson occurrences (refer to announcement 6 July 2023), whilst also providing additional data on the wider project area.

A total of 651 samples were systematically collected from a focused 25x50m and wider 100x100m offset grid patterns covering an area of 5 km2 (refer to Figure 4).

The results have defined two northwest-southwest striking trends coincident with high-grade outcropping spodumene-bearing pegmatites. Soil sampling assay results including up to 110.5 ppm Li strongly correlating with Cesium (Cs), Tantalum (Ta), and Tin (Sn) (typical pathfinder elements), (Table 1), have confirmed the presence of highly fractionated LCT-type pegmatites as the source of surficial geochemical anomalism.

Target areas are defined by coincident haloes of Li (90th percentile Li > 34ppm) and K/Rb and K/Cs ratios. The most noticeable anomaly was identified proximal to the Koshman spodumene pegmatites extending over 1.2km along a northwest-southeast striking trend. The second notable anomaly starts approximately 500 m southeast of the Nelson pegmatites extending over 1.4km, having a northwest-southeast striking trend. Both identified anomalies indicate the possible presence of multiple pegmatite dykes.

Based on the geochemical results of lithium and K/Rb and K/Cs ratios, the Company is able to utilise this data, together with its existing sampling and trenching data, to prioritise targets for further exploratory testing and drilling.

Click here for the full ASX Release

This article includes content from Balkan Mining and Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BMM:AU

The Conversation (0)

05 September 2021

Bayan Mining and Minerals

Mining Critical Minerals from the Balkan Region

Mining Critical Minerals from the Balkan Region Keep Reading...

19 January 2025

Further Exploration Targets Identified at Bayan Springs

Bayan Mining and Minerals (BMM:AU) has announced Further Exploration Targets Identified at Bayan SpringsDownload the PDF here. Keep Reading...

31 October 2024

Quarterly Activities/Appendix 5B Cash Flow Report

Balkan Mining and Minerals (BMM:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00