Investor Insight

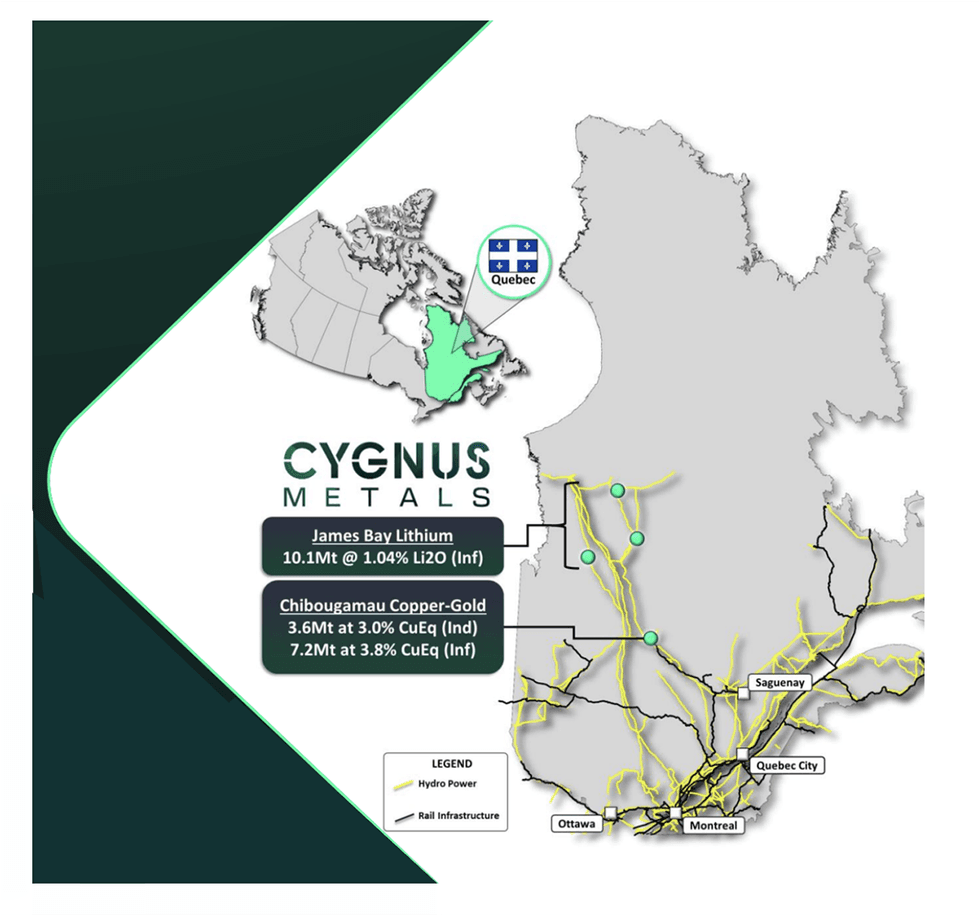

Cygnus Metals is advancing high-grade copper-gold and lithium projects in Quebec, Canada. Through asset consolidation and substantial exploration funding, the company is primed for scalable growth in a premier mining jurisdiction.

Overview

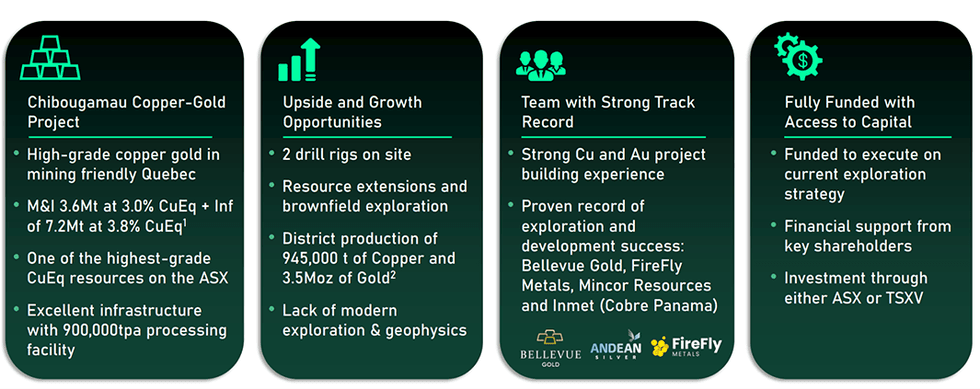

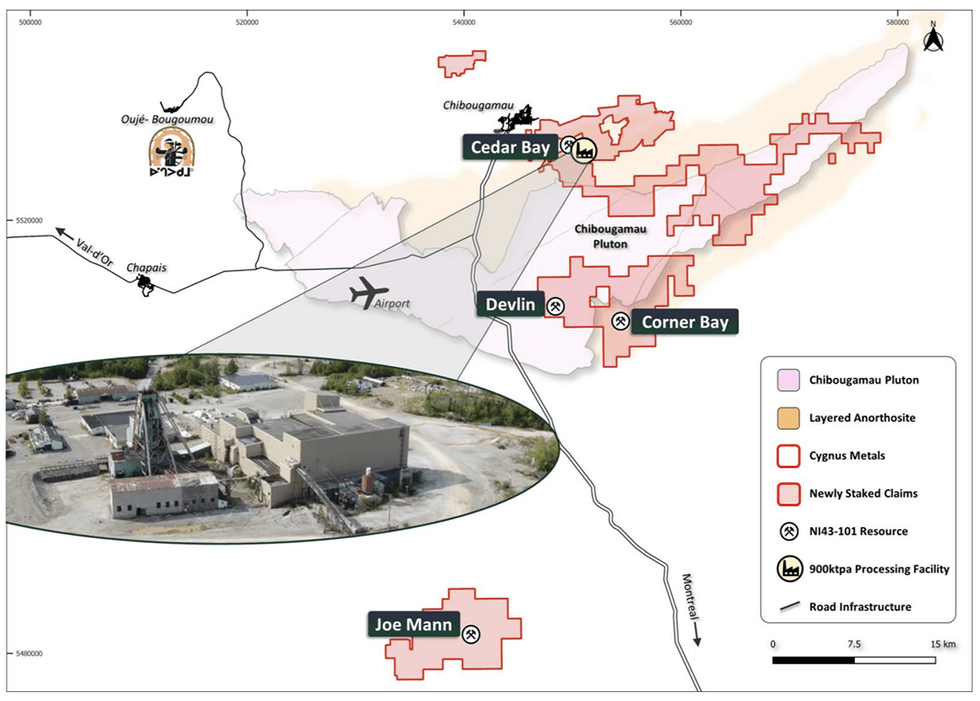

Cygnus Metals (TSXV:CYG) is a copper-gold and lithium exploration and development company focused on becoming a near-term producer in the highly prospective Chibougamau region of Québec, Canada. Leveraging a strategic portfolio of high-grade, brownfield copper and gold assets, the company is rapidly advancing toward production by capitalizing on existing infrastructure, including the centrally located Copper Rand mill. Operating in a mining-friendly jurisdiction, Cygnus Metals is executing a hub-and-spoke development model, intending to become Québec’s next significant copper producer.

Following its strategic merger with Dore Copper, Cygnus Metals has consolidated a significant 282 sq km land package in prolific mining regions in Quebec - Chibougamau (copper-gold) and James Bay (lithium) - boasting a high-grade copper and gold resource of 10.8 million tons (Mt) @ 3.5 percent copper equivalent, and existing infrastructure that includes a 900 ktpa processing facility. Doré Copper completed a preliminary economic assessment on a hub and spoke operation in June 2022.

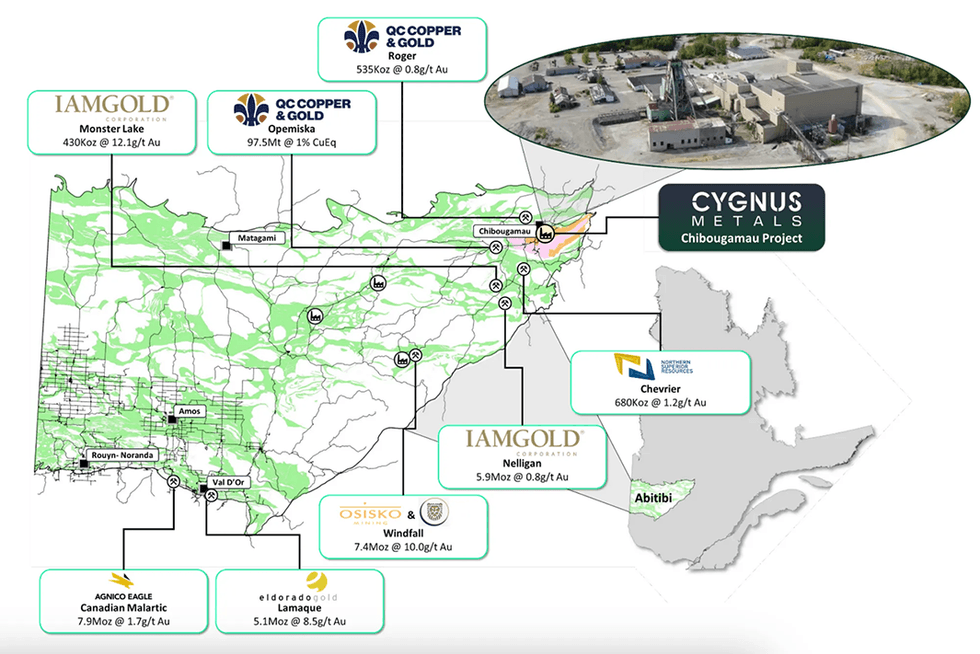

Cygnus Metals is currently advancing its flagship Chibougamau Project, located in a region with a rich history of copper and gold production within the world-renowned Abitibi Greenstone Belt of Québec.

The Copper Rand mill is the only processing facility in the area designed for a capacity of 1,350 tonnes per day. This infrastructure is expected to significantly reduce upfront capital costs and may offer future revenue-generating opportunities through toll milling arrangements with third-party operators.

Cygnus Metals is led by a seasoned management team with a proven track record in the mining sector. President and managing director Ernest Mast brings over 30 years of experience, including senior leadership roles at Primero Mining and Minera Panama (Inmet Mining). His background in guiding junior and mid-tier mining companies through key growth stages aligns well with Cygnus Metals’ development strategy. The broader team includes experienced professionals with deep expertise in exploration, project development, and mining operations, both in Canada and internationally.

Company Highlights

- Cygnus Metals has consolidated a significant land package within the prolific mining regions of Quebec, Canada: Chibougamau and James Bay.

- The company’s focus are the copper gold projects in the Chibougamau mining camp.

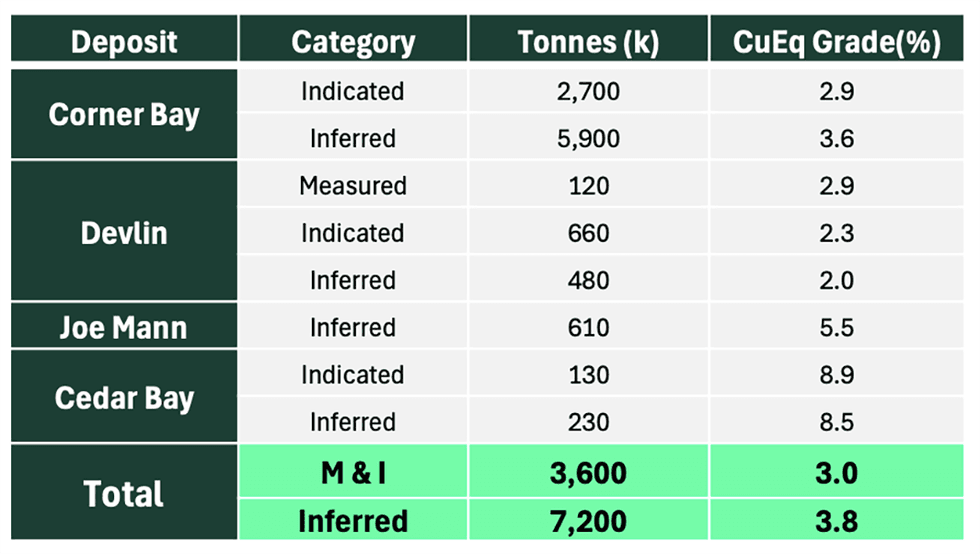

- The principal deposit is the Corner Bay deposit is known for high copper grades and strong exploration potential, with the latest resource estimate of 2.7 million tonnes of indicated resources at 2.9 percent CuEq, 5.9 million tonnes of inferred resources at 3.6 percent CuEq. In addition to Corner Bay there are numerous past-producing mines that could fit into a hub and spoke operating plan.

- The 100 percent owned Copper Rand mill will be refurbished for future production and will be the only operating mill in the Chibougamau region. The mill will have extra capacity and provide the ability to process its own ore while potentially offering toll milling services to other nearby mining projects.

- Cygnus Metals is led by an experienced and highly skilled management team.

Key Project

Location of the Chibougamau Project relative to other major deposits and processing facilities

Cygnus Metals' assets are located within two well-known mining regions in Quebec, with a long history of production. The company’s current strategy revolves around a hub-and-spoke model, with the Copper Rand mill serving as the processing hub, fed by multiple satellite deposits.

Chibougamau Copper Gold Project

Located within a historic, high-grade mining camp, the Chibougamau copper gold project spans 187 sq km and includes a 900 ktpa processing plant and existing major infrastructure. The project consists of seven exploration targets, three of which have an existing mineral resource 10.8 million tons @ 3.5 percent copper equivalent.

The Chibougamau region has a rich mining history dating back to the early 1900s. With 16 historic mines, the district has produced some 53.5 Mt @ 3.4 percent copper equivalent (1.8 percent copper and 2.1 grams per ton gold) for 945,000 of copper and 3.5 Moz of gold.

Metallurgical testing at Corner Bay has yielded positive results, with copper recoveries ranging from 96.8 percent to 98.2 percent, and the concentrate is of high commercial quality, making it highly attractive to smelters.

Cygnus is focused on growing the mineral resources base at the Chibougamau project and concurrently work on aspects of the project supporting a move towards a feasibility study. The resource base, which currently stands at 3.6 Mt of measured and indicated mineral resources at 3 percent copper equivalent and 7.2 Mt of inferred mineral resources at 3.8 percent copper equivalent, for a total of 10.8 Mt at 3.5 percent copper equivalent for 306 kt copper and 314 koz gold. Recent exploration results focused on the Golden Eye deposit located only 3 km from the mill with an intercept of 7.4 meters of 4.7 g/t gold, 0.9 percent copper and 5.6 g/t silver demonstrating the deposit being open down dip. Currently Golden Eye does not have a 43-101 Mineral Resource and represents a tremendous growth opportunity.

The Corner Bay deposit is the cornerstone of Cygnus Metals’ development strategy, recognized for its exceptional copper grades and significant exploration upside. The most recent resource estimate outlines 2.7 million tonnes of Indicated resources grading 2.9 percent CuEq, 5.9 million tonnes of Inferred resources at 3.6 percent CuEq. Continued drilling success is expanding mineralized zones, supporting future resource growth and extended mine life.

Devlin hosts 660,000 tonnes of indicated resources at 2.3 percent CuEq and 480,000 tonnes of inferred resources at 2 percent CuEq. While smaller in scale, Devlin offers strategic flexibility and early production potential. Ore will be transported to Corner Bay for pre-concentration, then hauled to the Copper Rand mill for final processing. Mining is expected to use room-and-pillar and drift-and-fill methods, with operations commencing shortly after Corner Bay comes online.

Cedar Bay, a past-producing mine near the Copper Rand mill, historically produced 3.9 million tonnes at an average grade of 1.63 percent copper and 3.21 g/t gold. Updated resources now include 130,000 tonnes of Indicated material grading 8.9 percent CuEq and 230,000 tonnes of inferred material at 8.5 percent CuEq. These standout grades underscore Cedar Bay’s potential as a valuable high-grade feed source and a near-term contributor to the production pipeline.

The Joe Mann deposit, located 60 kilometers south of the Copper Rand mill, adds further scale and upside. Over its mine life, Joe Mann produced 1.2 million ounces of gold and 28 million pounds of copper, with average grades of 8.26 g/t gold and 0.25 percent copper. The current resource includes 610,000 tonnes of inferred resources at 5.5 percent CuEq.

Across its portfolio, Cygnus Metals has outlined 3.6 million tonnes of measured and indicated resources at 3.0 percent CuEq and 7.2 million tonnes of inferred resources at 3.8 percent CuEq. Together, these deposits provide the foundation for a scalable, high-grade copper-gold operation centered on the refurbished Copper Rand mill, with a phased, multi-source production strategy unlocking long-term value in Québec’s historic Chibougamau mining district.

Board and Management

David Southam - Executive Chairman

David Southam is highly experienced in operations, project development and capital markets across the resources and industrial sectors. He was previously the managing director of Mincor Resources. Southam is non-executive director of Ramelius Resources and a non-executive chair of Andean Silver Limited.

Ernest Mast – President and Managing Director

Ernest Mast is a mining executive with over 30 years of global experience across operations, development, and corporate leadership. He has held senior roles at Primero Mining, New Gold, Copper Mountain, and Inmet Mining, where he led development of the $6B Cobre Panama project. Mast began his career at Noranda and serves on the board of Scottie Resources and other firms. He holds engineering degrees from McGill University and business credentials from Henley College and Universidad Catolica.

Mario Stifano – Non-executive Director

Mario Stifano is a mining executive and CPA with over 16 years of experience across exploration, development, and production. Currently CEO of Galantas Gold, he has held senior roles at Cordoba Minerals, Mega Precious Metals, Lake Shore Gold, and Ivernia. Stifano has raised over $700 million for mining projects, including $500 million to develop three gold mines now producing 180,000 oz annually as part of Pan American Silver.

Kevin Tomlinson - Non-executive Director

Kevin Tomlinson is a structural geologist and investment banker. He is the non-executive chair of Bellevue Gold and of FireFly Metals. Tomlinson has a successful track record in base and precious metals project development.

Raymond Shorrocks – Non-executive Director

Raymond Shorrocks brings a wealth of experience in corporate finance, stockbroking and financial services in Ontario. He was the previous non-executive chair of FireFly Metals and Bellevue Gold. He is the executive chair of Alicanto Minerals.

Brent Omland – Non-executive Director

Brent Omland is the co-CEO of Ocean Partners providing a range of trading services for miners, smelters and refiners globally. He is a chartered accountant and has held CFO roles for publicly listed companies in the resources industry.