(TheNewswire)

Vancouver, British Columbia September 11, 2025 TheNewswire - Stellar AfricaGold Inc. (TSX-V: SPX) ("Stellar" or the "Company") is pleased to announce that the final report by Dr. David Selley on the structural geology of Tichka Est confirms the exploration potential of Structure B and its possible extensions at the Company's Tichka Est Gold Project in Morocco.

The Selley Report

The Company received the final detailed report on the ‘ Structural Analysis of the Tichka Est Prospect, High Atlas, Morocco ' from Dr. David Selley of Base Instinct. This compilation and analysis of structural mapping, alteration studies, and mineralization provides the most comprehensive understanding to date of the gold potential of Structure B, outlines the regional potential of the Tichka Est Gold Project, and provides a window to the opportunity for value creation through additional gold discovery at Tichka Est.

CEO Commentary

" Dr. Selley's in-depth structural mapping report supports expansion of Stellar's planned drill program and gives us tremendous confidence in the immediate upside potential for additional near-term gold discoveries at Tichka Est ," said François Lalonde, CEO of Stellar AfricaGold. " The combination of Structure B's scale, the structural junctions with Structures A and C, and the intensity of alteration confirm we are in a fertile gold system. With current drill targets clearly defined, we are excited to maintain the pace of exploration activities and move quickly into the next phase of drilling ."

Key Findings from the Structural Report

The Structural Report confirms that:

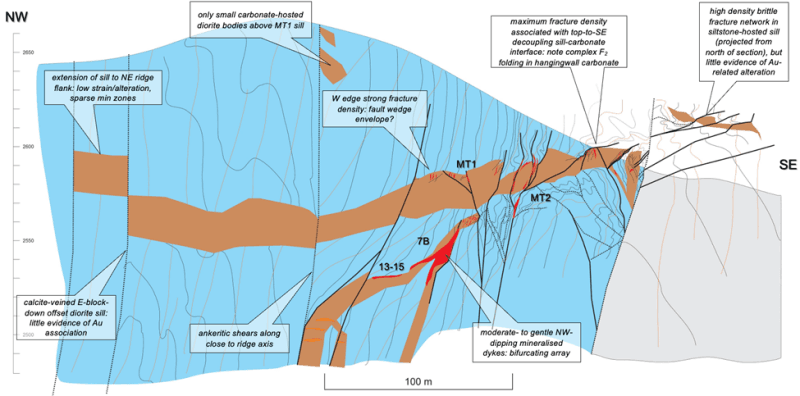

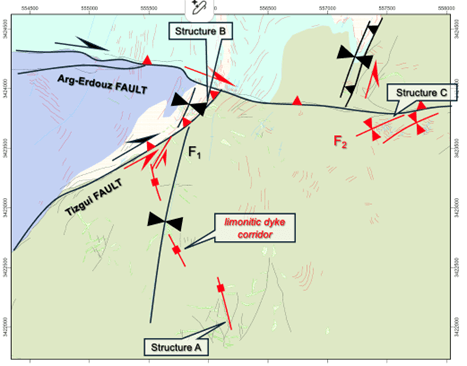

• Structure B hosts a strong gold-bearing system located at the intersection of the NE-striking Tizgui Fault Zone and the ENE-striking Arg-Erdouz Fault Zone ( Figure 1 ). This favourable structural setting has created a transpressive domain that focuses gold mineralisation within brittle deformed carbonate strata intruded by diorite sills ( Figure 2 ).

• Gold Mineralisation is closely associated with quartz-ankerite-arsenopyrite-bearing veins, marked by distinctive deep red limonitic alteration, hosted preferentially along sill margins and in zones of structural decoupling.

• Alteration signatures (notably deep red limonitic halos) are intense and dominated by Fe-carbonate halos, overprinting regional chloritic facies ( Figure 3 ). These alteration zones, combined with the abundance of high-density vein arrays, reflect a strong hydrothermal system.

• In addition to the current confirmatory drilling program, three high-priority targets have been identified for the next phase of drilling ( Figure 1 ):

1. The junction of Structures B and C , where structural corridors converge, creating a potential trap for high-grade mineralisation.

2. The northern continuation of Structure B , marked by alteration zones suggesting system extension.

3. The junction between Structures A and B , where limonitic dykes point to a possible feeder system.

See illustrations below.

Figure 1. Plan view highlighting Structures A–B limonitic dyke corridors and the

northern extension of Structure B, offset by the Arg-Erdouz Fault toward Structure C

Figure 2. Cross section showing the laterally extensive diorite sill and mineralized zones

Figure 3. Alteration contrasts in satellite imagery – green chloritic vs. Fe-carbonate halos,

highlighting an alteration plume north of Structure B

Unlocking Value at Tichka Est

The findings within Dr' Selley's report open the door to further value creation at Tichka Est:

• Confirm the potential to further expand Structure B along strike and at depth (400–600 meters drill targets).

• Prioritize the structural junctions of the A and B structures and the B and C structures as new high-value drill targets.

• Provide an expanding geological model that reinforces Tichka Est's potential as a multi-structure gold system .

Drill Campaign Progress Report

The diamond drilling campaign continues to advance with the third drillhole reaching a depth of 124 metres as of Thursday, September 4. Operations are scheduled to resume this week following a brief holiday break and road maintenance required following recent flooding in the area of the project.

Regarding assays, Stellar's geologist supervised the core cutting and sample preparation for the first drillhole. The samples have now been delivered to the lab for analysis, with results expected in the normal course.

About the Tichka Est Gold Project

The Tichka Est Gold Project is comprised of seven permits covering an area of 82km 2 located in the High Altas region of Morocco approximately 90km south of Marrakech. Under an earn-in agreement with Morocco's National Office for Hydrocarbons and Mining (ONYHM) Stellar can earn an 85% interest after incurring exploration expenditures totaling US$2.39M (C$3.5M) over three years.

To date early-stage exploration (mapping, sampling, trenching and a small first pass RC drill program) has identified three gold-bearing zones: Zone A extending over 450 meters along strike, Zone B: extending over two kilometers along strike and Zone C extending over two kilometers along strike. Additionally, regional stream sediment sampling over a 12km 2 area surrounding the three known gold zones identified numerous other anomalous metal zones that warrant further mapping and sampling. These new zones of mineralization include: 6 zones anomalous for gold, 5 zones anomalous for silver, 2 zones anomalous for copper and 3 zones anomalous for lead and zinc. Most of the overall property areas are unexplored or only superficially explored.

For more detailed information on the Tichka Est Gold Project readers are referred to Stellar's website at www.stellarafricagold.com .

About Stellar AfricaGold Inc.

Stellar AfricaGold Inc. is a Canadian precious metal exploration company focused on precious metals

in North and West Africa, with active programs in Morocco and Côte d'Ivoire. Stellar's principal

exploration projects are its advancing gold discovery at the Tichka Est Gold Project in Morocco, and its

early-stage exploration Zuénoula Gold Project in Côte d'Ivoire.

The Company is listed on the TSX Venture Exchange symbol TSX.V: SPX, the Tradegate Exchange TGAT: 6YP and the Frankfurt Stock Exchange FSX: 6YP.

The Company maintains its head office in Vancouver, BC and has a representative office in Casablanca, Morocco.

The technical content of this press release has been reviewed and approved by M. Yassine Belkabir, MScDIC, CEng, MIMMM, a Stellar director and a Qualified Person as defined in NI 43-101.

Stellar's President and CEO J. François Lalonde can be contacted at +1 514-994-0654 or by email at lalondejf@stellarafricagold.com

Additional information is available on the Company's website at www.stellarafricagold.com .

On Behalf of the Board

J. François Lalonde

President & CEO

This news release contains "forward-looking statements" within the meaning of applicable Canadian securities laws.

Forward-looking statements are based on expectations, estimates and projections as at the date of this news release and are subject to known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed or implied. Such risks and uncertainties include, but are not limited to, the Company not achieving the production milestones described herein, changes in business plans or commodity prices, failure to obtain regulatory approvals, and the risk factors described in the Company's most recent Management's Discussion and Analysis and Annual Information Form, which are available on SEDAR+ at www.sedarplus.ca .

Forward-looking statements are not guarantees of future performance and should not be unduly relied upon. Except as required by law, the Company undertakes no obligation to update or revise any forward-looking statements contained herein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2025 TheNewswire - All rights reserved.