NOT FOR DISTRIBUTION TO UNITED STATES SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Standard Uranium Ltd. (TSXV: STND,OTC:STTDF) (OTCQB: STTDF) (FSE: 9SU0) ("Standard Uranium" or the "Company") is pleased to announce plans for a diamond drill program at its flagship Davidson River project ("Davidson River" or the "Project") in the southwest Athabasca Basin region, northern Saskatchewan (Figure 1). In addition, the Company announces a non-brokered private placement to raise gross proceeds of up to C$3,500,000 (the "Offering").

Davidson River Highlights:

- First Multiphysics in SW Athabasca: Standard Uranium in partnership with Fleet Space Technologies Canada Corp. ("Fleet Space") recently executed the first Exosphere Multiphysics survey in the prolific southwest Athabasca Uranium District on the Davidson River project.

- Poised for Discovery: New and refined target areas across the Warrior, Bronco, and Thunderbird conductor corridors are significantly derisked with new high-resolution 3D imaging of basement structures and alteration zones, providing key targeting information for upcoming summer drilling.

- Drill Ready: The Company has secured all drill permits, has signed Exploration Agreements with our Clearwater River Dene Nation ("CRDN") partners, has secured all crucial vendors and drilling is now planned for a 4 to 6-week drill program, scheduled to begin in early September 2025.

Jon Bey, CEO of Standard Uranium commented, "Standard Uranium has been working towards this drill program for over three years, and we couldn't be more excited to see the drills turning once again. I would like to thank our technical team, all the vendors we are working with, our CRDN partners, and our shareholders that have supported this drill program and our company since inception. It is now time to make a discovery and add significant value for our shareholders and I have full confidence that our team is up for the task."

Private Placement

The Offering will consist of units of the Company (each, a "Unit") at a price of C$0.08 per Unit, and flow-through units of the Company (each, a "FT Unit", and collectively with the Units, the "Offered Securities") at a price of C$0.10 per FT Unit. Each Unit will consist of one common share of the Company (each a "Unit Share") and one-half of one common share purchase warrant (each whole warrant, a "Warrant"). Each FT Unit will consist of one common share of the Company to be issued as a "flow-through share" within the meaning of the Income Tax Act (Canada) (each, a "FT Share") and one-half of one Warrant. Each whole Warrant shall entitle the holder to purchase one common share of the Company (each, a "Warrant Share") at a price of C$0.15 at any time on or before that date which is twenty-four months after the closing date of the Offering.

The net proceeds raised from the Offering will be used for the exploration of the Company's Projects and for working capital purposes.

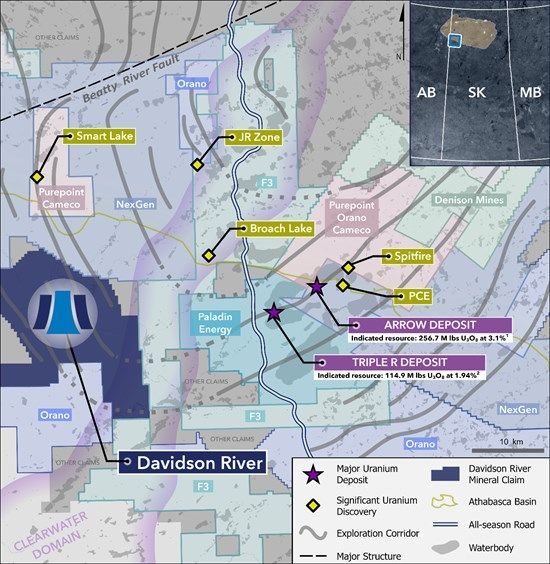

Figure 1. Overview of Standard Uranium's Flagship Davidson River Project in the southwest Athabasca Basin uranium district along trend from significant uranium discoveries and resources1,2.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10633/262330_58b7a86af45fea2c_001full.jpg

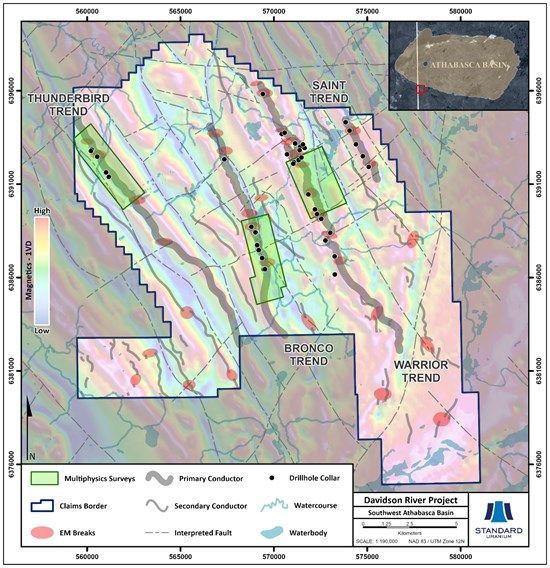

Figure 2. Summary map showing major EM conductor trends on Davidson River and completed ExoSphere Multiphysics grid locations, with first vertical derivative magnetics in the background.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10633/262330_58b7a86af45fea2c_002full.jpg

Davidson River 2025 Exploration

Davidson River covers 30,737 hectares of prime exploration real estate in the Southwest Athabasca Uranium District, highly prospective for basement-hosted uranium deposits along trend from high-grade* uranium deposits under development (Figure 1).

From May 26 to July 8, 2025, the Company and Fleet Space completed the first-ever ExoSphere Multiphysics survey grids in the uranium-rich southwest Athabasca Basin region. Multiphysics surveys collected three types of geophysical data (Ambient Noise Tomography ("ANT"), Horizontal-to-Vertical Spectral Ratio ("HVSR"), and Gravity) over three (Warrior, Bronco, and Thunderbird) of the four major conductive corridors on the Project. The surveys will provide critical targeting layers in the form of 3D ANT-HVSR shear velocity models and custom inversion models for subsurface density, leveraging both passive seismic and ground gravity datasets as inputs.

"This drill program is the culmination of years of hard work and represents a pivotal point for the Company," said Sean Hillacre, President & VP Exploration of Standard Uranium, "Utilizing the best geoscience tools and techniques available to generate our targets for this year, we are beyond excited to get the drill bit back in the ground at Davidson River. The newly acquired data from the Multiphysics survey has outlined density anomalies in the basement rock coinciding with known graphitic conductors, which are often indicative of potential zones of hydrothermal alteration of host rocks associated with uranium mineralization events. Drill targeting with this strategy has been proven through the discovery of world-class uranium deposits in the SW Athabasca Basin and upgrades our targets across the Project."

Following post-survey data analysis and integration, the Company plans to execute a diamond drill program to begin testing the highest priority targets across all three surveyed conductor corridors. Drilling is planned to be completed this summer, marking the first drill program on the Project since 2022. Positive results from previous drill campaigns will be integrated into drill targeting with the newly acquired Multiphysics data. High confidence datasets from all three survey grids have now been received and are in the process of joint inversion and modeling to refine drill targets for a summer drill program planned for September 2025.

About Davidson River

Davidson River is Standard Uranium's flagship property, located in the southwest Athabasca Uranium District of the Athabasca Basin, Saskatchewan, and encapsulates the inferred extension of the structural trend that hosts the Triple R and Arrow uranium deposits (Figure 1). The Project consists of 10 contiguous mineral dispositions and lies approximately 25 to 30 km west of Arrow and Triple R and 75 km south of the past-producing Cluff Lake uranium mines. The Company has completed 16,561 metres of diamond drilling in 39 drill holes on the Davidson River property since 2020, which has further refined the exploration strategy for high-grade basement hosted uranium mineralization on the property3.

Davidson River hosts four main conductive corridors - the Warrior, Bronco, Thunderbird, and Saint trends (Figure 2). These conductive trends are associated with graphitic-sulphidic structures in basement rocks, which are commonly associated with high-grade* uranium systems, providing the conduits for mineralizing fluids. This concept has been proven for all four corridors, with several instances of graphitic-sulphidic fault rocks and reactivated structures intersected along the tested strike length.

Favorable basement rock types and alteration phases have been observed across the strike length of the main trends, resembling those which host other uranium deposits in the southwestern Athabasca Basin region. Key indicators include clay-dravite alteration and stacked lenses of variably strained graphite and sulphide-bearing garnetiferous gneisses and altered feldspar-rich rocks. Structural zones in the basement are locally associated with elevated uranium and/or boron values (over 1,000 ppm B), such as in DR-20-009 and -0113.

The results from diamond drilling programs to date highlight the potential for the Davidson River Project to host significant basement hosted unconformity-related uranium mineralization, and the property contains several priority targets along all four trends that warrant further exploration.

*The Company considers uranium mineralization with concentrations greater than 1.0 wt% U3O8 to be "high-grade".

Qualified Person Statement

The scientific and technical information contained in this news release has been reviewed, verified, and approved by Sean Hillacre, P.Geo., President and VP Exploration of the Company and a "qualified person" as defined in NI 43-101.

Historical data disclosed in this news release relating to sampling results from previous operators are historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. The Company's future exploration work may include verification of the data. The Company considers historical results to be relevant as an exploration guide and to assess the mineralization as well as economic potential of exploration projects. Any historical grab samples disclosed are selected samples and may not represent true underlying mineralization.

References

1 Arrow deposit, Rook I Project, Saskatchewan, NI 43-101 Technical Report on Feasibility Study, Prepared for NexGen Energy Ltd., Effective date: February 22, 2021

2 Feasibility Study, NI 43-101 Technical Report, for PLS Property, Prepared for Fission Uranium Corp., Effective date: January 17, 2023

3 Davidson River Project Overview, https://standarduranium.ca/projects/davidson-river-project

About Standard Uranium (TSXV: STND,OTC:STTDF)

We find the fuel to power a clean energy future

Standard Uranium is a uranium exploration company and emerging project generator poised for discovery in the world's richest uranium district. The Company holds interest in over 233,254 acres (94,394 hectares) in the world-class Athabasca Basin in Saskatchewan, Canada. Since its establishment, Standard Uranium has focused on the identification, acquisition, and exploration of Athabasca-style uranium targets with a view to discovery and future development.

Standard Uranium's Davidson River Project, in the southwest part of the Athabasca Basin, Saskatchewan, comprises ten mineral claims over 30,737 hectares. Davidson River is highly prospective for basement-hosted uranium deposits due to its location along trend from recent high-grade uranium discoveries. However, owing to the large project size with multiple targets, it remains broadly under-tested by drilling. Recent intersections of wide, structurally deformed and strongly altered shear zones provide significant confidence in the exploration model and future success is expected.

Standard Uranium's eastern Athabasca projects comprise over 42,303 hectares of prospective land holdings. The eastern basin projects are highly prospective for unconformity related and/or basement hosted uranium deposits based on historical uranium occurrences, recently identified geophysical anomalies, and location along trend from several high-grade uranium discoveries.

Standard Uranium's Sun Dog project, in the northwest part of the Athabasca Basin, Saskatchewan, is comprised of nine mineral claims over 19,603 hectares. The Sun Dog project is highly prospective for basement and unconformity hosted uranium deposits yet remains largely untested by sufficient drilling despite its location proximal to uranium discoveries in the area.

For further information contact:

Jon Bey, Chief Executive Officer, and Chairman

Suite 3123, 595 Burrard Street

Vancouver, BC, V7X 1J1 - Canada

Tel: 1 (306) 850-6699

E-mail: info@standarduranium.ca

Cautionary Statement Regarding Forward-Looking Statements

This news release contains "forward-looking statements" or "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements include, but are not limited to, statements regarding: the timing and content of upcoming work programs; geological interpretations; timing of the Company's exploration programs; and estimates of market conditions.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by forward-looking statements contained herein. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Certain important factors that could cause actual results, performance or achievements to differ materially from those in the forward-looking statements are highlighted in the "Risks and Uncertainties" in the Company's management discussion and analysis for the fiscal year ended April 30, 2024.

Forward-looking statements are based upon a number of estimates and assumptions that, while considered reasonable by the Company at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies that may cause the Company's actual financial results, performance, or achievements to be materially different from those expressed or implied herein. Some of the material factors or assumptions used to develop forward-looking statements include, without limitation: the future price of uranium; anticipated costs and the Company's ability to raise additional capital if and when necessary; volatility in the market price of the Company's securities; future sales of the Company's securities; the Company's ability to carry on exploration and development activities; the success of exploration, development and operations activities; the timing and results of drilling programs; the discovery of mineral resources on the Company's mineral properties; the costs of operating and exploration expenditures; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); uncertainties related to title to mineral properties; assessments by taxation authorities; fluctuations in general macroeconomic conditions.

The forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Any forward-looking statements and the assumptions made with respect thereto are made as of the date of this news release and, accordingly, are subject to change after such date. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262330