November 13, 2023

Plus, new assayed visible gold intercept 110m below the current high-grade 721koz Mineral Resource; Drilling continuing with multiple rigs

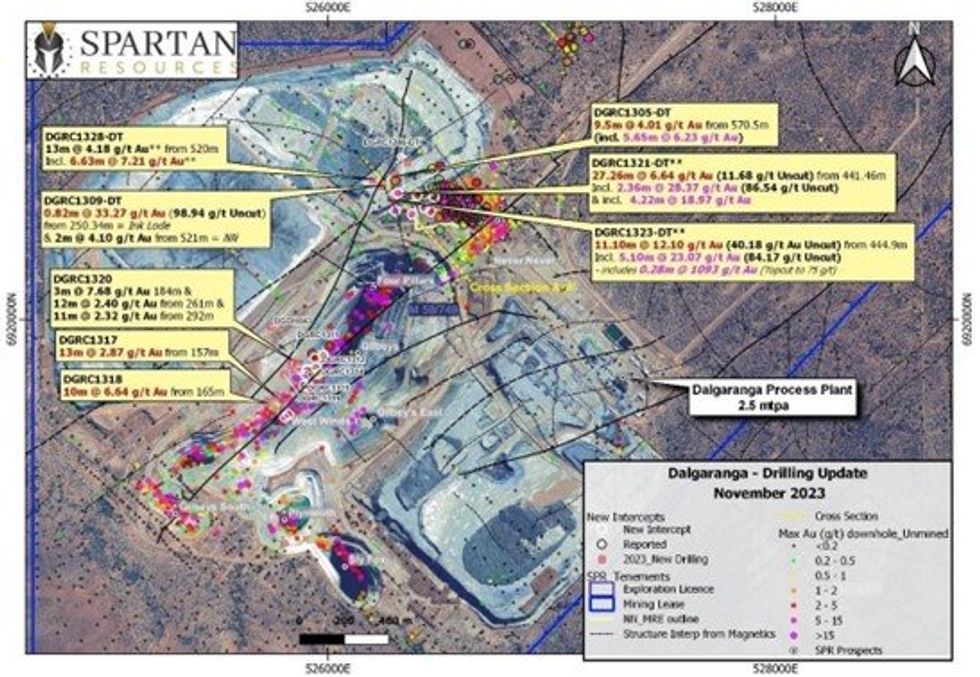

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to report updated drilling and assay information from recent drilling at its 100%-owned Dalgaranga Gold Project “DGP” in the Murchison region of Western Australia.

Highlights:

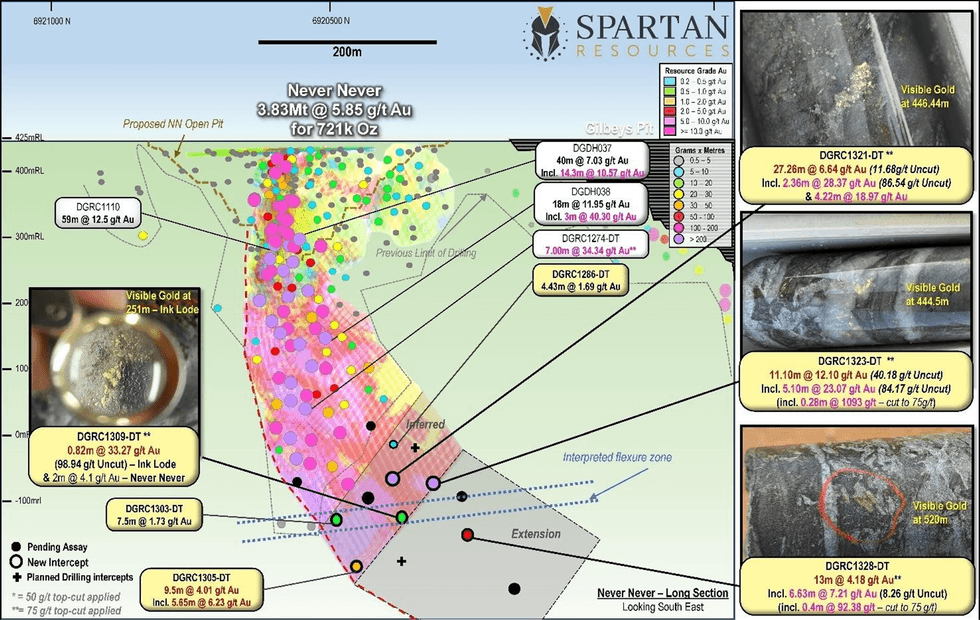

Never Never Gold Deposit – new gold intercepts:

- 27.26m @ 6.64g/t gold (11.68g/t uncut) from 441.46m down-hole, including:

- 2.36m @ 28.37g/t (86.54g/t uncut) and 4.22m @ 18.97g/t – DGRC1321-DT

- 11.10m @ 12.10g/t gold (40.18g/t uncut) from 444.90m down-hole, including:

- 5.10m @ 23.07g/t (84.17g/t uncut) including 0.28m @ 1,093g/t – DGRC1323-DT

- 9.50m @ 4.01g/t gold from 570.5m down-hole, including:

- 5.65m @ 6.23g/t – DGRC1305-DT – This assay comes from the previously reported visible gold intercept reported in late October: “Visible Gold Intercept Logged 130m Below Deepest Previous Assay” (see ASX: SPR release 23 October 2023).

- 13.00m @ 4.18g/t gold (4.71g/t uncut) from 520.0m down-hole, including:

- 6.63m @ 7.21g/t (8.26g/t uncut) - DGRC1328-DT – this assay comes from a ~15.0m intercept (down-hole) of “Never Never-style” mineralisation, including visible gold, ~110m beyond and down-plunge of the current 721koz Never Never Mineral Resource Estimate extent.

Ink Lode – new gold intercept:

- 0.82m @ 33.27g/t gold (98.94g/t uncut) from 250.34m - DGRC1309-DT this assay extends the potential strike length of high-grade mineralisation at the Ink lode by 135m. This hole is along- strike of the previously reported 10.00m @ 12.14g/t gold from 237.0m (DGRC1183-PC)

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “The assay records keep tumbling the more we drill at Never Never – another indication we have a fantastic orebody on our hands. The fact that we keep hitting visible gold in drill-core and RC chips the deeper we go is also a great sign. It tells us that gold is present in the targets we are drilling and, while never a substitute for actual assays, it continues to reinforce that our exploration model is valid. When we see alteration and damage in the core that is always a great sign but spotting visible gold is always a buzz for any gold exploration geologist!

“With these latest assays validating the very furthest extents of the Never Never Resource and multiple drill rigs spinning across multiple targets, we are applying a substantial amount of statistical pressure to good, proven, high-grade gold geology. We are working the numbers, closing the gaps, chasing down the leads and hunting those high-grade drill returns.

“Simultaneously, we are working to de-risk Dalgaranga for the future, turning concepts into actual prospects and then into deposits, delivering solid, consistent outcomes and hopefully providing insights to our investors along that journey.

“These latest drill-holes provide a window into the growing excitement at Spartan. Our Mineral Resource asset base is growing strongly with each drilling campaign, we are well on the path to establishing new high-grade reserves and we have shown we can discover, define and deliver. We are determined to keep driving sustainable and long-term value into our company for all our shareholders.”

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00