February 28, 2022

Southern Silver Exploration Corp. (TSXV: SSV) ("Southern Silver" and the "Company") reports that drilling has started on a 4,000-metre diamond drilling program on its wholly owned Oro property, located in southwestern New Mexico, USA.

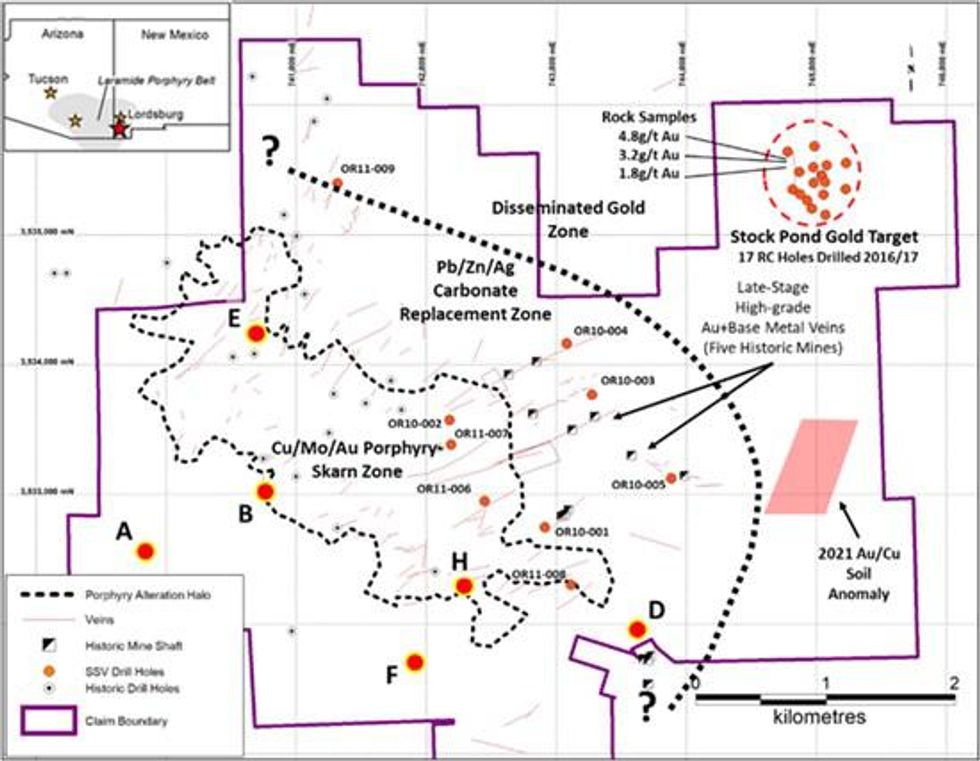

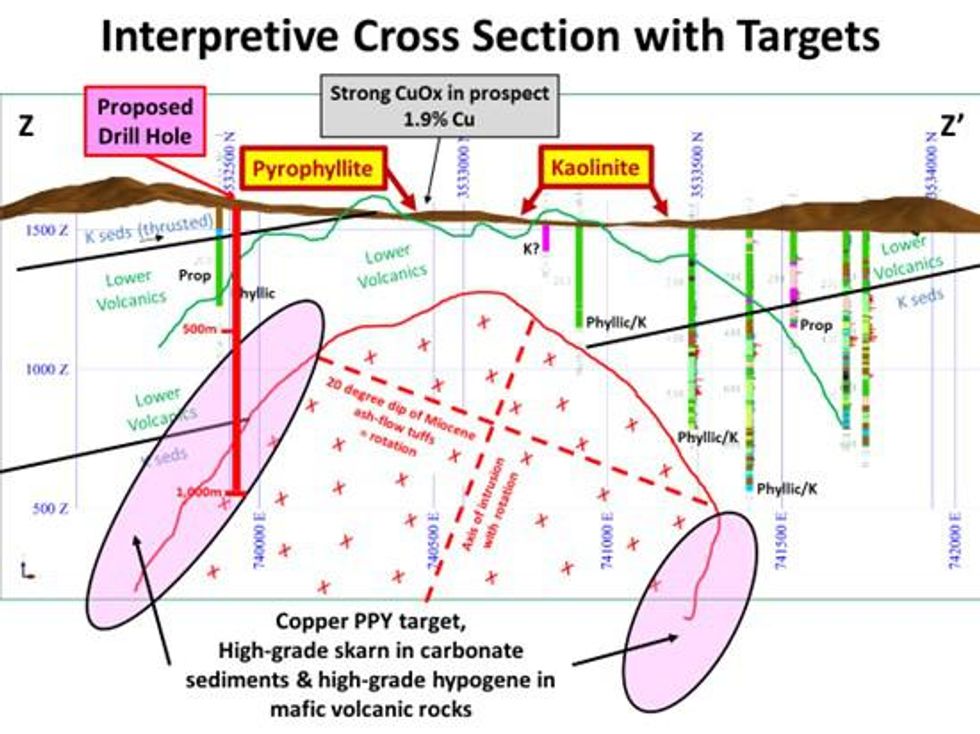

The six-hole program will test several copper porphyry and skarn targets which form part of a large, well-zoned Laramide-age mineral system consisting of a ring of Carbonate Replacement Deposits (CRDs) around a core of an intensely sericite-pyrite altered lithocap overlying an unexposed porphyry center. Several sediment-host gold targets have been identified well outboard of the main porphyry center.

Drilling will first test three porphyry copper targets (targets A, B and E; see Figure 1) and then transition to three copper-skarn targets (targets F, H and D) in the southern part of the property and is anticipated to take approximately eight to twelve weeks to complete.

Figure 1: Selected Drill Targets (A-H) on the Oro Project

The Oro Project is a large district play that Southern has systematically consolidated, expanded and explored since initial acquisition in late 2005. Current drill targeting is based upon 3D modelling of data generated by geologic mapping, historic drill holes, geochemical zoning studies, alteration clay zoning studies, and geophysical surveys through this large zoned porphyry-system. The current program follows initial diamond drilling in 2010-11 which targeted several skarn and CRD targets and two phases of RC drilling which targeted the Stockpond gold target in 2016-17.

Figure 2: Interpretive Cross-section of Porphyry targets on the Oro Property

El Sol Claim

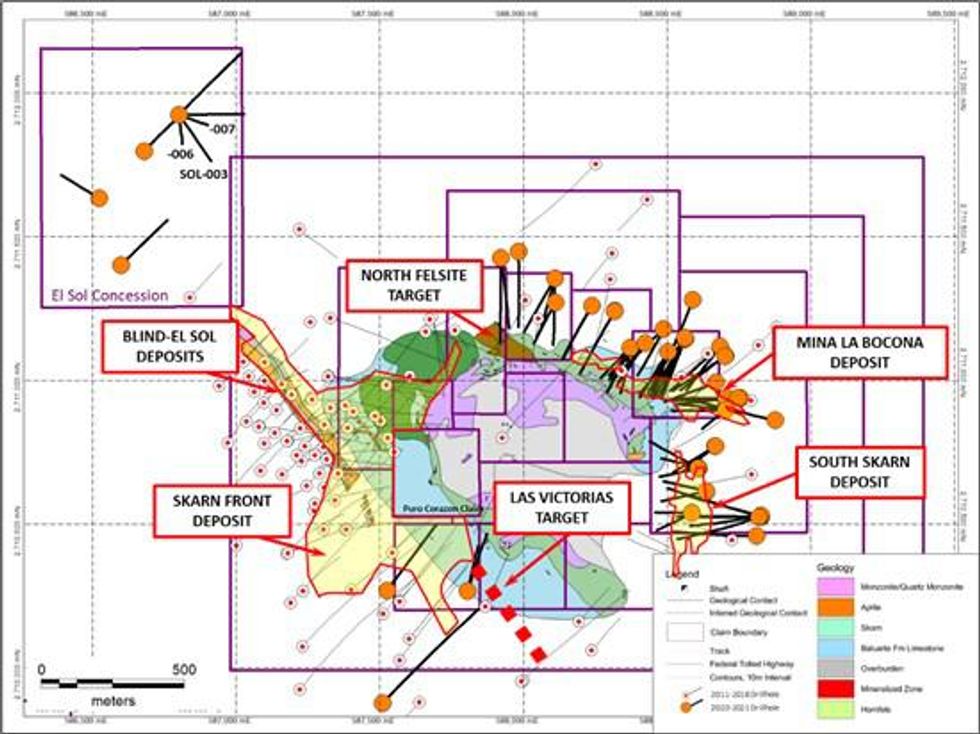

The company also reports that it has completed the final payment to Monarca Minerals Inc., acquiring a 100% interest in the El Sol mineral claim, Cerro Las Minitas Project, Durango, Mexico.

Acquisition cost was $US 300,000 payable in three equal instalments with a 2% NSR on production from the claim with a right in Southern Silver to purchase the royalty at any time for US$1,000,000.

The El Sol claim is largely gravel covered, 63ha in size and is located on the northwestern boundary of the Bocona block of claims and adjacent to the Area of the Cerro which hosts the six mineral deposits currently identified by Southern Silver on the Cerro Las Minitas claim package.

Previously reported highlights from the El Sol claim include (see NR-02-22; January 25, 2022) include:

- a 0.8 metre interval grading 1,760g/t Ag, 0.9g/t Au, 23.6% Pb and 1.2% Zn (2,622g/t AgEq) within a 3.5 metre interval averaging 549g/t Ag, 0.3g/t Au, 8.6% Pb and 3.6% Zn (982g/t AgEq) from drill hole 21SOL-003

Drill hole 21SOL-003 is one of five holes drilled in the Autumn of 2021 to test a series of targets defined by surface mapping, rock and soil sampling and proximity to artisanal workings. The highlight interval intersected down-dip of historic workings located on a northeast-southwest trending structure which has been traced on surface for up to 300 metres laterally before plunging under gravel cover. Three further holes (22Sol-006, to -008) were completed on the concession in January 2022. Assays from these holes are pending with results anticipated in the coming weeks.

Figure 3: Plan Map of the Area of the Cerro showing drilling on the El Sol concession

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is an exploration and development company with a focus on the discovery of world-class mineral deposits. Our specific emphasis is the 100% owned Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico's Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, Los Gatos, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and supervised directly or was part of the team that supervised the collection of the data from the El Sol Project that is reported in this disclosure and is responsible for the presentation of the technical information in this disclosure.

On behalf of the Board of Directors

"Lawrence Page"

Lawrence Page, Q.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver's website at southernsilverexploration.com or contact us at 604.641.2759 or by email at ir@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Southern Silver Exploration Corp. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.

The Conversation (0)

04 May 2022

Southern Silver Exploration

Developing One of the World’s Largest High-Grade Undeveloped Silver Projects

Developing One of the World’s Largest High-Grade Undeveloped Silver Projects Keep Reading...

06 March

Peter Krauth: Silver Cycle Still Early, Big Money Ready to Buy

Peter Krauth, editor of Silver Stock Investor and Silver Advisor, shares his thoughts on silver price activity and where the white metal is in the cycle. He believes the awareness phase is just beginning, with mania still relatively far in the future. Don't forget to follow us @INN_Resource for... Keep Reading...

05 March

Chen Lin: Key Silver Date to Watch, My Favorite 2026 Commodities

Chen Lin of Lin Asset Management weighs in on silver and gold, as well as the critical minerals market, which is his favorite sector for 2026. He also discusses how conflict in the Middle East could impact the resource sector. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

05 March

Prince Silver: Fully Funded and Targeting 100 Million Ounces Silver Equivalent in Nevada

Ranking first in the world in the Fraser Institute’s 2025 Annual Survey of Mining Companies, Nevada remains a top choice for companies. Prince Silver’s (CSE:PRNC,OTCQB:PRNCF) flagship Prince silver project stands to benefit from its outstanding permitting process and geology.Prince Silver CEO... Keep Reading...

04 March

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00