May 20, 2024

Sierra Nevada Gold (ASX: SNX) is pleased to announce plans to follow up drill hole BHD006 which returned up to 1270 g/t silver at Endowment Mine, part of its Blackhawk Epithermal project in Nevada, USA.

Highlights

- Sierra Nevada to review potential for a large, high-grade epithermal silver-dominated vein system.

- Previously drilled core hole BHD006 returned 5m at 479 g/t Ag within a larger mineralised zone of 12m at 219 g/t Ag from 250m beneath the Endowment mine at its Blackhawk Epithermal Project in Nevada, USA.1

- This high-grade intercept is situated 150m vertically below the deepest portion of the historic mine and includes higher grade intersections of:

- 0.5m at 1270g/t Ag from 256.5m

- 1m at 823g/t Ag from 257m

- 1m at 654g/t Ag from 258m

- These silver intercepts are associated with very high-grade lead-zinc-gold (see table 1), demonstrating the potential for extremely high value ore.

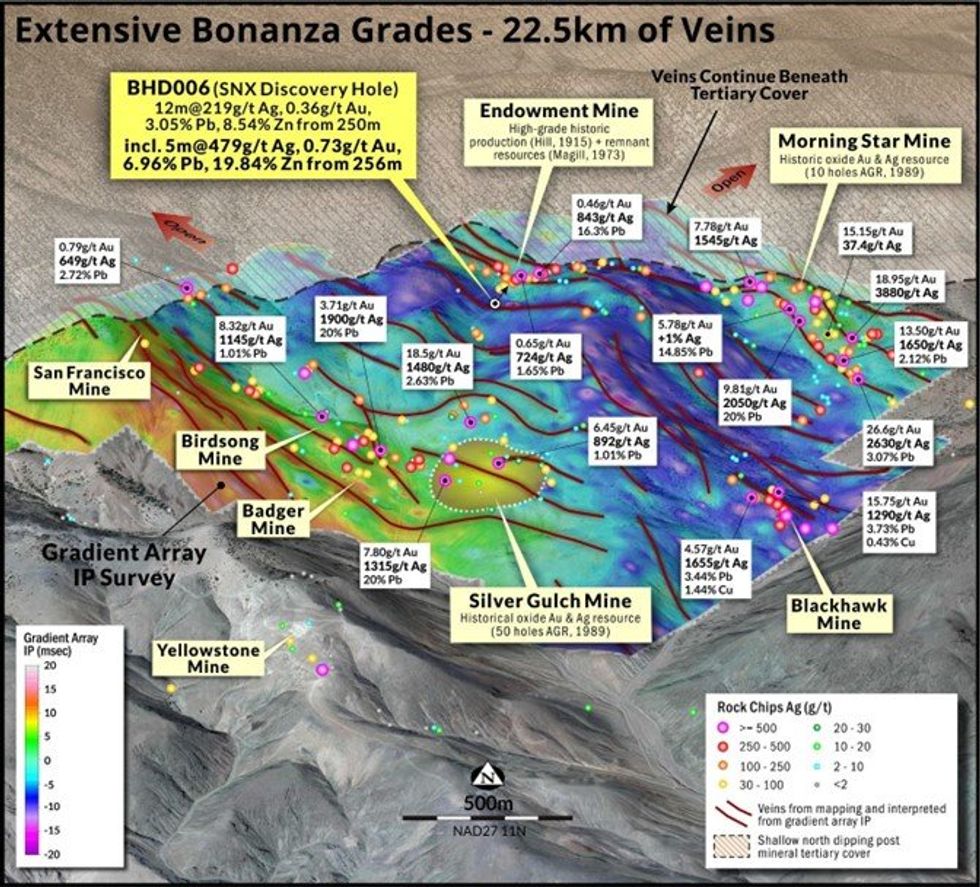

- Potential for a company-making silver discovery at Blackhawk, where SNX has identified 22.5-line kilometres of high-grade silver-gold-lead-zinc veins.1

- Two shallow oxide resources (historic, non-JORC) estimated at Silver Gulch and Morning Star.1

- SNX has recently defined several high priority drill targets, and a multi-hole drill program is permitted.

SNX Executive Chairman Peter Moore said “These results which returned up to 1270 g/t silver from Blackhawk are very promising, coming from a vast and extensive vein network. We’ve identified 22.5-line kilometres of veins at Blackhawk, but this known mineralisation has sat largely untouched since mining ceased in the area in the 1920s. We have two shallow oxide resources which have not been defined to a JORC-compliant level but this provides us the opportunity to deliver value from an existing project with further drilling and mineral resource definition. Our 20-hole drill program is permitted and ready to drill, providing us with the opportunity to use modern exploration techniques to potential to return further high-grade results and shape this as a company-making discovery for Sierra Nevada.”

SNX has previously identified a large and high-grade intermediate sulphidation epithermal Ag-Au-Pb-Zn vein system, likely related to a large porphyry system located immediately to the south. Partially coincident with the porphyry system, the Blackhawk epithermal project vein system covers about 5km2 and is open under cover to the north and northeast, with 22.5-line km of veins identified to date (see figure 1).1

Previous drilling by SNX beneath the Endowment mine at Blackhawk returned 12m at 219 g/t Ag from 250m including 5m at 479 g/t Ag from 256m. This drill intercept is 150m vertically below the deepest portion of the mine and includes higher grade intersections of:

- 0.5m at 1270 g/t Ag from 256.5m (21.5% Pb + Zn)

- 1m at 823g/t Ag from 257m (30.1% Pb + Zn)

- 1m at 654 g/t Ag from 258m (+50% Pb+ Zn)

As shown in Table 1, the intersection described above comes with considerable polymetallic credits. The complete mineralised intersection of 12m at 219g/t Ag also contains 3.05% Pb and 8.54% Zn across the interval, significantly increasing the potential value of mineralisation within the vein/structures.

Click here for the full ASX Release

This article includes content from Sierra Nevada Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

9h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00