- WORLD EDITIONAustraliaNorth AmericaWorld

June 01, 2023

SNOWLINE GOLD CORP. (TSX-V:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce purchase from two arm's-length entities of a mineral property portfolio comprising 92 claims in the vicinity of its Rogue Project in the Yukon Territory, Canada. Historical work on these claims suggests the presence of multiple reduced-intrusion related gold systems (RIRGS) within the Rogue Plutonic Complex, the geological system which hosts Snowline's Valley discovery. A historical diamond drill intersection at the "Reid" target roughly 8 km east of Valley and 4 km east of Gracie reported 2.1 g/t Au over 96.0 m within 234.7 m of 0.94 g/t Au, including high-grade intersections of 76.9 g/t Au and 26.7 g/t Au over 1.5 m each, within a granodiorite stock with similarities to the Valley intrusion. These results have not been verified by the Company, but descriptions of geology and mineralization intersected by this drilling, including visible gold in sheeted quartz veins and the poly-phase nature of the intrusion, are consistent with observations made in drilling at Valley, demonstrating the potential for regional gold fertility.

- Snowline purchases 92 long-held mineral claims (roughly 1,920 ha) constituting 10 targeted claim blocks within and adjacent to its Rogue Project

- Claims include historical drill intersection of 2.1 g/t Au over 96.0 m from within poly-phase granodiorite "Reid" intrusion 8 km east of Snowline's Valley discovery, and on trend with the Gracie target

- Additional targets with promising historical drill and surface sampling results throughout acquired portfolio solidify Snowline's position in the district and highlight broader potential of the Rogue Plutonic Complex.

Table 1 - Historical diamond drill highlights reported in 1996 from the Reid target. These results have not been directly verified by the Company but are believed to be generally indicative of the potential for gold endowment at the target, particularly given anomalous gold in nearby talus fines sampled by the Company and given the demonstrated fertility of the Valley intrusion 8 km to the west of Reid. *Drilled widths reported, true widths not determined.

"This acquisition is a significant step in the transition of Snowline's Rogue Project from a discovery to a district," said Scott Berdahl, CEO & Director of Snowline. "We are excited to explore the Reid target as a part of our 2023 drill campaign at Rogue. The historical results from the 1996 drilling provide strong additional evidence of the gold potential of the Reid intrusion and of the many other intrusion-related gold targets on our Rogue Project outside of our Valley discovery. This claim package covers a first-mover land position based on early exploration efforts in the area. Alongside the strongly anomalous gold values from regional stream sediment geochemistry samples draining many parts of the Rogue Plutonic Complex, these historical results were a key draw in attracting our initial attention to Rogue. The Valley discovery has since shown that the necessary components are present at Rogue to produce substantial bulk-tonnage gold systems with unusually high grades for the RIRGS deposit type. We are thrilled to bring this collection of targets into the fold, and to give our shareholders much more exposure to the unique exploration potential of the Yukon's newest gold district."

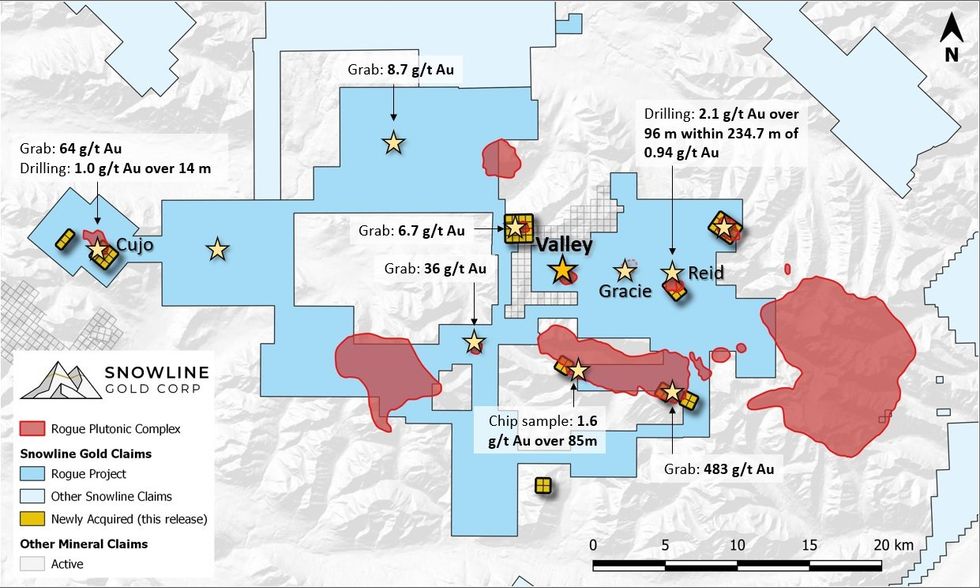

Figure 1 - The Rogue Plutonic Complex (red), showing Snowline Gold's newly acquired claims (yellow squares) against the Company's pre-existing Rogue Project (medium blue). Highlight historical samples noted herein have not been verified by the Company, but they provide evidence for the general gold endowment of the broader Rogue Project area. Grab samples are selective in nature and don't necessarily represent bulk tonnage grades. Not shown are 30 "WEAS" claims, covering an intrusion some 26 km to the south (Figure 3).

On behalf of the vendors of the claims, Anthony Beruschi added: "Congratulations to the Snowline team on their wonderful gold discovery at the Rogue project, where skill and hard work have led to exploration success. In my view the Yukon is the best place in the world for explorers. I consider it a privilege to add our mineral claims, with their excellent historical drill results, to Snowline's impressive land package. I look forward to the realization of this opportunity with so many benefits for the Yukon and its people."

REID

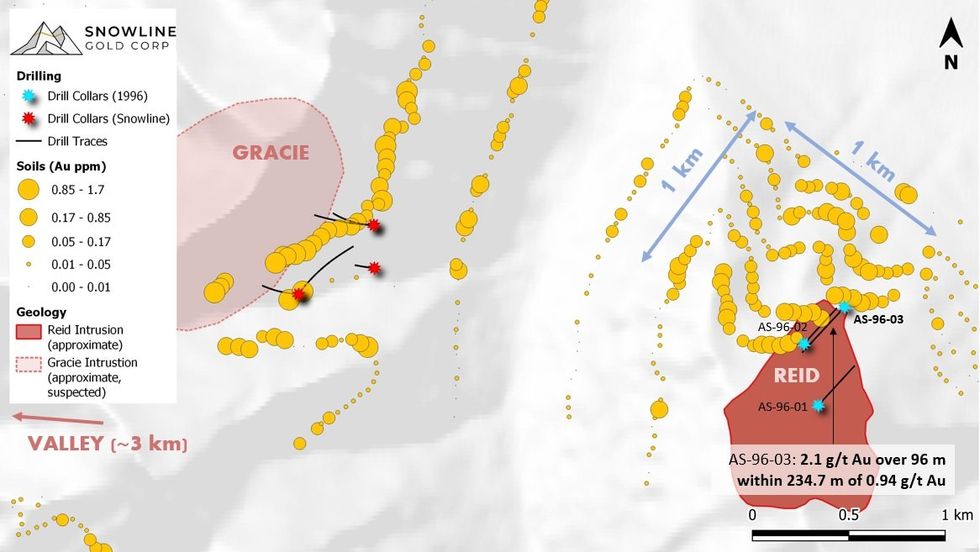

The newly acquired Reid claims cover an exposed reduced intrusion adjacent to an open, 1 x 1 km gold-in-soil-and-talus-fine anomaly delineated by Snowline through surface sampling (Figure 2). Consistent with the surface geochemical anomalies at the Rogue Project's adjacent Valley and Gracie targets, the Reid anomaly is complemented by anomalous bismuth and tellurium values that correlate well with anomalous gold values. Follow up mapping by Snowline personnel confirmed earlier observations of sheeted quartz veins near the margin of the intrusion, oriented parallel to mineralized veins present at Valley and Gracie. Sixteen grab samples of quartz vein material from across an open, 450 x 600 m area within the anomaly ranged in grade from 0.2 g/t Au to 8.0 g/t Au.

Figure 2 - Plan map of the Reid and Gracie targets, with historical drill collar sites from drilling at Reid (sky blue) and Snowline's 2022 Phase I drilling at Gracie (red). AS-96-03 is collared downslope from AS-96-02, and thus the holes do not significantly overlap one another. While the historical drill results have not been verified by the Company, the scale of the associated soil and talus fine anomaly sampled by Snowline and the extent of mineralization observed during subsequent mapping provide additional evidence for a significant reduced intrusion-relation gold system at Reid.

Immediately south of the 1x1 km anomaly, the Reid intrusion is a 1-kilometer scale granodiorite body responsible for local hornfels alteration on the eastern end of a roughly 9 km trend of similar alteration that extends from the Rogue Project's Valley discovery in the west and includes the Gracie target in between (Figure 1), suggesting potential for a corridor of related intrusions with demonstrated gold fertility.

Historical surface sampling and drilling demonstrate the presence of gold mineralization associated with the Reid intrusion, particularly along its northern margin. Three diamond drill holes totalling 1,253 m were drilled in 1996. Samples from holes AS-96-01 and AS-96-02 returned anomalous but likely subeconomic gold grades, whereas hole AS-96-03 reported a 234.7 m interval of sheeted veins within the intrusion averaging 0.94 g/t Au, including 96.0 m at 2.09 g/t Au. These intervals are influenced by two 1.5 m intersections averaging 76.9 g/t Au and 26.7 g/t Au respectively (Table 1). They nonetheless demonstrate potential for the presence of fertile reduced intrusion-related gold system at Reid, particularly in the context of the nearby Valley discovery.

Historical descriptions of the Reid drill core parallel observations made in drilling the Rogue Project's Valley discovery. Notably, multiple phases of intrusion are described - at Valley, multiple phases of the intrusion characterize the strongest zone of mineralization found to date. Also, at Reid, reported observations of visible gold in AS-96-03 are associated with bismuthinite in quartz veins. At Valley and Gracie, bismuth and tellurium minerals (including bismuthinite) in quartz are key indicators for the presence of gold, and this is a fingerprint of the RIRGS deposit model.

The Company is currently planning for a 3-hole, Phase I drill program at Reid, totalling roughly 1,000 m.

CUJO

The Cujo target covers an elongate, 1 x 2 km intrusion at the west end of the Rogue Plutonic Complex (Figure 1). A historical drill program of 6 holes (total metres unknown) is reported to have been conducted in 1996 near the eastern edge of the intrusion, with an interval of 1.0 g/t Au over 13.6 m (true width unknown) referenced in subsequent reports. The Company has not been able to locate the original report describing this drilling, but the interval is reported in the Yukon Geological Survey's 1996 Yukon Exploration and Geology (YEG) annual report. Fieldwork by Snowline personnel in the vicinity of the claims yielded a grab sample of 63.8 g/t Au from hornfels metasedimentary rocks associated with the intrusion.

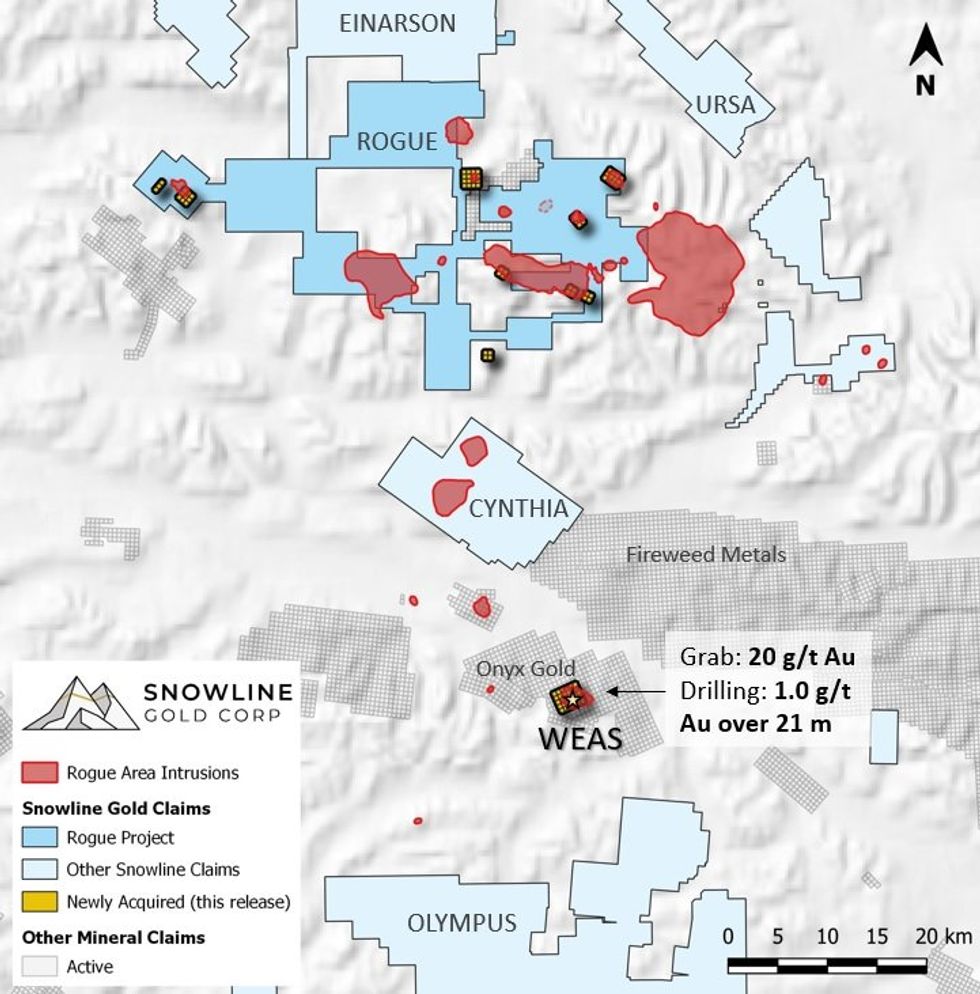

WEAS

The 30-claim (627 ha) WEAS property is located south of the Rogue Plutonic Complex, midway between Snowline's Cynthia and Olympus projects (Figure 3). Historical work on the property reported gold-bearing sheeted quartz veins within an exposed, 3 km by 2 km intrusion. Drilling in 1996 (5 holes, 1,280 m) is reported in the same 1996 YEG report to have intersected 1.0 g/t Au across 21 m (true width unknown) associated with the sheeted veins, along with surface grab samples of up to 20.1 g/t Au. The property is central to a larger claim block owned indirectly by HighGold Mining Inc., which currently in the process of spinning out those claims into a new company, Onyx Gold Corp.

The Company cautions that none of the historical results, including drill results, on the newly acquired claims have been verified. Assay methods and sampling techniques are not disclosed in the historical reports, and in the case of drilling on the Cujo and WEAS targets, the Company has only been able to locate indirect references to the results, but no primary source. Historical results discussed herein are presented more generally as an indication of the regional potential of the Rogue Plutonic Complex to host additional reduced intrusion-related gold systems.

Figure 3 - The WEAS claims shown in the context of surrounding mineral properties. Highlight historical samples noted herein have not been verified by the Company, but they provide evidence for the general gold endowment of the claims. Grab samples are selective in nature and don't necessarily represent bulk tonnage grades.

ACQUISITION TERMS

The Company has entered into an agreement with arm's length parties RST Klondike Discoveries Ltd. and Whistler Minerals Corp. (together, the "Vendors"), whereby the Company has acquired 92 mineral claims in exchange for (i) the payment of $1,000,000 in cash (the "Cash Consideration") and (ii) the issuance of 200,000 warrants (the "Warrant Consideration"), each for purchase of a single common share of the Company at a price of $3.50 for a period of two years (the "Acquisition"). The Warrants are subject to a hold period of four months and one day from the closing of the Acquisition, in accordance with applicable Canadian securities laws, expiring on October 1, 2023. The Vendors will retain a 1.0% NSR on the claims and will be entitled to up to two bonus payments of $1M each if a measured or indicated mineral resource of >1 million ounces of gold is disclosed in compliance with NI 43-101 standards on certain claims.

ABOUT ROGUE

The Valley Zone on Snowline's flagship Rogue Project is a newly discovered, bulk tonnage style, reduced intrusion-related gold system (RIRGS), with geological similarities to multi-million-ounce deposits currently in production such as Kinross's Fort Knox Mine in Alaska and Victoria Gold's Eagle Mine in the Yukon. Early drill results demonstrate unusually high gold grades for such a system, present near surface across drill intersections of hundreds of metres. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays within and along the margins of a one-kilometer-scale, mid-Cretaceous aged Mayo-series intrusion. Valley is an early-stage exploration project without a resource estimate, and while initial results are encouraging, the presence or absence of an economically viable orebody cannot be determined until additional work is completed.

The Rogue Project area hosts multiple intrusions similar to Valley along with widespread gold anomalism in stream sediment, soil and rock samples. Elsewhere, RIRGS deposits are known to occur in clusters. The Rogue Project is thus considered by the Company to have district-scale potential for additional reduced intrusion-related gold systems.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with an eight-project portfolio covering >280,000 ha. The Company is exploring its flagship >111,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. The Company's first-mover land position and extensive database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by J. Scott Berdahl, M.Sc., P. Geo., CEO and Director for Snowline and a Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the potential to participate in multiple future discoveries, newly acquired areas having elevated potential to host gold deposits, the Rogue project having district-scale prospectivity, the creation of a new gold district and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SGD:CNX

The Conversation (0)

24 May 2023

Snowline Gold

A Cornerstone Position in a New Gold District in the Yukon

A Cornerstone Position in a New Gold District in the Yukon Keep Reading...

21h

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

23h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00