May 10, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to announce a JORC (2012) Mineral Resource Estimate (MRE) for the Supreme Gold Project in Reefton, New Zealand.

Highlights

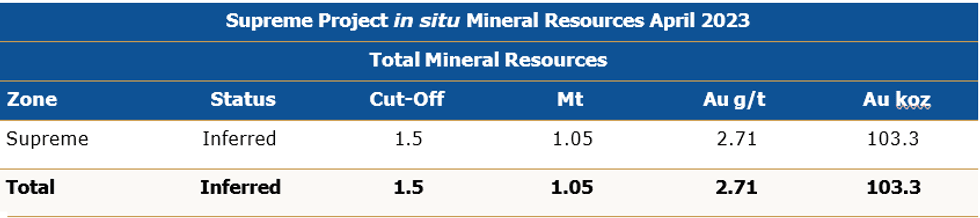

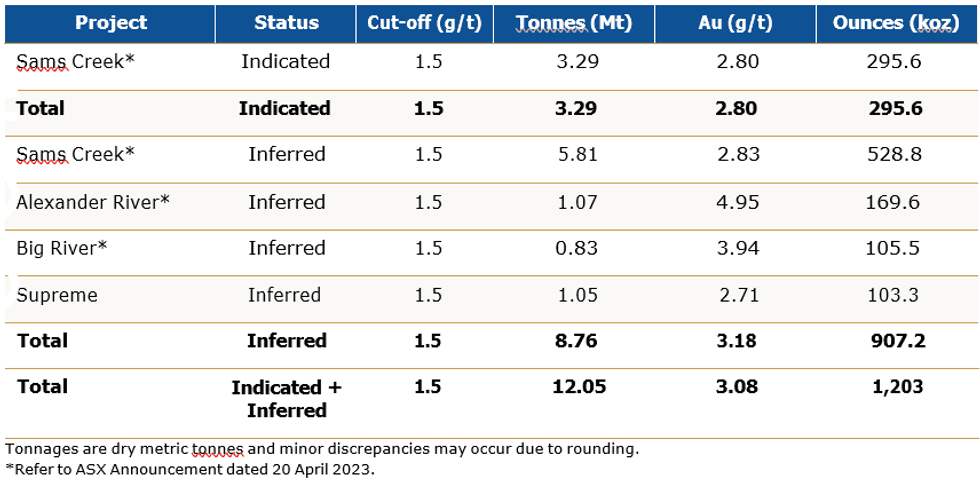

- Mineral Resource Estimate (MRE) at Siren’s Supreme prospect of 103koz at 2.7g/t Au at a 1.5g/t cut-off.

- Supreme lies within the recently acquired Cumberland tenement along the main structural corridor that hosts all the larger mines in the Reefton Goldfield, and links through Globe Progress to Siren’s very promising Auld Creek Au-Sb prospect.

- Mineralisation is a similar style to the historical Globe-Progress mine that produced 1.1Moz @ 6g/t Au.

- The MRE based on historical data down to only 200m depth with significant intersections including:

- 14.0m @ 3.5g/t Au;

- 14.0m @ 3.2g/t Au;

- 29.0m @ 2.6g/t Au;

- 10.0m at 3.5g/t Au, and

- 9.5m @ 4.1g/t Au.

- The Supreme deposit remains open at depth, with significant potential for increased gold resources from additional exploration drilling.

- Siren’s Global Mineral Resource now stands at 1.2Moz at 3.1g/t Au (100% basis).

Background

The Cumberland permit comprises the northern and southern areas of the previous Globe Progress mining permit, as shown in Figure 1. The Cumberland permit joins Siren’s Big River, Golden Point and Reefton South permits and abuts the Federation Mining permit, where they are currently developing the Snowy River underground mine to extract around 700koz of gold below the historic Blackwater mine.

Gold bearing reefs in the Cumberland project area were first discovered at Supreme in 1872 and mining proceeded from then until 1923 when Sir Francis Drake mine closed. Relative to the rest of the Reefton Goldfield, the historical Cumberland mines were undercapitalised, with a total production of 44,626 oz of gold from 97,993 tonnes of ore at an average grade of 14.2 g/t Au.

The mineralisation in the Cumberland permit extends for 3kms south of the Globe Progress mine and is open to the west (under cover) and south (Figure 2). This area lies along the main structural corridor that hosts all the larger mines in the Reefton Goldfield and links to Siren’s very promising Auld Creek Au-Sb prospect. The gold and antimony mineralisation extends for 10kms from Auld Creek south into the Globe Progress Mine, including the Globe Deeps area below the open pit, through Souvenir, Supreme and Big River. A total of 77 drillholes for a total of 10,933m have been completed.

Supreme’s gold mineralisation is a similar style to the Globe-Progress deposit, with high-grade quartz breccia, pug and disseminated sulphides. The Supreme prospect contains three sub-parallel mineralised shoots that have been traced down dip for approximately 200m and are open at depth (Figure 3). The shoots plunge moderately to the SE, with an average thickness of approximately 12m. Significant intersections include 10m @ 3.5g/t Au and 14m @ 3.5g/t Au (RDD013), 14m @ 3.2g/t Au (RDD017), 29m @ 2.6g/t Au (RDD018), 9.5m @ 2.3g/t Au (RDD021) and 9.5m @ 4.1g/t Au (RDD025).

The Gallant prospect contains a shear hosted, 1m-5m thick quartz vein, that extends for over 300m and dips steeply east and west. Diamond hole GLA001 was drilled to the west and appears to have drilled obliquely down a steeply west dipping reef. The hole intersected a 27m mineralised zone dominated by a quartz reef with visible gold and disseminated arsenopyrite mineralisation in the hangingwall. The true thickness of the mineralised zone is unclear but estimated to be around 5m. The average down- hole grade of the mineralised zone was 27m @ 74.9g/t Au, which includes 1m @ 1,911g/t Au. Detailed soil sampling and trenching will be utilised in Quarter 2 to try and expose the Galant Reef to determine its orientation and true thickness.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

42m

Filing of Initial Prospectus

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce that it has filed a preliminary non-offering prospectus (the "Prospectus") with the Ontario Securities Commission (the "Commission") and has applied to the Canadian Securities... Keep Reading...

12 February

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

12 February

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00