November 06, 2024

Silver47 Exploration (TSXV:AGA) is a compelling investment story, well-positioned to capitalize on the increasing global demand for silver, gold, copper, zinc, antimony, tin and graphite driven by its vast industrial applications and investment potential. The company wholly owns a diverse portfolio of silver-polymetallic projects across North America, including Red Mountain VMS (Alaska), Adams Plateau (British Columbia) and Michelle (Yukon).

Focused on rapid resource growth and new discoveries, Silver47 is backed by an experienced technical and management team that brings decades of successful experience in mineral exploration. Silver47 has outlined aggressive drill programs to rapidly advance its projects toward development.

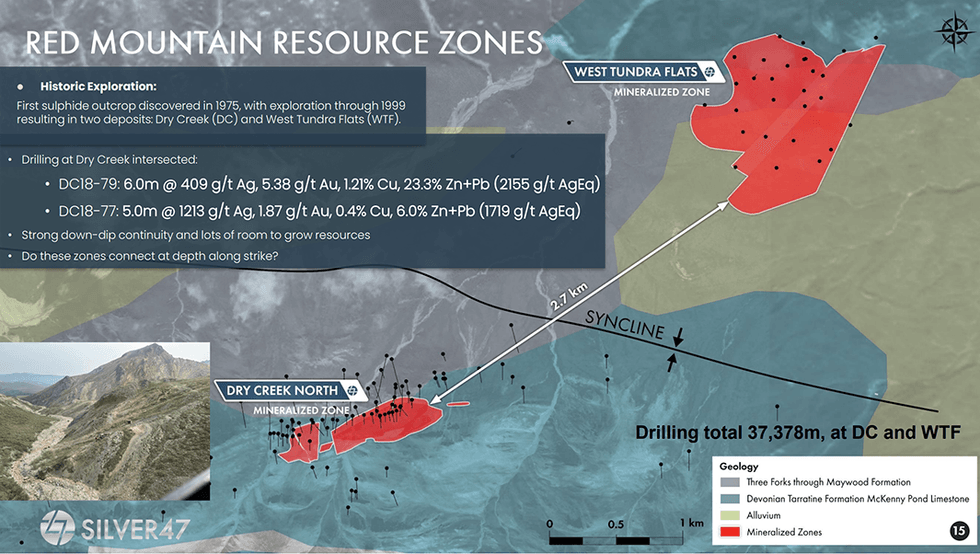

The Red Mountain VMS project is Silver47's flagship asset located about 100 kilometers south of Fairbanks, Alaska. Red Mountain is a polymetallic VMS deposit, rich in silver, gold, zinc, copper, and lead. Red Mountain holds an NI 43-101 inferred resource of 15.6 million tonnes (Mt) at 7 percent zinc equivalent, or 168.6 Moz of silver equivalent at a grade of 335.7 grams per ton (g/t) silver equivalent. The project is located in a mining-friendly jurisdiction on state managed lands with reasonable access to infrastructure.

Company Highlights

- Silver47 Exploration wholly owns a diverse portfolio of silver-polymetallic projects across North America, including Red Mountain VMS (Alaska), Adams Plateau (British Columbia) and Michelle (Yukon).

- In 2022, Silver47 made a significant new silver discovery at the Michelle project with 7.68m of 1,577 g/t Ag, 45 percent Pb, 4 percent Zn within 15m of 907 g/t Ag, 26 percent Pb, 2.7 percent Zn at the Silver Matt Target, Michelle Project.

- The Red Mountain VMS project currently holds an inferred resource of 168.6 million ounces of silver equivalent, with the “Exploration Target” of 500 to 900 Moz silver equivalent through further exploration.

- The Company’s focus on rapid resource growth and new discoveries for silver, copper, and gold is supported by an extensive number of targets identified across its properties.

- Silver47 is poised to capitalize on increasing global demand for silver, driven by its critical role in industrial applications including solar, Ai and AgZn, AgC batteries and investments.

- A projected silver supply deficit of 240 Moz further strengthens the market outlook.

- Backed by an experienced technical and management team, and led by seasoned geologist and company builder Gary R. Thompson, the team brings decades of successful experience in mineral exploration.

- Aggressive drill programs are planned to rapidly advance its projects toward development.

This Silver47 Exploration profile is part of a paid investor education campaign.*

Click here to connect with Silver47 Exploration (TSXV:AGA) to receive an Investor Presentation

AGA:CC

The Conversation (0)

3h

Peter Krauth: Silver Cycle Still Early, Big Money Ready to Buy

Peter Krauth, editor of Silver Stock Investor and Silver Advisor, shares his thoughts on silver price activity and where the white metal is in the cycle. He believes the awareness phase is just beginning, with mania still relatively far in the future. Don't forget to follow us @INN_Resource for... Keep Reading...

05 March

Chen Lin: Key Silver Date to Watch, My Favorite 2026 Commodities

Chen Lin of Lin Asset Management weighs in on silver and gold, as well as the critical minerals market, which is his favorite sector for 2026. He also discusses how conflict in the Middle East could impact the resource sector. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

05 March

Prince Silver: Fully Funded and Targeting 100 Million Ounces Silver Equivalent in Nevada

Ranking first in the world in the Fraser Institute’s 2025 Annual Survey of Mining Companies, Nevada remains a top choice for companies. Prince Silver’s (CSE:PRNC,OTCQB:PRNCF) flagship Prince silver project stands to benefit from its outstanding permitting process and geology.Prince Silver CEO... Keep Reading...

04 March

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00