September 06, 2022

Silver Eagle Mines (CSE:SEM) implements a straightforward business quarry strategy, “Blow it up. Dig it up. Grind it up. Bag It up. And Ship it out by rail,” by using a direct-ship, pit-run system that brings truly organic, direct to application phosphorus to market. The companyfocuses on producing the only certified raw rock organic phosphate eligible for organic farming in the United States.

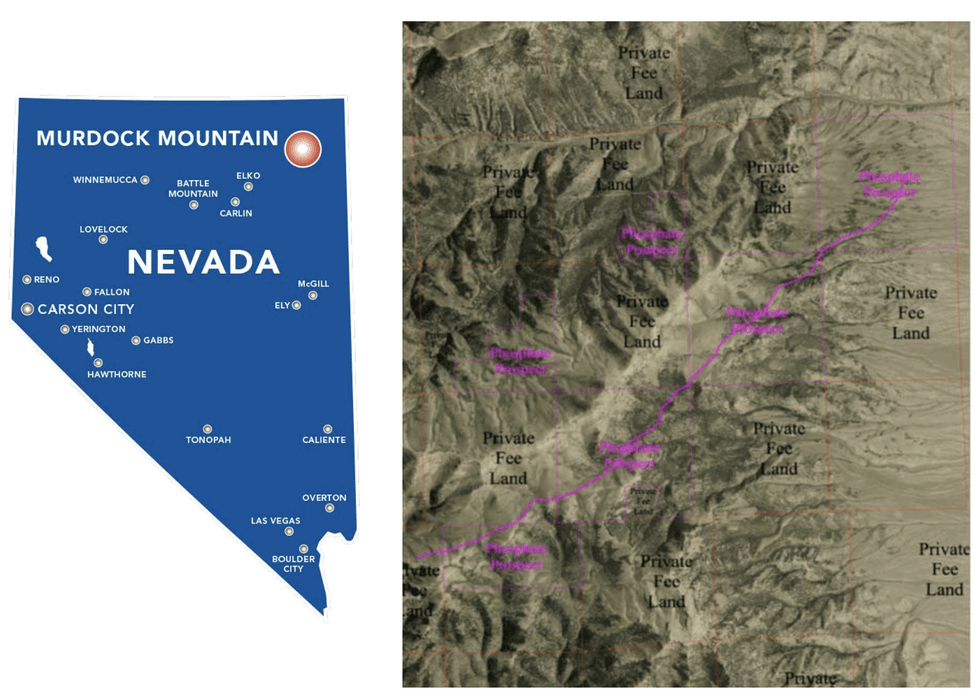

The organic food market in the United States is growing because of factors such as increasing health awareness among consumers and increasing environmental concerns due to the heavy use of pesticides, chemical fertilizers, and other chemicals in conventional farming. As a reagent, raw rock organic phosphate from Murdock Mountain is perfectly suited to regenerate soil to serve the fast growing organic food market.

Company Highlights

- Silver Eagle Mines has a unique asset containing raw phosphate ore suitable for direct application in organic farming.

- Once in production, the company will produce the only large scale, certified organic phosphate in the United States.

- Raw organic phosphate from Murdock Mountain is perfectly suited to serve the fast growing US$59.28 billion organic food market.

- The company aims to complete a NI-43-101 resource related Premlinary Economic Estimate (PEA) by Q3-4 in 2023 and Q1-3/2022 carry out an exploration program to confirm and extend the known deposit.

- The company’s project, Murdock Mountain, produces phosphate ore that does not require costly processing before it is usable.

This Silver Eagle Mines profile is part of a paid investor education campaign.*

Click here to connect with Silver Eagle Mines (CSE:SEM) to receive an Investor Presentation

The Conversation (0)

19 March 2018

Verdant Minerals Signs Offtake MOU with Wilson International Trading

Australia’s Verdant Minerals (ASX:VRM) announced Monday (March 19) that it has signed an offtake memorandum of understanding (MOU) for its Ammaroo phosphate project. According to the company, Wilson International Trading has agreed to potentially purchase 350,000 tonnes per year of phosphate... Keep Reading...

20 February 2018

Focus Ventures to Conduct Technical & Economic Study with Global Specialty Chemical Group for P4 Production and its Derivatives

Focus Ventures Ltd. (“Focus”) (TSXV:FCV) announced that it has entered into a Technical & Economic Study agreement with Italmatch Chemicals (“Italmatch”), an innovative chemical group based in Genoa, Italy. The programme entails conducting economic due diligence on the potential to construct and... Keep Reading...

16 December 2017

Gensource Announces Final Closing of Non-Brokered Private Placement Totalling $1,605,899.82

Further to its news releases dated November 22, 2017 and November 29, 2017, Gensource Potash Corporation (“Gensource” or the “Company“) (TSXV:GSP) announces today it has completed the second tranche of its non-brokered private placement financing (the “Offering“). The second tranche of the... Keep Reading...

30 August 2017

Phosphate Mining in the US and Canada

China is the largest producer of phosphate in the world by far, but significant operations can also be found across the globe in North America. The US and Canada are the continent’s major phosphate hotspots. In fact, the US put out 27.8 million metric tons of the material in 2016, making it the... Keep Reading...

15 June 2017

Seabed Phosphate Mining Projects Facing Challenges

A company aiming to develop the world’s first seabed phosphate extraction project is facing another delay in court. The case between Namibian Marine Phosphate (NMP) and several fishing organizations was postponed for a fourth time on Thursday (June 15). The case was filed in November 2016 by the... Keep Reading...

24 December 2015

Phosphate Outlook 2016: Steady Demand on the Horizon

For investors, the 2016 outlook for most commodities has been less than impressive. In fact, it seems that for the coming year there is not much of an expectation for a swift recovery in the metals markets. Luckily for those interested in phosphate, the fertilizer material is expected to perform... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00