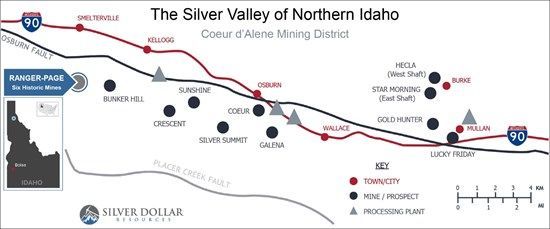

The Ranger-Page Project is in the Coeur d'Alene Mining District that ranks among the world's top producers of silver, lead and zinc

Silver Dollar Resources Inc. (CSE: SLV,OTC:SLVDF) (OTCQX: SLVDF) (FSE: 4YW) ("Silver Dollar" or the "Company") is pleased to announce that, further to its new release of August 7, 2024, it has completed the exercise of its option to acquire an initial 75% interest in the Government Gulch portion of the Ranger-Page Project located in Shoshone County, Idaho, USA

Figure 1: Location of the Ranger-Page Project in the Coeur d'Alene Mining District.

To view an enhanced version of this graphic, please visit:

https://silverdollarresources.com/images/Ranger-Page/Ranger-Page_Silver-Valley.jpg

Pursuant to the Government Gulch Option and Joint Venture Agreement (the "Government Gulch Agreement") dated July 20, 2021, and as amended by agreements dated July 20, 2022, May 22, 2024, and August 7, 2025, to exercise its option to acquire a 75% interest in the Government Gulch property under the Government Gulch Agreement (the "First Option"), Silver Dollar paid the optionor US$250,000 and incurred more than US$1,210,000 in exploration expenditures on the property.

Silver Dollar has the option to acquire the remaining 25% interest in the Government Gulch property (the "Second Option") through good faith negotiations with the optionor. In the event the optionor and the Company cannot agree on a purchase price for the Second Option, the Company can elect the purchase price of the Second Option to be: (a) US$2,250,000, (b) US$1,000,000 and issue US$1,250,000 of Silver Dollar's shares valued at the 20-day volume-weighted average price ("VWAP"), or (c) if the optionor so requests, US$2,250,000 of Silver Dollar's shares valued at the 20-day VWAP.

If Silver Dollar does not exercise the Second Option on or before December 31, 2025, a joint venture will be formed among the parties and Silver Dollar will serve as operator. The Government Gulch Agreement includes dilution provisions where if a joint venture participant contributes less than its proportionate share of expenses, that participant's interest will be diluted. If a joint venture participant's interest is diluted to less than 10%, the other party will automatically acquire the diluted participant's interest and it will grant a 2.0% net smelter returns royalty on the Government Gulch property. Silver Dollar has the right to purchase half of such royalty (1.0% of net smelter returns) for US$1,000,000.

If Silver Dollar exercises its option under the Government Gulch Agreement, as described above, it will grant Silver Valley Metals Corp. a royalty equal to 0.5% of net smelter returns from the Government Gulch property.

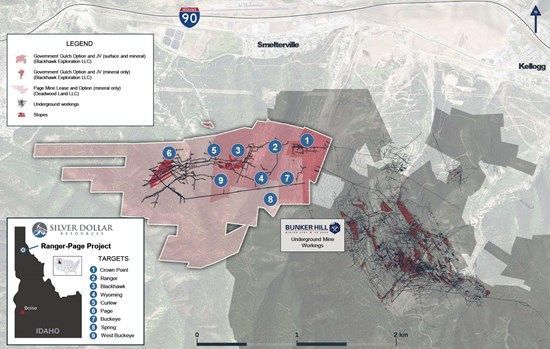

Figure 2: Ranger-Page claim groups, underground mine workings, and new target areas.

To view an enhanced version of this graphic, please visit:

https://silverdollarresources.com/images/Ranger-Page/Ranger-Page_Claims-Targets-082025.jpg

About the Ranger-Page Project

Located in a world-class silver district, the Ranger-Page land package covers six historic mines and is ideally situated near Interstate 90 with year-round access to power, water, local infrastructure and a workforce in the Silver Valley skilled in exploration and mining. The primary target areas are up and down plunge from historic underground mining, along strike where ground induced polarization (IP) surveys have identified anomalies, and where surface trenching identified near surface mineralization. Additional exploration targets have also been identified away from historic mine infrastructure, using soil geochemical data, mapping, and ground IP survey data.

About Silver Dollar Resources Inc.

Silver Dollar is a dynamic mineral exploration company focused on two of North America's premier mining regions: Idaho's prolific Silver Valley and the Durango-Zacatecas silver-gold belt. Our portfolio includes the advanced-stage Ranger-Page and La Joya projects, as well as the early-stage Nora project. The Company's financial backers include renowned mining investor Eric Sprott, our largest shareholder. Silver Dollar's management team is committed to an aggressive growth strategy and is actively reviewing potential acquisitions with a focus on drill-ready projects in mining-friendly jurisdictions.

For additional information, you can visit our website at silverdollarresources.com, download our investor presentation, and follow us on X at x.com/SilverDollarRes.

ON BEHALF OF THE BOARD

Signed "Gregory Lytle"

Gregory Lytle,

President, CEO & Director

Silver Dollar Resources Inc.

Direct line: (604) 839-6946

Email: greg@silverdollarresources.com

179 - 2945 Jacklin Road, Suite 416

Victoria, BC, V9B 6J9

Forward-Looking Statements:

This news release may contain "forward-looking statements." Forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263104