February 12, 2025

The Board of Inca Minerals Limited (ASX: ICG) (Inca or the Company) is pleased to provide shareholders a progress report on due diligence associated with the recently announced (ASX 5 February 2025) Binding Implementation Agreement to acquire Stunalara Metals Limited (Stunalara) via an off market takeover bid. Stunalara’s key asset is the high-grade gold & gold- antimony Hurricane Project located approximately 110km west-northwest of Cairns and 75km southwest of Port Douglas in North Queensland. Hurricane boasts multiple undrilled high-grade gold & gold-antimony prospects developed from rock chip and grab sampling.

Inca’s technical team recently conducted a site visit as part of the due diligence process to confirm and replicate historical geochemical data, culminating with the collection and dispatch for assaying of 84 rock chip samples. Assays have now been received for those samples with exceptional results recorded for gold (Au) and antimony (Sb) at multiple prospects including Holmes, Cyclone, Tornado, Hurricane and Bouncer confirming the high-grade prospectivity of the Hurricane Project.

Assay Highlights (Refer to table 1, Appendix 1 for full results)

Assays with gold greater than 5g/t:

- Hurricane South - Sample MC0374: 81.5g/t Au

- Hurricane North - Sample MC0368: 12.95g/t Au

- Hurricane South - Sample MC0379: 11.9g/t Au

- Bouncer - Sample HRX10042: 8.29g/t Au and 12.7% Sb.

- Typhoon - Sample HRX10055: 7.84g/t Au

- Holmes - Sample HRX10083: 6.4g/t Au

- Holmes - Sample MC0392: 6g/t Au

- 2 other samples returned gold greater than 4g/t, three with grades over 3g/t and 12 with grades over 1g/t.

Highly anomalous levels of Antimony (Sb) were also recorded, which included:

- Bouncer - Sample HRX10029 with 35.1% Sb

- Bouncer - Sample HRX10036: 20.8% Sb

- Bouncer - Sample HRX10042: 12.75% Sb

- Bouncer - Sample HRX10037: 9.54% Sb

- Bouncer - Sample HRX10033: 7.78% Sb

- Holmes - Sample MC0393: 5.28% Sb, and

- Holmes - Sample MC0398: 4.89% Sb

29 samples returned highly anomalous arsenic values > 0.1% (>1000ppm As, up to 9840ppm in 1 sample).

“The identification of high-grade gold and antimony in rock chips across different locations which have never been drilled, highlights the significant exploration potential of the Hurricane Project for the discovery of gold and antimony. Inca Minerals is looking forward to progressing follow-up exploration programs to build on this significant rock chip data,” said Inca Exploration Manager, Dr Emmanuel Wembenyui.

In addition to gold, the Hurricane Project results include high levels (up to 35%) of antimony, a critical and new economy metal. Antimony is listed as a critical mineral by the United States, the European Union, Japan, India, the United Kingdom and the Commonwealth of Austalia. New economy metals are pivotal for modern technologies, economies and national security, providing direct support for technologies that are paving the way to the transition from fossil fuels to net zero emmisions , advanced manufacturing and defence technologies/capabilities amongst other applications.

HURRICANE PROJECT

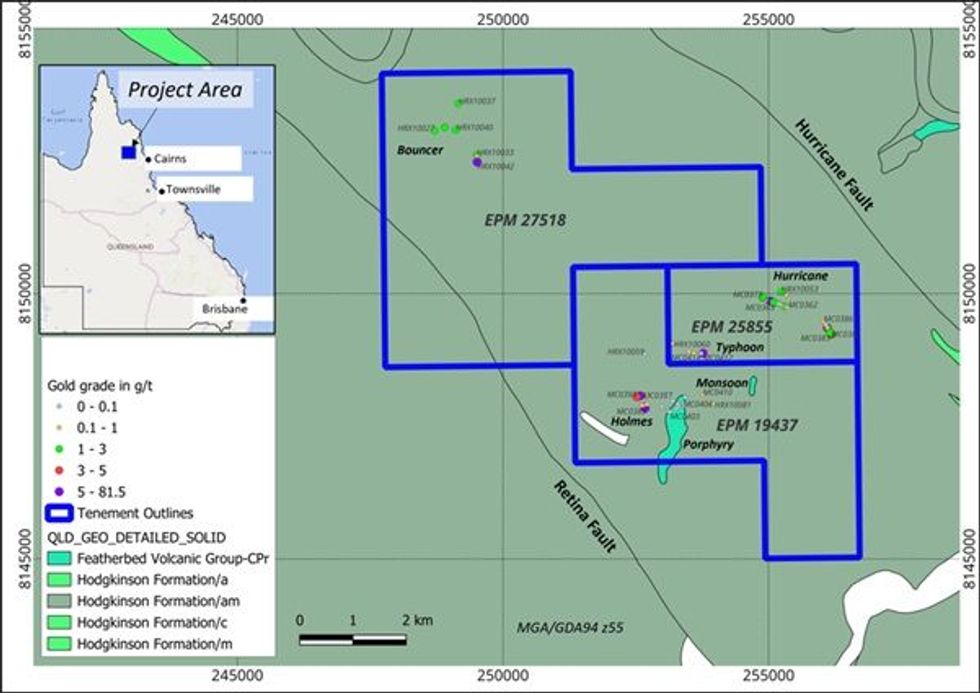

Inca is pleased to report highly encouraging results from a geological reconnaissance field trip to the gold and antimony Hurricane Project. The Hurricane Project is located about 110km west-northwest of Cairns and 75km southwest of Port Douglas in North Queensland, Figure 1.

The Hurricane Project comprises three tenements – EPM 19437, which hosts the Holmes, Porphyry, Monsoon and Cyclone prospects, EPM 25855 in which are located the Hurricane and Tornado Prospects, and EPM 27518, which hosts the Bouncer prospect, Figure 1.

Geology of the Hurricane Project Regional Geology

The Hurricane Project area falls within the Mossman 1:250,000 and the Mount Mulligan 1:100,000 Queensland Geological map sheets. The regional geology traverses a wide Geological Timescale from the Devonian in the Hodgkinson Formation through granodiorite and rhyolitic Carboniferous and Permian intrusions to Triassic and Quaternary Sandstones. The Hodgkinson Formation comprises dark grey to greenish, fine to medium quartz greywackes interbedded with siltstones, mudstones and conglomerates. The Carboniferous to Permian granitic/granodiorite and rhyolite intrusions comprise a suite of felsic porphyritic intrusions. The main porphyritic bodies comprise medium to coarse-grained mineral crystals including euhedral hornblende- biotite, k-feldspar and quartz, which locally grade into fine-grained silicified granites.

Local Geology

The three tenements which make up the Hurricane Project are structurally set within two major NW-SE trending faults, being the Hurricane Fault and the Retina Fault. The Hodgkinson Formation dominates these tenements and comprises of tightly folded greywackes, siltstones, shales, cherts, conglomerates and limestones. Locally within the Hurricane Project are 2 felsic intrusions, which occur in EPM 19437 and are predominantly porphyritic granites. These intrusions are the major source of heat, which mobilised hydrothermal fluids to interact with surrounding country rock, leading to widespread alteration in the form of silicification, sericite and carbonates, and account for the deposition of epithermal gold, silver, and antimony mineralised veins. Epithermal gold deposits are strongly associated with hydrothermal fluids that are related to calc-alkaline volcanism and magmatism. Plots of La-Y-Nb on the ternary diagram of Cabanis and Lecolle, 1989; shows that the Hurricane Project falls within the Arc Calc-Alkaline geo-tectonic setting, supporting an epithermal exploration model for the project (Figure 2). Epithermal gold could be low or high sulfidation, depending on mineralogy and can occur as veins, stockworks, replacements or disseminations. Mineralisation within the project area is associated with variably altered, silicified and brecciated quartz veins ranging in widths from 2 to >50m and lengths over 700m. The mineralogy of the Hurricane Project which includes gold, antimony, silver, very limited sulphur, +/- lead and zinc, leans towards the low sulfidation model.

Click here for the full ASX Release

This article includes content from Inca Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18 March 2025

Inca Minerals

Advancing high-grade gold-antimony project in Northern Queensland

Advancing high-grade gold-antimony project in Northern Queensland Keep Reading...

3h

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

14h

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

03 March

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

Steve Barton: Gold, Silver, Oil — Key Price Levels to Watch Now

Steve Barton, host of In It To Win It, shares key price levels for silver and gold.He also explains his current approach to the oil and copper markets, and outlines an emerging opportunity in nickel as Indonesia loosens its hold on the space. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

02 March

Gold, Silver Prices Spike on US-Iran War

Prices for gold and silver spiked higher over the weekend and in early morning trading on Monday (March 2) as a full-blown war broke out in the Middle East.Tensions between Iran on one side and the US and Israel on the other have been intensifying over the past few weeks. On Sunday (February... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00