June 02, 2022

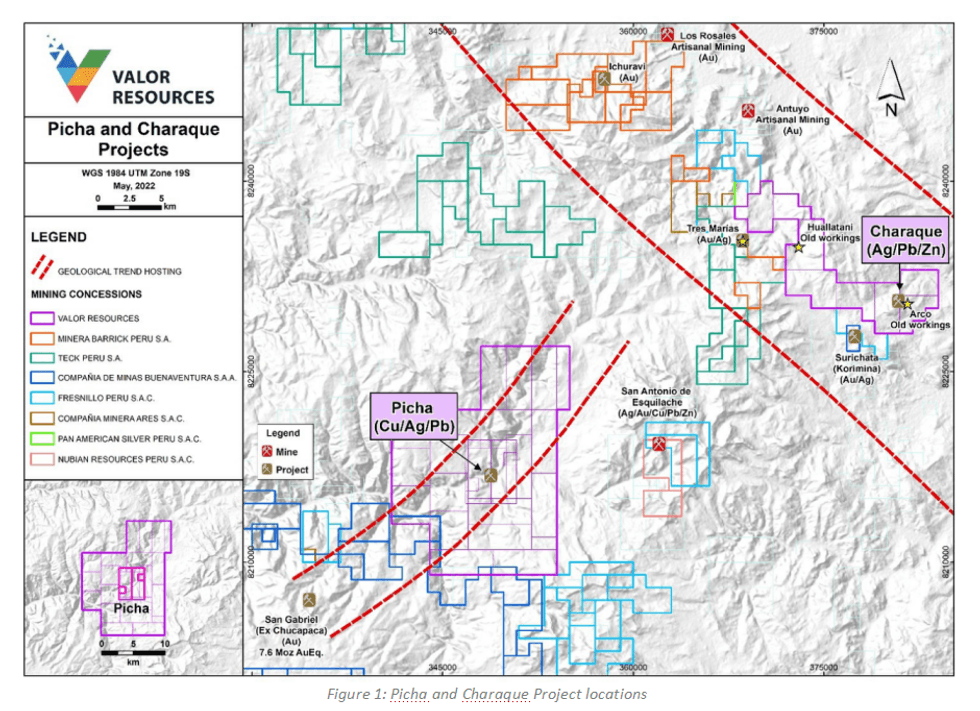

Valor Resources Limited (“Valor” or the “Company”) is pleased to announce the results of rock chip samples taken from new copper targets at the Company’s Picha Project and from targets at the recently acquired Charaque Project in southern Peru. Samples were taken from three new targets at the Picha Project which were first highlighted in the Company’s ASX announcement dated 19th January 2022, titled “Copper-Silver Picha Project landholding expanded following outstanding results from 2021 exploration program”. Further samples were also taken from the Huancune target where Valor’s previous channel sampling had returned assays up to 3.95% Cu (see ASX announcement dated 21 April 2022, titled “Additional Copper Targets confirmed with assays up to 3.95% Cu and 229g/t Ag at Picha Project”). The sample details and assay results from the Picha and Charaque Projects are shown below in Tables 1 and 2 respectively.

HIGHLIGHTS

- Picha Project – three new targets confirmed

- Ichucollo Target with channel samples (2m x 0.20m) up to 2.69% Cu and selective rock chips of 2.43% Cu, 1.34% Cu and 394ppm Mo.

- Occsani Target with channel samples (0.5m x 0.2m) up to 2.14% Cu and rock chip samples up to 2.48% Cu, 92g/t Ag and 200ppm Mo.

- Chullunquiani Target with channel samples (0.5m x 0.2m) up to 5.57% Pb and 5.33% Zn.

- Picha Project – Huancune target

- Further channel samples returned assays of 2.82%, 2.03% and 1.72% Cu

- Charaque Project

- Huallatani Target with a channel sample (0.3m x 0.2m) of 538g/t Ag and 19.5% Pb and dump samples, from historical artisanal mining, up to 43.2g/t Ag and 7.74% Pb

- Arco Target with channel samples (2.0m x 0.2m) up to 929g/t Ag and another up to 0.98% Cu, with five channel samples returning assays greater than 60g/t Ag.

- Phase one 5,000m maiden diamond drilling program planned to commence in the September quarter, permitting processing advancing subject to government approvals.

- Follow-up work at new targets to include further surface sampling, geological mapping and ground geophysics

Executive Chairman George Bauk said “The Picha Project is shaping up as an exciting copper-silver project in a world class gold-copper-silver province, with Peru being the world’s second largest producer of both copper and silver. The results of the 2021 exploration program completed by our Peruvian team have been exceptional, which has led to the definition of a significant number of drill targets, with Phase one comprising 8 holes to an average depth of around 600m.”

“Further targets have now been confirmed at Picha by the exploration team in 2022, with high-grade copper and silver rock chip and channel samples, highlighting just how prospective this project is. Added to this is the new Charaque Project, which is already delivering high-grade silver and lead assays from the initial sampling. The second half of 2022 is promising to be an exciting time for the Company.”

Picha Project surface sampling results

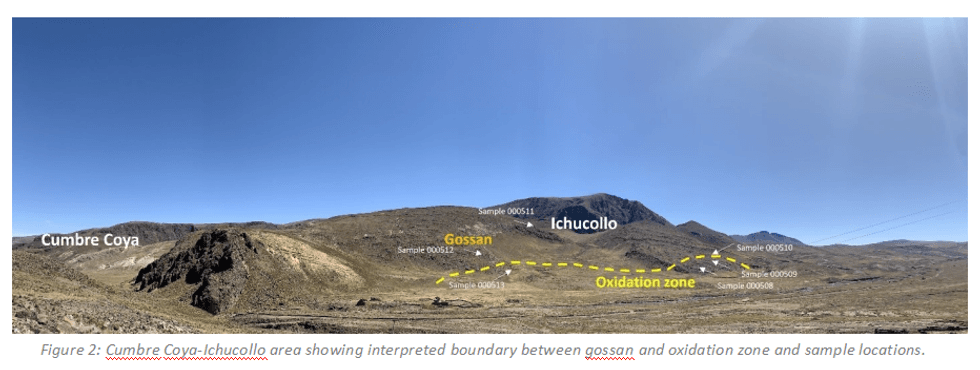

A total of 15 samples were taken at Picha, three of which were from the Huancune target and the rest from the new targets of Chullunquiani, Ichucollo and Occsani. At the Ichucollo target, which is located just 1km east of the Cumbre Coya drill target, three channel samples and three selective samples were taken. Channel samples returned assays up to 2.69% Cu, while two of the selective samples returned assays of 2.43 and 1.34% Cu. The third selective sample from Ichucollo returned an assay of 394ppm Mo.

Mineralisation at Ichucollo occurs within andesitic volcanics and associated argillic alteration and there is evidence of possible geochemical zonation, with an interpreted gossanous zone overlying a zone of oxidation (see Figure 2 below).

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00