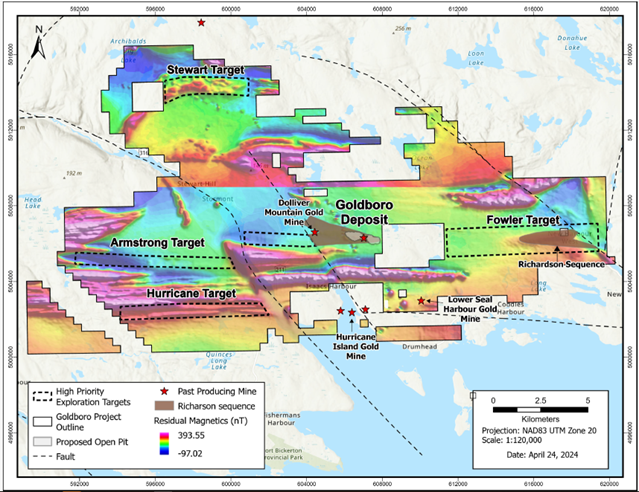

Signal Gold Inc. ("Signal Gold" or the "Company") (TSX:SGNL)(OTCQX:SGNLF) is pleased to announce its exploration program at the Fowler target, located along strike to the east of the multi-million-ounce Goldboro Deposit1. The Fowler target is located within the Goldboro Trend, a 28-kilometre-long geological trend defined by an anticlinal fold structure that hosts the Goldboro Deposit. The Fowler target is part of an initial group of high-priority regional growth targets identified from an airborne geophysical survey across the Company's extensive exploration property of approximately 27,200 hectares (~272 km2) in the Goldboro Gold District (Exhibit A). The Company recently collected 335 soil samples at Fowler to complement existing historical sampling and surveys, which assayed up to 144 ppb gold with 51 samples assaying 10 ppb gold and above. The Company is initiating an exploration program that will include geological mapping, prospecting, surface geochemical sampling, and ground geophysics, with the aim of identifying drill specific targets to discover gold mineralization at Fowler

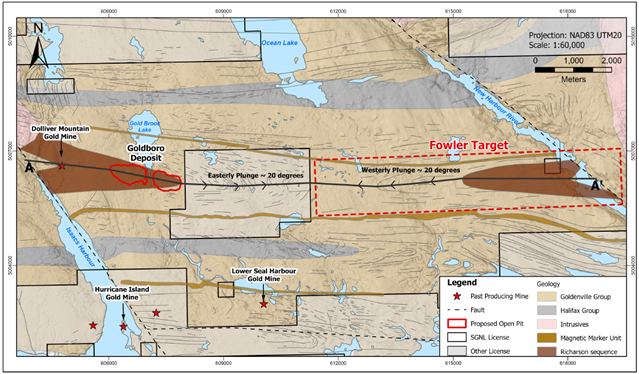

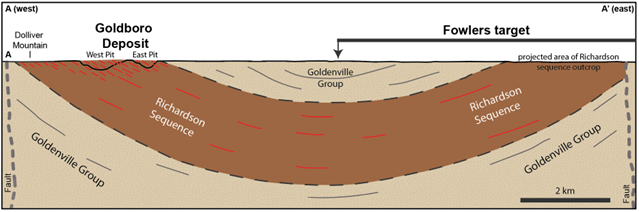

The Goldboro Deposit is hosted within a geological level referred to as the Richardson sequence which plunges eastward. Geological mapping and geophysics indicate that in the Fowler area, the structure changes its plunge to westward such that the Richardson sequence that hosts the Goldboro Deposit may resurface eight (8) kilometers east of the existing Mineral Resource (Exhibits B and C).

"We are excited to commence exploration work at the Fowler target, where there is potential to discover further Goldboro-like mineralization just eight kilometres east of our existing, multi-million-ounce mineral resource1. The highly prospective Fowler target is directly along strike and within the same structure that hosts the Goldboro Deposit and, importantly, is where we believe the specific sequence of rocks that host Goldboro gold mineralization returns to surface. The focus of our work at the Fowler target will be to identify specific drill targets with the ultimate goal of making a new gold discovery in the Goldboro Gold District."

~ Kevin Bullock, President and CEO, Signal Gold Inc.

1Please refer Mineral Resource Estimate section below.

Geology

The Meguma Terrane of Nova Scotia is host to numerous gold deposits located within anticlinal structures within a unit of rocks known as the Goldenville Group. The Goldboro Deposit and its western continuation at Dolliver Mountain is preferentially hosted within a level of stratigraphy of the Goldenville Group referred to as the Richardson sequence, a sequence of rocks that are made up of a minimum 1,000-metre-thick section of alternating argillite and greywacke. The anticlinal structures are doubly-plunging (plunge both to the east and the west) at the regional scale and at the scale of the Goldboro Gold District. Along the Goldboro Trend, the Goldboro Deposit, host stratigraphy, and structure plunge gently eastward.

The Richarson sequence is characterized by an elevated magnetic signature that is coincident with the trend of gold mineralization and alteration. This magnetic pattern outlined by the Company's airborne geophysical survey repeats approximately eight (8) kilometres to the east, due to the reversal in the fold plunge (Exhibit C). This repetition, along with the results of LiDAR and structural data interpretation, suggests that this favourable stratigraphy re-emerges at the Fowler target.

The Fowler target has been covered by previous exploration that comprises collection of 710 historic B-horizon soil samples, four (4) stream sediment samples and 20 broadly spaced till samples. Soil samples, collected by Seabright Exploration and Carrick Gold Resources in 1988, assay up to 17 ppb gold with three samples assaying over 10 ppb gold. Of the 24 till samples, collected from the area by Seabright in 1988 and Acadian in 2011, 2 samples assayed for anomalous gold including 110 ppb and 174 ppb.

In February 2024, the Company collected 335 soil samples, filling gaps in coverage of the historic surveys. Soil samples assayed up 144 ppb gold with 51 samples assaying 10 ppb and above gold.

Seven (7) reverse circulation drill holes were completed by Acadian Mining in 2007 in the Fowler area, targeting the overburden, but no detectable (>5 ppb gold) results were returned from overburden. Fifteen shallow percussion drill holes in 2 lines, completed by D.D.V. Gold in 2013, tested near the trace of the anticline at the Fowlers target with no detectable (>5 ppb) gold returned from samples of overburden and shallow bedrock. Similarly, Onitap Resources completed three (3) diamond drill holes in the Fowler target area in 1989 with the best result of 0.06 g/t (60 ppb) gold returned. These drill holes are thought to be several hundred meters south of the interpreted anticline.

Exhibit A. The location of high priority exploration targets at the Goldboro Project including the Fowler target located east of the Goldboro Deposit.

Exhibit B. A plan map showing the geology of the Goldboro Trend near the Goldboro Deposit and the Fowler target. The map shows a reversal in the plunge of the host anticlinal structure and the projection of the favorable Richardson sequence eight (8) kilometres east of the Goldboro Deposit, forming the Fowler target.

Exhibit C. A conceptual long section (A-A') through the axial plane of the host fold structure and the Goldboro Deposit. The Richardson sequence, which includes the Goldboro Deposit on the western end of the section, plunges gently eastward on the left side of the section. The plunge reverses westward in the Fowler area where the Richardson sequence is believed to outcrop, forming the Fowler target.

Mineral Resource Estimate - Goldboro Project

The Mineral Resource Estimate presented was prepared by Independent Qualified Person Glen Kuntz, P. Geo., of Nordmin Engineering Ltd. as part of the Technical Report titled ‘NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia'. The Mineral Resource Estimate is based on validated results of 681 surface and underground drill holes for a total of 121,540 metres of diamond drilling completed between 1984 and the effective date of November 15, 2021, including 55,803 metres conducted by the Company.

Mineral Resource Estimate for the Goldboro Gold Project - Effective Date November 15, 2021

Resource Type | Gold Cut | Category | Tonnes | Grade | Gold Troy Ounces |

| Open Pit | 0.45 | Measured | 7,680,000 | 2.76 | 681,000 |

Indicated | 7,988,000 | 2.89 | 741,000 | ||

Measured + Indicated | 15,668,000 | 2.82 | 1,422,000 | ||

Inferred | 975,000 | 2.11 | 66,000 | ||

| Underground | 2.40 | Measured | 1,576,000 | 7.45 | 377,000 |

Indicated | 4,350,000 | 5.59 | 782,000 | ||

Measured + Indicated | 5,925,000 | 6.09 | 1,159,000 | ||

Inferred | 2,206,000 | 5.89 | 418,000 | ||

| Combined Open Pit and Underground* | 0.45 and 2.40 | Measured | 9,255,000 | 3.56 | 1,058,000 |

Indicated | 12,338,000 | 3.84 | 1,523,000 | ||

Measured + Indicated | 21,593,000 | 3.72 | 2,581,000 | ||

Inferred | 3,181,000 | 4.73 | 484,000 |

* Combined Open Pit and Underground Mineral Resources; The Open Pit Mineral Resource is based on a 0.45 g/t gold cut-off grade, and the Underground Mineral Resource is based on 2.40 g/t gold cut-off grade.

Mineral Resource Estimate Notes

- Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). Mineral Resources that are not mineral reserves do not have demonstrated economic viability. This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral Resources are inclusive of Mineral Reserves.

- Open Pit Mineral Resources are reported at a cut-off grade of 0.45 g/t gold that is based on a gold price of C$2,000/oz (~US$1,600/oz) and a metallurgical recovery factor of 89% around cut-off as calculated from ((GRADE-(0.0262*LN(GRADE)+0.0712))/GRADE*100)-0.083.

- Underground Mineral Resource is reported at a cut-off grade of 2.60 g/t gold that is based on a gold price of C$2,000/oz (~US$1,600/oz) and a gold processing recovery factor of 97%.

- Assays were variably capped on a wireframe-by-wireframe basis.

- Specific gravity was applied using weighted averages to each individual wireframe.

- Effective date of the Mineral Resource Estimate is November 15, 2021.

- All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.

- Excludes unclassified mineralization located within mined out areas.

- Reported from within a mineralization envelope accounting for mineral continuity.

Historic till, soil and rock samples as well as historic geophysical surveys and drill holes referred to in this news release were obtained from digital data made public by the Nova Scotia Department of Natural Resources including numerous assessment reports. The QP has not completed sufficient work to validate and verify all of the historic data referred to in this news release.

Soil samples collected by Signal Gold Inc. were analyzed for gold by fire assay with AA finish and 34-elements by ICP at Eastern Analytical Ltd. in Springdale, NL.

This news release has been reviewed and approved by Paul McNeill, P.Geo., VP Exploration with Signal Gold Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

ABOUT SIGNAL GOLD

Signal Gold is advancing the Goldboro Gold Project in Nova Scotia, a significant growth project subject to a positive Feasibility Study which demonstrates an approximately 11-year open pit life of mine ("LOM") with average gold production of 100,000 ounces per annum and an average diluted grade of 2.26 grams per tonne gold. (Please see the ‘NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia' on January 11, 2022, for further details). On August 3, 2022, the Goldboro Project received its environmental assessment approval from the Nova Scotia Minister of Environment and Climate Change, a significant regulatory milestone which enables the Company to commence site-specific permitting processes including the Industrial Approval and Crown Land Lease and Mining Lease applications. The Goldboro Project also has potential for further Mineral Resource expansion, particularly towards the west along strike and at depth. A future study will consider upgrading and expanding potentially mineable underground Mineral Resources as part of the longer-term mine development plan.

FOR ADDITIONAL INFORMATION CONTACT:

Signal Gold Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@signalgold.com

Reseau ProMarket Inc.

Dany Cenac Robert

Investor Relations

(514) 722-2276 x456

Dany.Cenac-Robert@ReseauProMarket.com

SOURCE: Signal Gold Inc.

View the original press release on accesswire.com