November 03, 2024

Results from Phase 2 drilling confirm McNabs East as a high-priority target for follow-up exploration, with diamond drilling to commence in November

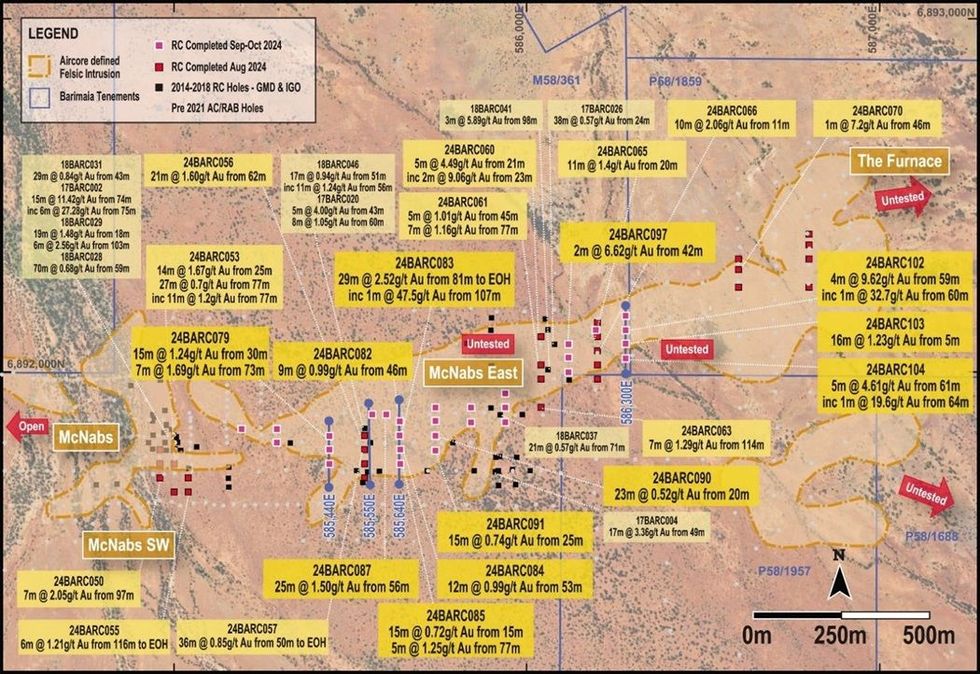

Ordell Minerals Limited (ASX Code: “ORD”) (“Ordell” or “the Company”) is pleased to announce significant drill results from recent, shallow, wide-spaced Reverse Circulation (RC) drilling at its Barimaia Gold Project (“Barimaia”), located near Mount Magnet in the Murchison region of Western Australia.

Key Points:

- Significant results received from the second phase of shallow Reverse Circulation (RC) drilling at the McNabs East Prospect at the Barimaia Gold Project in Western Australia, including:

- 2Gm @ 2.52g/t Au from 81m 24BARC083

- Including 1m @ 47.5g/t Au from 107m (visible gold present)

- 4m @ G.62g/t Au from 5Gm 24BARC102

- Including 1m @ 32.7g/t Au from 60m

- 25m @ 1.50g/t Au from 56m 24BARC087

- 5m @ 4.61g/t Au from 61m 24BARC104

- Including 1m @ 1G.6g/t Au from 64m

- 16m @ 1.23g/t Au from 5m 24BARC103

- 15m @ 1.24g/t Au from 30m 24BARC07G

- 2m @ 6.62g/t Au from 42m 24BARC0G7

- 7m @ 1.6Gg/t Au from 73m 24BARC07G

- 2Gm @ 2.52g/t Au from 81m 24BARC083

- Extensive zone of gold mineralisation now defined at McNabs East at shallow depths (typically <80m vertical) over a strike length of +1,000m and remains open along strike and untested at depth.

- The recent shallow drilling at McNabs East was completed on ~100m-spaced sections to continue the first-pass test of the Barimaia felsic intrusion.

- Primary mineralisation in the McNabs East area is associated with an interpreted granodiorite intrusion, strongly supporting the potential for Eridanus-style deposits at Barimaia.

- Diamond drilling planned for November to obtain structural and lithological data at McNabs East, which will be followed by extensional and in-fill RC drilling in the March 2025 Ǫuarter.

The RC drilling program was completed in September and October 2024 as the second phase of a larger, ongoing program to systematically test at shallow depths (typically < 80m vertical) the currently defined 2.5km strike extent of gold mineralisation at Barimaia.

Results from the program continue to confirm shallow, open pit potential, with coherent zones of gold mineralisation starting to be defined within an extensive gold system that remains untested at depth and remains open along strike.

Drilling completed on section 585,640E (see Figures 1 and 2) returned significant high-grade gold mineralisation in 24BARC083 (2Gm @ 2.52g/t Au from 81m) to the end of the hole (EOH) at 110m.

Visible gold was panned in the interval from 107m to 108m, which returned an intercept of 1m @ 47.5g/t Au.

Strong gold mineralisation was also returned from 24BARC087 (25m @ 1.50g/t Au from 56m) on section 585,550E (see Figures 1 and 3), adjacent to where a robust zone of gold mineralisation was intersected in drilling completed in August 2024 in 24BARC056 (21m @ 1.60g/t Au from 62m) and 24BARC057 (36m @ 0.85g/t Au from 50m). This interpreted flat-lying zone of gold mineralisation is over 80m wide on section.

Drilling completed on the eastern limit of the Phase 2 program on section 586,300E (see Figures 1 and 5) returned high-grade gold mineralisation in two separate zones, including 4m @ G.62g/t Au from 5Gm in 24BARC102 including 1m @ 32.7g/t Au from 60m; and 5m @ 4.61g/t Au from 61m in 24BARC104 including 1m @ 1G.6g/t Au from 64m. Importantly, no RC drilling has been completed east of this line along the interpreted strike of the mineralisation.

Management Comment

Commenting on the results, Ordell’s Managing Director, Michael Fowler, said:

“Our second drill program at Barimaia has delivered some great results, with wide zones of shallow gold mineralisation intersected within the targeted felsic intrusion host rock. Importantly, a number of high- grade gold results were returned from the program which are open at depth and along strike.

“This shows the potential of the mineralised system, which is beginning to take shape, pointing to significant future growth opportunities as our drilling programs advance.

“We have now completed over 5,000m since we listed on the ASX in July, with the results from this drilling showing clear potential for shallow open pits at Barimaia.

“Our next step is to complete a diamond drilling program in November to help confirm the orientation, lithologies and geometry of the significant mineralisation centred on section 585,550E. This drilling will be followed up by further extensional and in-fill drilling in the coming months.”

Ordell’s exploration at Barimaia is targeting new discoveries of a similar style to the Eridanus deposit, which forms part of Ramelius Resources’ (ASX: RMS) Mount Magnet gold mining operations (Figure 6).

Eridanus lies approximately 6km north-west of Barimaia and hosts a current Mineral Resource Estimate of 21Mt @ 1.7g/t Au for 1,200,000oz of contained gold1, with an additional +300,000 ounces of gold already mined from the open pit.

Click here for the full ASX Release

This article includes content from Ordell Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

7h

Pan African To Acquire Emmerson Resources in US$218 Million Gold Deal

South African gold producer Pan African Resources (LSE:PAF) has agreed to acquire Australian explorer Emmerson (LSE:EML) in an all-share transaction valued at approximately US$218 million.The acquisition will be carried out through a scheme of arrangement under which Pan African will acquire 100... Keep Reading...

12h

American Eagle Announces Exercise of Participation Rights by South32 and Teck, Updates Details of Recently Announced Financing

Highlights: South32 and Teck will maintain their equity ownership in American Eagle Gold.Including Eric Sprott's private placement, American Eagle Gold's cash balance will increase by $34 million to more than $55 million upon close of this financing.Eric Sprott, South32 and Teck are the sole... Keep Reading...

23h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

23h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

10 March

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00