November 03, 2024

Results from Phase 2 drilling confirm McNabs East as a high-priority target for follow-up exploration, with diamond drilling to commence in November

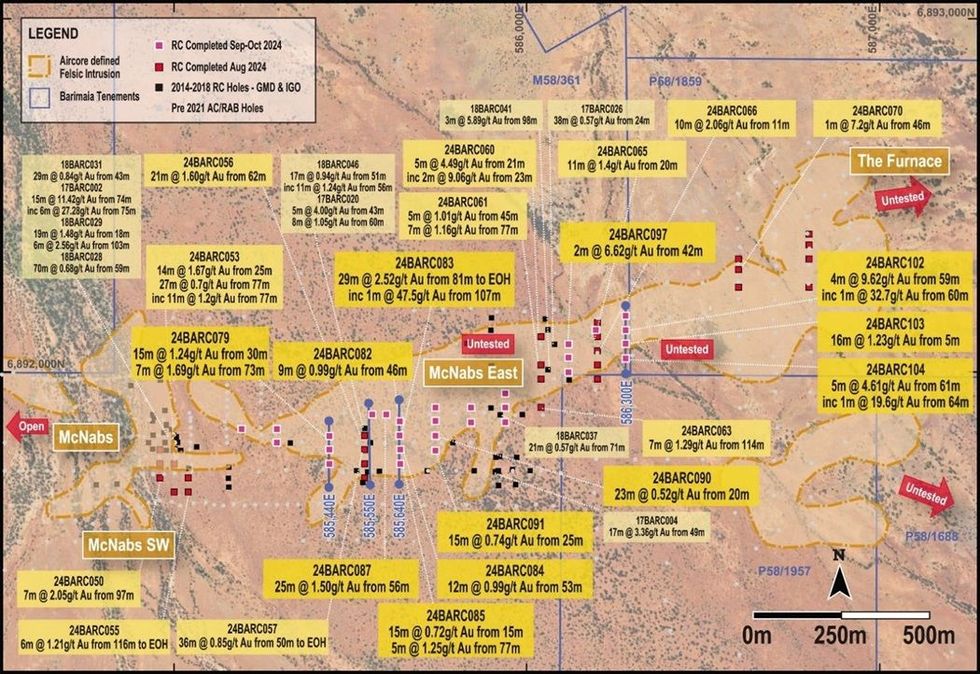

Ordell Minerals Limited (ASX Code: “ORD”) (“Ordell” or “the Company”) is pleased to announce significant drill results from recent, shallow, wide-spaced Reverse Circulation (RC) drilling at its Barimaia Gold Project (“Barimaia”), located near Mount Magnet in the Murchison region of Western Australia.

Key Points:

- Significant results received from the second phase of shallow Reverse Circulation (RC) drilling at the McNabs East Prospect at the Barimaia Gold Project in Western Australia, including:

- 2Gm @ 2.52g/t Au from 81m 24BARC083

- Including 1m @ 47.5g/t Au from 107m (visible gold present)

- 4m @ G.62g/t Au from 5Gm 24BARC102

- Including 1m @ 32.7g/t Au from 60m

- 25m @ 1.50g/t Au from 56m 24BARC087

- 5m @ 4.61g/t Au from 61m 24BARC104

- Including 1m @ 1G.6g/t Au from 64m

- 16m @ 1.23g/t Au from 5m 24BARC103

- 15m @ 1.24g/t Au from 30m 24BARC07G

- 2m @ 6.62g/t Au from 42m 24BARC0G7

- 7m @ 1.6Gg/t Au from 73m 24BARC07G

- 2Gm @ 2.52g/t Au from 81m 24BARC083

- Extensive zone of gold mineralisation now defined at McNabs East at shallow depths (typically <80m vertical) over a strike length of +1,000m and remains open along strike and untested at depth.

- The recent shallow drilling at McNabs East was completed on ~100m-spaced sections to continue the first-pass test of the Barimaia felsic intrusion.

- Primary mineralisation in the McNabs East area is associated with an interpreted granodiorite intrusion, strongly supporting the potential for Eridanus-style deposits at Barimaia.

- Diamond drilling planned for November to obtain structural and lithological data at McNabs East, which will be followed by extensional and in-fill RC drilling in the March 2025 Ǫuarter.

The RC drilling program was completed in September and October 2024 as the second phase of a larger, ongoing program to systematically test at shallow depths (typically < 80m vertical) the currently defined 2.5km strike extent of gold mineralisation at Barimaia.

Results from the program continue to confirm shallow, open pit potential, with coherent zones of gold mineralisation starting to be defined within an extensive gold system that remains untested at depth and remains open along strike.

Drilling completed on section 585,640E (see Figures 1 and 2) returned significant high-grade gold mineralisation in 24BARC083 (2Gm @ 2.52g/t Au from 81m) to the end of the hole (EOH) at 110m.

Visible gold was panned in the interval from 107m to 108m, which returned an intercept of 1m @ 47.5g/t Au.

Strong gold mineralisation was also returned from 24BARC087 (25m @ 1.50g/t Au from 56m) on section 585,550E (see Figures 1 and 3), adjacent to where a robust zone of gold mineralisation was intersected in drilling completed in August 2024 in 24BARC056 (21m @ 1.60g/t Au from 62m) and 24BARC057 (36m @ 0.85g/t Au from 50m). This interpreted flat-lying zone of gold mineralisation is over 80m wide on section.

Drilling completed on the eastern limit of the Phase 2 program on section 586,300E (see Figures 1 and 5) returned high-grade gold mineralisation in two separate zones, including 4m @ G.62g/t Au from 5Gm in 24BARC102 including 1m @ 32.7g/t Au from 60m; and 5m @ 4.61g/t Au from 61m in 24BARC104 including 1m @ 1G.6g/t Au from 64m. Importantly, no RC drilling has been completed east of this line along the interpreted strike of the mineralisation.

Management Comment

Commenting on the results, Ordell’s Managing Director, Michael Fowler, said:

“Our second drill program at Barimaia has delivered some great results, with wide zones of shallow gold mineralisation intersected within the targeted felsic intrusion host rock. Importantly, a number of high- grade gold results were returned from the program which are open at depth and along strike.

“This shows the potential of the mineralised system, which is beginning to take shape, pointing to significant future growth opportunities as our drilling programs advance.

“We have now completed over 5,000m since we listed on the ASX in July, with the results from this drilling showing clear potential for shallow open pits at Barimaia.

“Our next step is to complete a diamond drilling program in November to help confirm the orientation, lithologies and geometry of the significant mineralisation centred on section 585,550E. This drilling will be followed up by further extensional and in-fill drilling in the coming months.”

Ordell’s exploration at Barimaia is targeting new discoveries of a similar style to the Eridanus deposit, which forms part of Ramelius Resources’ (ASX: RMS) Mount Magnet gold mining operations (Figure 6).

Eridanus lies approximately 6km north-west of Barimaia and hosts a current Mineral Resource Estimate of 21Mt @ 1.7g/t Au for 1,200,000oz of contained gold1, with an additional +300,000 ounces of gold already mined from the open pit.

Click here for the full ASX Release

This article includes content from Ordell Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

17h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00