June 13, 2023

Great Boulder Resources (“Great Boulder” or the “Company”) (ASX: GBR) is pleased to provide an update on recent RC drilling at the Side Well Gold Project (“Side Well”) near Meekatharra in Western Australia.

HIGHLIGHTS

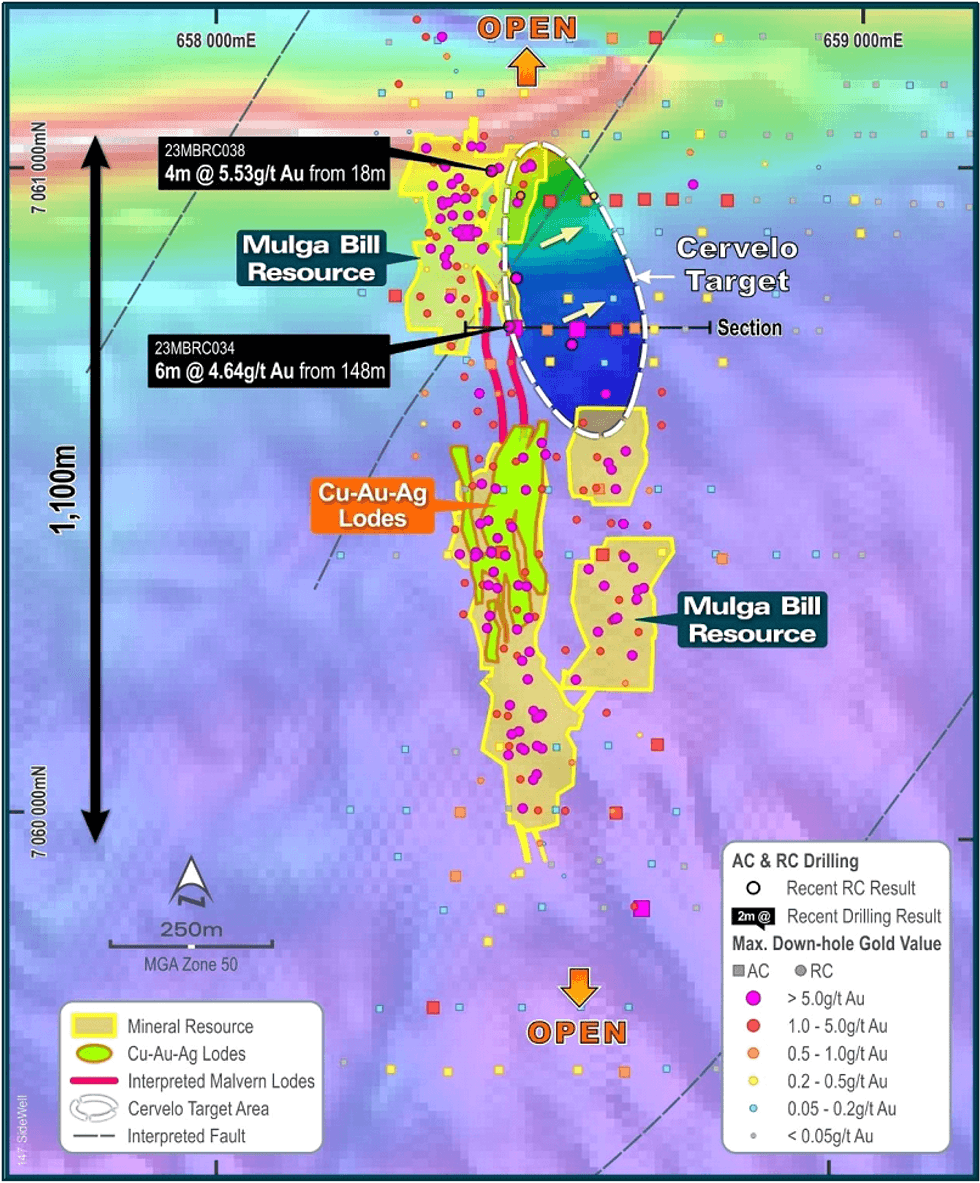

- Assays have been received for the final six holes targeting gold mineralisation at Cervelo prospect on the east side of Mulga Bill. Highlights include:

- 4m @ 5.53g/t Au from 18m in 23MBRC038

- 6m @ 4.64g/t Au from 148m, including 4m @ 6.62g/t Au from 148m, in 23MBRC034

- 4m @ 3.24g/t Au from 153m, including 1m @ 8.27g/t Au from 153m, in 23MBRC035

- Diamond drilling program at Mulga Bill is completed, with core processing underway

- Further AC and RC campaigns will commence in July

Assay results have now been received for the final six RC holes targeting gold mineralisation at the newly discovered Cervelo target, located immediately east of Mulga Bill. These are the final results from the Phase 2 RC drilling program at Side Well.

Great Boulder’s Managing Director, Andrew Paterson commented:

“These six holes were targeting extensional mineralisation identified in our recent AC program as announced on April 27. We were looking for near-surface extensions of high-grade veins intersected at depth within the Mulga Bill HGV Zone.”

“Significantly, the intersection of 4m @ 5.53g/t Au from 18m on hole 23MBRC038 is our shallowest high-grade result at Mulga Bill since we started drilling in August 2020. This new zone of mineralisation lies outside the current mineral resource. Shallow mineralisation is particularly important in any potential mining scenario, as any near-surface ounces can provide early cashflow while pushing towards the bonanza grades deeper down.”

“While the holes further east didn’t intersect the same tenor of grade as we see in the HGV Zone, they have confirmed a broad mineralised corridor which was first identified in the AC drilling. We will continue testing this target with more RC holes in the next program.”

“Now that the diamond program is complete, we’ll finish logging and processing the core, then regroup in Perth for some mid-year training with the team before starting the next drilling programs in July.”

Six RC holes were drilled in the Cervelo area immediately east of the Mulga Bill HGV Zone, testing positions down-dip from anomalous intersections, as announced in late April. Cervelo is a large target area which remains largely untested by RC drilling.

Hole 23MBRC038 (4m @ 5.38g/t Au from 18m) has intersected a new zone of gold mineralisation very close to surface and above the current 518koz Mineral Resource. The mineralised orientation remains unclear. The deeper part of this hole did not intersect west-dipping high-grade veins, and the shallow AC intersections further east may represent other subvertical lodes not previously identified. A diamond hole has since been completed on the same northing and assays will be released when available.

Click here for the full ASX Release

This article includes content from Great Boulder Resources licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GBR:AU

The Conversation (0)

1h

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

9h

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

11h

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

21h

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

22h

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

04 February

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00