May 11, 2023

SensOre Ltd (ASX:S3N) through its subsidiary EXAI (SensOre/Deutsche Rohstoff AG) have reachedagreement with Venture Minerals (ASX:VMS) to farm-in to the Golden Grove North project on the terms above.

Highlights

- SensOre subsidiary, Exploration Ventures AI Pty Ltd (EXAI), a collaboration with Deutsche Rohstoff AG1have reached agreement with Venture Minerals to farm-in to the Golden Grove North project

- SensOre’s AI technology has identified copper (VMS) and lithium potential at Golden Grove North

- EXAI may earn 70% in all mineral rights (excluding rare earths) by expending up to $4.5m in two stages ($1.5m to earn a 51% over two years and $3m for an additional 19%).

- Venture Minerals has an option to clawback 10% within the first 2 years on certain conditions

- As part of the initial RC drilling program, EXAI has agreed to test the Vulcan Drill2rare earth target with a single hole to 300m.

Richard Taylor, SensOre CEO, said: “We are excited about both the copper and lithium potential of the area. With our partners at Deutsche Rohstoff, we are building a compelling portfolio of lithium projects and honing new techniques for discriminating lithium fertility over large areas. We bring to the joint-venture with Venture Minerals a growing body of R&D from Western Australia to New South Wales on how to narrow in on Australia’s next generation lithium targets.”

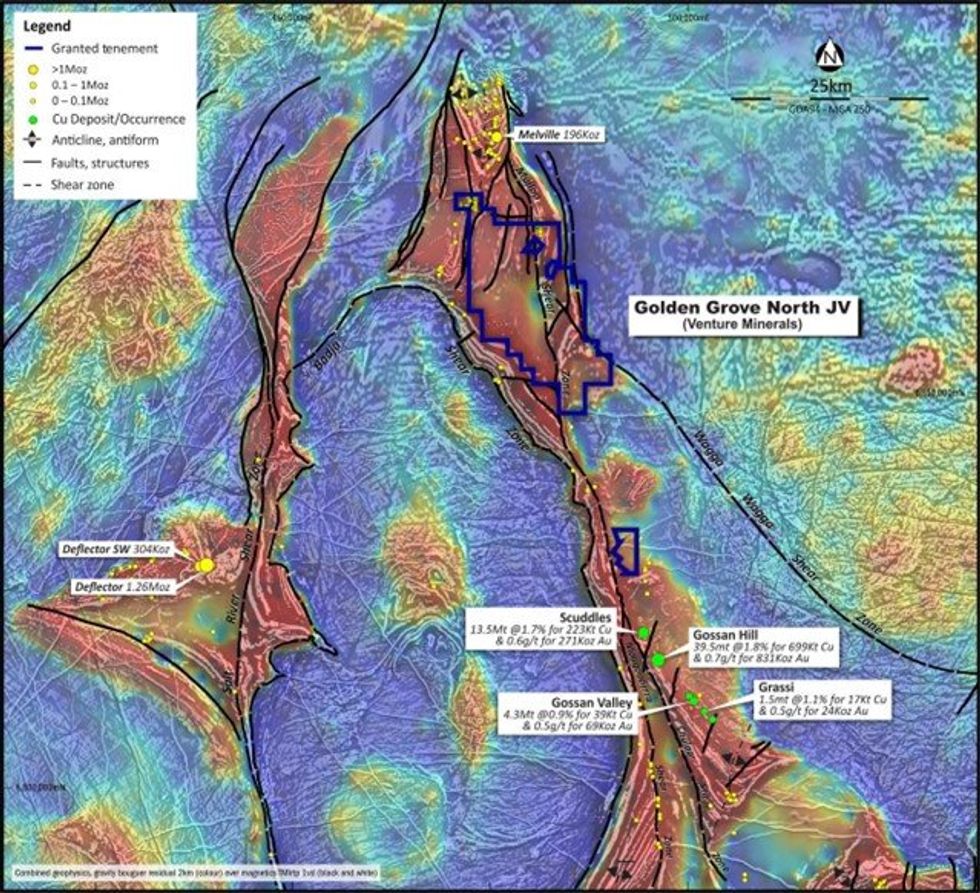

The land package is a total of 288 square kilometres, less than 10 kilometres north of the Golden Grove mine, currently Western Australia’s premier location for VMS deposits and is approximately 370 km north-northeast of Perth (see Figure 1 next page). Venture Minerals has explored for VMS copper and identified the Vulcan rare earths target.

SensOre’s AI technology has identifiednewareas for VMS copper potential and in mid-2022 SensOre AI technology deployed over Western Australia predicted unidentified and untested lithium potential over the northern portion of the greenstone belt covered by the tenements. The predicted targets are considered consistent with the recognition of an emerging lithium pegmatite province over the greater Murchison region.

Geology covered by the Joint Venture tenements includes the northern part of the Yalgoo-Singleton greenstone belt in the Murchison province. The greenstone belt is intruded by multiple phases of granitic intrusions of various compositions and ages including LCT pegmatites. The lower Luke Creek volcanic sequence in the east and north of the tenement package hoststhe Golden Grove VMS camp of deposits to the south. VMS style copper, zinc, gold mineralisation has been located on the northern portion of the greenstone belt at the Orcus prospect.

About SensOre

SensOre (ASX: S3N) aims to become the top performing global minerals targeting company through deployment of big data, artificial intelligence/machine learning technologies and geoscience expertise. SensOre’s three business pillars are software, technology and exploration services. SensOre collects all available geological information in a terrane and places it in a multidimensional hypercube or data cube. SensOre’sbig data approach allows DPT predictive analytics to accurately predict known endowment and generate targets for further discovery.

Click here for the full ASX Release

This article includes content from SensOre Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

S3N:AU

The Conversation (0)

29 January

Quarterly Activities/Appendix 4C Cash Flow Report

Unith (UNT:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

20 January

The Performance Chasm: Is the AI Rally Over or Just Shifting Gears?

The investment landscape of 2025 will be remembered for its historic divide, where the widespread boom in artificial intelligence (AI) created a tale of two worlds in the stock market.On one side, the Magnificent 7 and specialized players like Palantir Technologies (NASDAQ:PLTR) drove massive... Keep Reading...

20 January

Nextech3D.ai Scales National Event Infrastructure to 35 Major U.S. Cities; Launches 58 New AI-Ready Experiences to Meet Enterprise Demand

Strategic Integration of Generative AI 'Semantic Memory' via OpenAI and Pinecone Vector Database Supports Rapid Expansion of Corporate Engagement Platforms TORONTO, ON / ACCESS Newswire / January 20, 2026 / Nextech3D.ai (OTCQB:NEXCF)(CSE:NTAR,OTC:NEXCF)(FSE:1SS), a leader in AI-powered event and... Keep Reading...

16 January

Tech Weekly: Chip Stocks Soar on Taiwan Semiconductor Earnings

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market. We also break down next week's catalysts to watch to help you prepare for the week ahead.Don't forget to follow us @INN_Technology for real-time news updates!Securities Disclosure: I, Meagen... Keep Reading...

16 January

Nextech3D.ai Partners with BitPay to Power Crypto and Stablecoin Payments for Events

Company Strengthens Event Tech Infrastructure with Milestone AWS Migration and Enhanced Blockchain CredentialingAWS Cloud Infrastructure OptimizationSmart Contract UniformityFlexible Asset Standards ERC721/ ERC1155 TORONTO, ON AND NEW YORK CITY, NY / ACCESS Newswire / January 16, 2026 /... Keep Reading...

16 January

Nextech3D.ai Partners with BitPay to Power Crypto and Stablecoin Payments for Events

Company Strengthens Event Tech Infrastructure with Milestone AWS Migration and Enhanced Blockchain CredentialingAWS Cloud Infrastructure OptimizationSmart Contract UniformityFlexible Asset Standards ERC721/ ERC1155 TORONTO, ON AND NEW YORK CITY, NY / ACCESS Newswire / January 16, 2026 /... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00