July 13, 2022

Sarama Resources Ltd. (“Sarama” or the “Company”) (ASX:SRR, TSX- V:SWA) is pleased to provide an update on the planned +50,000m drilling program at its 100%-owned(4), multi-million ounce Sanutura Project (the “Project”) (news release dated May 12, 2022).

The drilling program was designed to materially grow the oxide component of the 0.6Moz Au (Indicated) plus 2.3Moz Au (Inferred)(1) Mineral Resource, to test a number of high priority regional targets and to define additional exploration targets for follow-up drilling. The Company has completed over 20,000m of drilling including ~4,000m of reverse circulation (“RC”) drilling and ~16,000m of air core (“AC”) drilling.

Most of the samples have been dispatched to the SGS and ALS assay laboratories in Ouagadougou where sample turn- around time is averaging approximately 4 weeks. Sample assays are starting to be returned and will be released after their compilation and interpretation are complete.

The seasonal rains are beginning to arrive in southwest Burkina Faso and the Company expects to complete the current season’s drilling by the end of July and recommence drilling in the fourth quarter after seasonal rains have abated, local farmers have harvested their crops and access routes have dried up.

A majority of the drilling has been undertaken in the southern portion of the Project while the Company awaits the completion of government paperwork to expedite tax exonerations and facilitate drilling at the Bondi, Zanawa and Bamako 2 prospects. Drilling of high-priority extensional and regional exploration targets at the Bondi Deposit, which has over 50 shallow, +75 gram/metre Au historical drill intercepts(a) including 52m @ 5.31 g/t Au from 38m, 13m @20.41 g/t Au from 8m, 66m @ 3.83 g/t Au from 6m and 70m @ 3.04 g/t Au from surface, plus other northern prospects, including Zanawa and Bamako 2, will be undertaken in the field season commencing in Q4, 2022.

Sarama’s President, CEO & MD, Andrew Dinning commented:

“We have been very pleased with the progress made in the drilling campaign at the Sanutura Project and completing 20,000m of drilling within two months is testament to the teams we have in the field and their ability to expedite activity in the southwest of the Country. Although our highest ranked exploration targets in and around the Bondi Deposit are yet to be drilled, we remain pleased with the progress made and look forward to the receipt, compilation and publication of results.

The first part of the program has been structured to increase the oxide component of the already large Mineral Resource at the Tankoro Deposit by targeting near-surface material in extensions to the currently modelled deposits as well as testing a number of regional targets. We look forward to providing updates as the program concludes and assay results come to hand in the coming weeks.”

Drilling at the Sanutura Project

A Large Mineral Resource with Potential to Grow

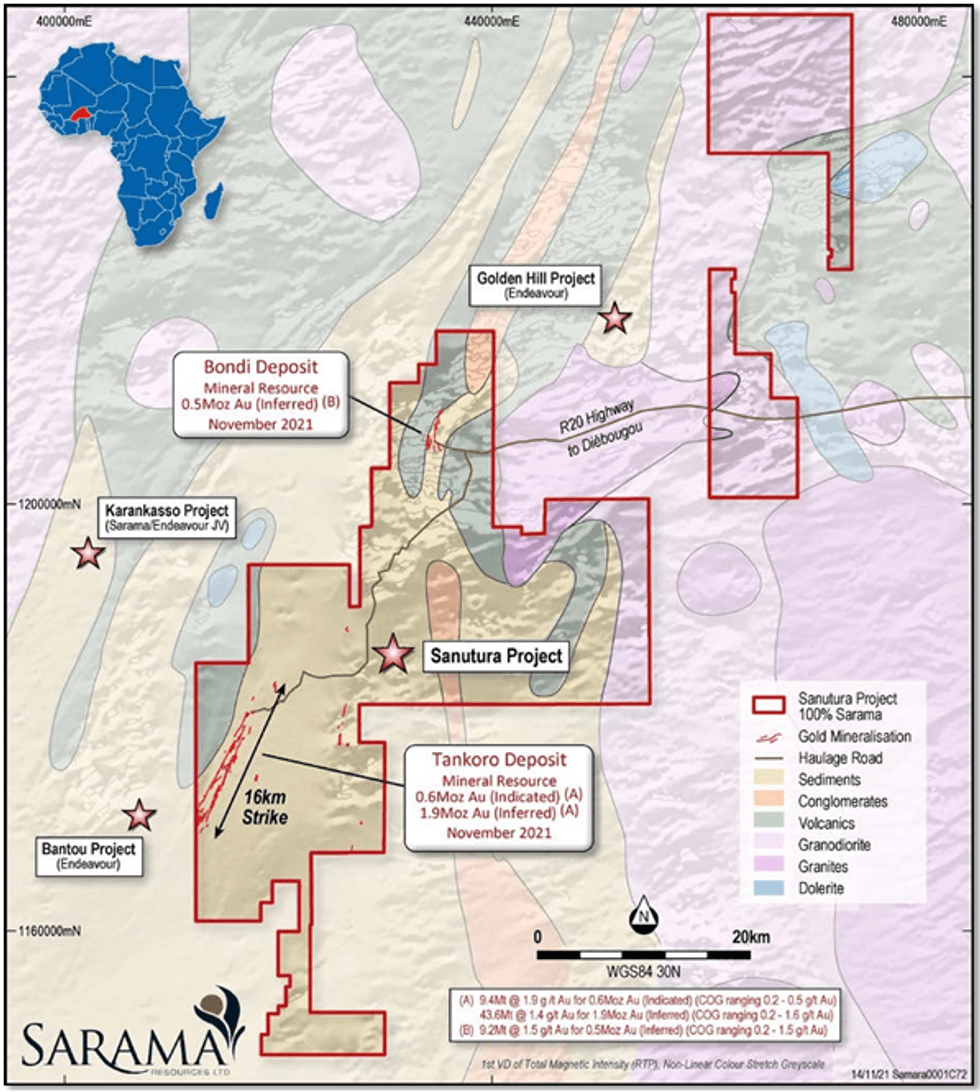

The Company’s primary focus is its 100%-owned(4) Sanutura Project, which covers an area of 1,420km2 and has a multi- million ounce Mineral Resource of 0.6Moz Au (Indicated) plus 2.3Moz Au (Inferred)(1) with significant growth potential available through its commanding position along 70km of strike in the prolific Houndé Belt (refer Figure 1).

The Sanutura Project is situated immediately adjacent to Endeavour Mining’s Bantou Project which hosts a 1.5Moz Au resource (Inferred)5 and the Karankasso JV Project, a joint venture between Sarama and Endeavour Mining which hosts a 0.7Moz Au resource (Inferred)4. The Bantou deposit is situated ~6 kilometres west of the Sanutura Project’s Tankoro Deposit which hosts approximately three quarters of the current Project resource.

Figure 1 –Sanutura Project Location Plan

Tankoro Deposit – Further Opportunity within 16km of Strike Length

The key contributor to the Sanutura Project’s large Mineral Resource is the Tankoro Deposit; extending for a semi- continuous, drill-defined strike length of 16km most of which has only been tested to 70m depth. Drilling of certain higher-grade zones, however, has shown the system extends 550m deep where it remains open, illustrating the size of the mineralised system and the potential for additions.

The Mineral Resource is principally contained in an extensive package of mineralised lenses, presenting as gold-quartz- sulphide veinlets and disseminated gold-pyrite within quartz-feldspar-porphyry dykes and bounding sedimentary rocks. The package is interpreted to sit in a trend that spans approximately 1.4km across the strike (refer Figure 2). The mineralized corridor, as presently defined by drilling, lies within a greater 30km-long, gold-in-soil geochemical anomaly that remains a focus for ongoing regional exploration.

Click here for the full ASX Release

This article includes content from Sarama Resources Ltd., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SWA:CA

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

18h

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

18h

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

03 February

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

03 February

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

02 February

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

02 February

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00