November 04, 2024

Cosmo Gold Shareholders Vote in Favour of Transaction

Sarama Resources Ltd. (“Sarama” or the “Company”) (ASX:SRR, TSX- V:SWA) is pleased to advise that the shareholders of Cosmo Gold Ltd (“Cosmo”) have voted in favour of Sarama’s acquisition of a majority interest(1) in the Cosmo Gold Project (the “Project”) in Western Australia. This shareholder approval was a key outstanding condition to be satisfied for the Transaction (defined below) to be completed.

The acquisition now has approval from the shareholders of both Sarama and Cosmo and Sarama has received requisite approval and conditional approval from securities exchanges in Australia and Canada respectively. It is anticipated the Transaction will be completed in mid-November 2024.

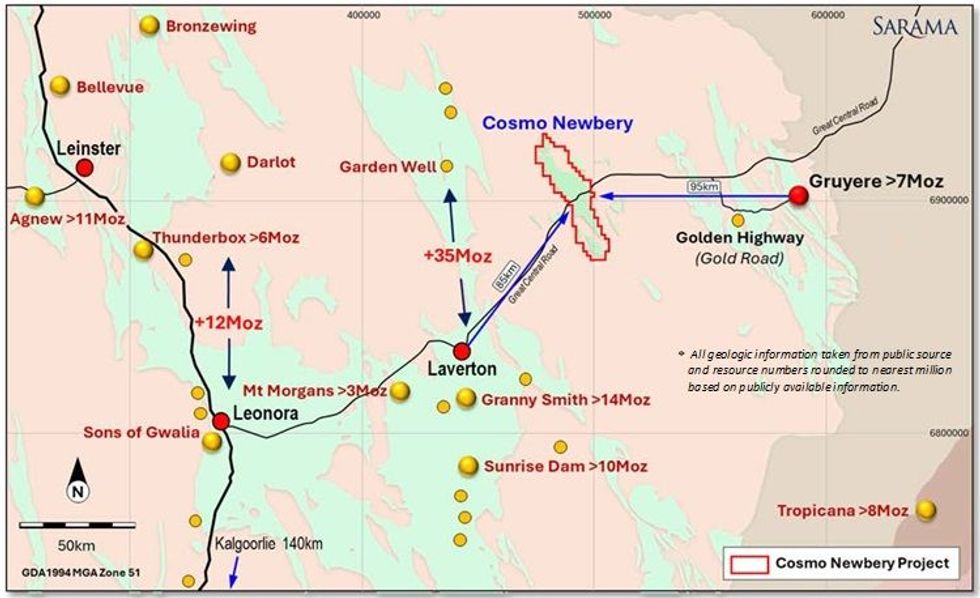

The 580km² Cosmo Gold Project(2) covers the entirety of the Cosmo-Newbery Greenstone Belt and is located approximately 85km north-east of Laverton in a region known for its prolific gold endowment (refer Figure 1). As one of the last effectively unexplored greenstone belts in Western Australia, the Project presents a unique and compelling opportunity for the Company.

Highlights

- Sarama acquiring a majority interest in, and control of, Cosmo Gold Project in Western Australia

- Sarama acquiring an initial 80% interest(1) with ability to increase to 100% in the majority of the Project(1)

- 580km² landholding capturing +50km strike length in highly prospective gold producing region; 95km from both the world-class Gruyere Mine and Laverton gold district

- Project captures one of the last effectively unexplored greenstone belts in Western Australia; virtually no effective exploration undertaken for several decades

- Project is very well located being only a 4 hour drive from Kalgoorlie on predominantly paved roads

- All shareholders approvals for the Transaction secured

- Key conditions precedent satisfied and completion of transaction anticipated in mid-November 2024

- Meetings with Traditional Owners confirm support for Sarama’s involvement and its planned endeavours

- Soil geochemistry program underway to generate regional targets in unexplored areas

Sarama’s Executive Chairman, Andrew Dinning commented:

“We are pleased to have passed this major milestone and look forward to finalizing the acquisition of a majority interest in the Cosmo Gold Project in the coming weeks. Together with Cosmo, we have commenced our first soil geochemistry program which will continue over the next 6-8 weeks and feed into larger targeting efforts and work up of drill targets for the 2025 exploration season.”

Cosmo Newbery Project

The Project is comprised of 7 contiguous exploration tenements covering approximately 580km² in the Eastern Goldfields of Western Australia, approximately 85km north-east of Laverton and 95km west of the world-class Gruyere Gold Mine. The Project is readily accessible via the Great Central Road which services the Cosmo Newbery Community.

The Project captures one of the last unexplored greenstone belts in Western Australia and with a strike length of +50km, the Cosmo Newbery Belt represents a large and prospective system with gold first being discovered in the area in the 1890’s. Multiple historical gold workings are documented within the Project area and work undertaken to date, has identified multiple exploration targets for follow up.

Despite this significant prospectivity, the Project has seen virtually no modern exploration or drilling of merit due to a lack of land access persisting over a significant period. As a result, the Project has not benefited from the evolution of geochemical and geophysical techniques which now facilitate effective exploration in deeply weathered and complex regolith settings which is particularly pertinent given approximately 75% of the Project area is under cover.

Following the relatively recent securing of land access, the Project is now available for systematic and modern-day exploration programs to be conducted on a broad-scale. It is anticipated that future exploration programs will initially follow-up preliminary targets generated from regional soil sampling and limited reconnaissance drilling programs, a majority of which extended to approximately 5m below surface with a small percentage extending up to 30m below surface.

Click here for the full ASX Release

This article includes content from Sarama Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

15h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00