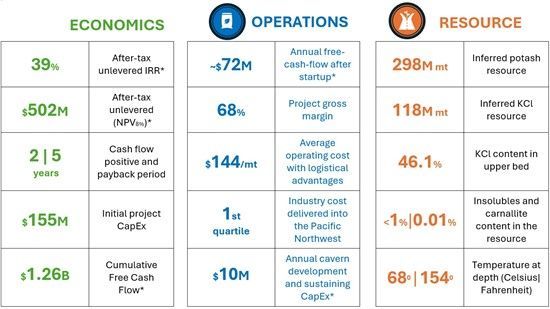

PEA Highlights

Compelling project economics with US$502 million* unlevered and after-tax Net Present Value (NPV8%) and 39%* Internal Rate of Return (IRR).

A premium potash deposit with an inferred resource of 298 million metric tonnes, with 42.1% KCl grade (26.6% K2O) and less than 1 percent insolubles and 0.01% carnallite.

A critical mineral potash project that supports domestic production with potential for scalable incremental capacity and resource expansion.

Cash flow positive in 2 years and rapid investment payback within 5 years attributable to advance status of permitting, engineering and short timeline to production.

Significant US (United States) in-market transportation cost advantages.

Industry low start-up project Capital Expenditures (CapEx) of $155 million including $26 million contingencies and $16 million construction indirect costs (combined 27% of total project).

Cautionary statement: Readers are cautioned that the PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. The Company has not defined any mineral reserves for the Project. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

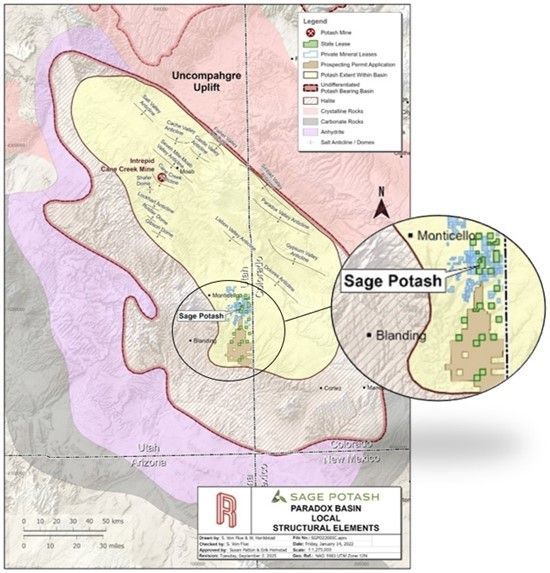

Vancouver, British Columbia--(Newsfile Corp. - September 22, 2025) - Sage Potash Corp. (TSXV: SAGE,OTC:SGPTF) (OTCQB: SGPTF) ("Sage Potash" or the "Company"), a Canadian company focused on advancing its Sage Plain Potash Project (the "Project") in the Paradox Basin, Utah, is pleased to announce the results of a positive Preliminary Economic Assessment ("PEA"). The PEA highlights the potential for robust project economics, a significant domestic resource base, and growth potential to establish a scalable and sustainable potash production hub in the United States.

CEO Commentary

Peter Hogendoorn, Chief Executive Officer of Sage Potash, stated:

"This PEA reinforces our conviction that our proposed approach of incremental potash production using solution mining is a cost effective and low risk strategy to bring in-market potash production on-line in the US. We expect this approach would allow us to scale up production with cash flow to eventually become the largest domestic potash supplier in the US market. Currently, the US market imports more than 95 percent of its potash requirements and Sage Potash's goal is to become a supplier of choice in the United States. The possibility of high margins and scalable expansion suggested by the PEA makes for a robust asset with stability through a wide range of market conditions."

President Commentary

Tim Mizuno, President and Chief Operating Officer of Sage Potash, added:

"The PEA suggests that we can support the critical agricultural and food security needs of the US market and deliver meaningful value to shareholders. This is an exceptionally accretive potash project with a high grade and expansive potash resource. Sage Plain is one of the best potash projects I have seen in the decades I've spent in the industry and foundational to me joining the Company earlier this year. As we advance toward production, we expect to further de-risk the Project and build strong partnerships with farmers and the broader agricultural industry."

PEA Overview

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11610/267506_sp%20table.jpg

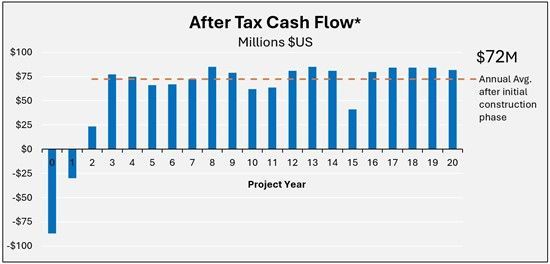

The PEA was completed by Sage Potash in partnership with RESPEC, a leading engineering firm specializing in integrated technology solutions for mining, energy, infrastructure, water and natural resources. The PEA includes design of an initial solution-based mining and production unit for an annual capacity of 300,000 metric tonnes (mt) per year delivering an average of approximately $72 million* per year in free cash flow once it is fully in production.

The Project is located in San Juan County, Utah, in close proximity to the agricultural areas in the Pacific Northwest region of the United States. The PEA estimates an inferred mineral resource of 298 million mt in-situ sylvinite equating to approximately 118 million mt KCl within a 2,400-meter radius of drilled wells. This radius represents approximately 4 percent of the approximately 26,000 acres of leased mineral rights. This resource can support multiple phases of production and does not include potential results from Bureau of Land Management prospecting permits accounting for another 58,780 acres.

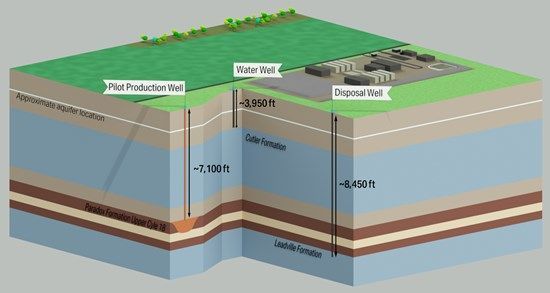

Utah Paradox Basin Deposit and Sage Potash

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11610/267506_sage%20potash%20fig%201.jpg

The PEA will be filed with Canadian securities regulatory authorities and available on SEDAR+ within 45 days of this announcement. When available, readers are encouraged to read the PEA in the Company's technical report ("Technical Report") prepared pursuant to National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("43-101") in its entirety, including all qualifications, assumptions and exclusions that relate to the PEA and mineral resource model. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

ECONOMIC Overview

The economic analysis in the PEA includes the proposed construction of a 300,000 mt per year potash plant with an initial development plan of 7 caverns and growing to 15 caverns over the first 5 years of production. Sage Potash plans to complete an already permitted exploration well designed to production specifications to confirm cavern porosity and flow rates, which will then be converted to the Company's first production well. Results from this well may result in lowering cavern requirements.

Potash would be produced through an initial 300,000 mt plant accessing the potash resource from the upper and lower potash horizons of Cycle 18. Processing for recovery of potassium chloride (KCl) uses triple-effect evaporators, crystallization and fluidized bed dryer for the removal of sodium chloride (NaCl) and recovery of KCl. This method requires minimal amounts of fresh water when compared to solar evaporation methods and allows the facility to operate year-round. This approach may be replicated and scaled in future Project considerations.

With the mine to be located in-market and close to domestic demand, the Project has an economic advantage relative to other sources of potash located outside of the United States. Additionally, construction and operation of the proposed mine is de-risked by advanced engineering, advanced permitting and the inclusion of potash as a critical mineral in the US.

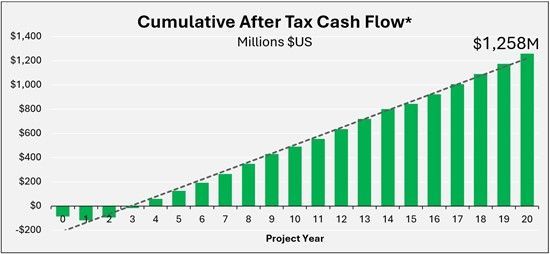

Initial project CapEx of $155 million includes $26 million in contingencies and $16 million in construction indirect costs (a combined 27% of total project). Over a 20-year Project life, the Project would generate an unlevered after-tax NPV of $502 million* and 39 percent* IRR. Sustaining CapEx and further cavern development average approximately $10 million per year equating to approximately $33/mt* over the life of the Project. Total Project cumulative free cash flow is estimated at $1.26 billion* including total CapEx over the life of the Project of $327 million*.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11610/267506_sage%20potash%20fig%202.jpg

Economic Model Assumptions

| NPV (After Tax Unlevered) | $502 million* |

| IRR (After Tax Unlevered) | 39%* |

| Total Cash flow | $1.26 billion |

| Payback period Cash flow positive | 5 years 2 years |

| Sales Price(1) | $450 ($/mt) |

| Discount rate | 8% |

| Start-up Capital Expenditures | |

| Solution Mining | $50M (33%) |

| Plant and Infrastructure | $63M (40%) |

| Construction Indirect Costs | $16M (10%) |

| Contingencies | $26M (17%) |

| Total | $155M (100%) |

(1) The sales price of $450 per tonne FOB mine site selected for the economic analysis is based on publicly available information through the US Department of Agriculture, US Geological Society, Intrepid Potash financial statements and Green Market regional quotes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11610/267506_51b450a714192872_011full.jpg

OPERATIONS Overview

The Project is strategically located in San Juan County, Utah, in the United States close to agricultural markets. Utah has been ranked a top US State in terms of business and trade opportunities and mine development - which has supported the Company's advancement of construction planning and permitting.

The United States is heavily reliant on potash imports, sourcing more than 95% of its annual demand from Canada, the former Soviet Union and the Middle East. By developing the Project, Sage Potash has the opportunity to become a reliable source of potash for American farmers backstopped by low-cost and high-quality potash production. Additionally, the Pacific Northwest of the United States has historically commanded a price premium for potash relative to other domestic potash markets.

Over the life of the Project, we expect to produce an annual average gross margin of 68%, generating an average of $72 million* of annual free cash flow to finance resource and production expansion and investor returns.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11610/267506_sage%20potash%20fig%203.jpg

Operational Model Assumptions

| Items | Units | Annual Steady State Production Years | All Years |

| Saleable Tonnes of Muriate of Potash (MOP) | mt | 300,000 | 5,630,000 |

| Sales Price(1) | $/mt | $450 | $450 |

| Operating Cost | $/mt | $144 | $144 |

| Gross Revenue | $Millions | $135 | $2,533 |

| Operating Cost | $Millions | $43 | $806 |

| EBITDA* | $Millions | $92 | $1,727 |

| Operating Cash Flow* | $Millions | $80 | $1,503 |

| Capital Items | $Millions | $10 | $327 |

| Free Cash Flow* | $Millions | $75 | $1,258 |

(1) The sales price of $450 per tonne FOB mine site selected for the economic analysis is based on publicly available information through the US Department of Agriculture, US Geological Society, Intrepid Potash financial statements and Green Market regional quotes.

RESOURCE Overview

The Project is underpinned by a significant potash resource located in the Paradox Basin, a geologically favorable region with a proven history of solution mining. Inferred Resources are derived from Cycle 18's upper and lower potash horizon, some of the highest quality potash resource globally.

The Technical Report authors have confidence in the classification of the resource as an "inferred resource" using recent and historical well results, because the Paradox Basin is very well explored with published maps of the high-grade potash beds, and the 2D seismic showed bedding continuity.

Inferred total potash resource: 298 million mt; a potash deposit that supports the potential for production and significant future incremental capacity expansion potential.

-

Inferred potash resource: 118 million mt KCl (42.1%) and 74.8 million mt K2O (26.6%)

Upper Potash Bed: 72 million mt KCl (46.1%) and 45.8 million mt K2O (29.1%)

Lower Potash Bed: 46 million mt KCl (35.8%) and 29.0 million mt K2O (22.6%)

Flat lying potash deposits with up to 7.3 meter potash seams with virtually no carnallite or insoluble content.

Potential Upper Bed Potash Quantities: 460-530 million mt (25-29% K₂O| 40-46% KCl) within 2,400-5,000 meters of Johnson 1 drilled well.

Next Steps

With the completion of the PEA, which includes favorable environmental and cultural study results, Sage Potash intends to accelerate efforts towards further delineating the resource by converting inferred resources to measured and indicated resources, and evaluating many of the Project optimization and upside opportunities. This includes:

Drilling an already permitted exploration well to confirm final cavern concentrations and flow rates to complete and submit a solution mine plan, upon which the well will be converted into an initial production well.

Advancing plant and solution mine engineering and plans to support the issuance of the Large Mine Operations permit.

Advancing commercial initiatives including potential off-take agreements and industry partnerships.

Progressing logistics and financing for moving the Company's secured plant and equipment into Utah.

About Sage Potash Corp.

Sage Potash Corp. (TSXV: SAGE,OTC:SGPTF) (OTCQB: SGPTF) is a Canadian company dedicated to the development of its flagship Sage Plain Potash Project, located in the Paradox Basin, Utah. With a large and high-grade resource base, the Company is advancing toward its goal of establishing a secure and sustainable domestic potash production platform in the United States. Sage Potash is committed to food security, environmental stewardship, and creating value for shareholders and stakeholders alike.

For more information, please visit: www.sagepotash.com.

On behalf of the Board of Directors

Peter Hogendoorn - Chief Executive Officer; (604) 764-2158

Tim Mizuno - President and Chief Operating Officer

For further information, please contact:

Marcus van der Made

E: IR@sagepotash.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Qualified Persons as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects. Qualified Persons are:

Erik Hemstad, Professional Engineer (PE),of RESPEC Company LLC

Dr. Susan B. Patton, RM-SME, of RESPEC Company LLC

Kathy Adams, PEng, PE, of Paterson & Cooke USA Ltd

Dr. R. Nick Gow, QP-MMSA, of Paterson & Cooke USA Ltd

Use of Non-GAAP Financial Measures

This news release contains certain financial measures and ratios that do not have a standardized meaning prescribed by International Financial Reporting Standards ("IFRS") and may not be comparable to similar measures presented by other issuers. These non-GAAP measures are provided as supplemental information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

Management uses these measures internally to evaluate operating performance, project economics, and liquidity, and believes they provide investors with additional insight into the Company's financial and operational results. However, investors are cautioned that non-GAAP measures do not have any standardized meaning under IFRS and may differ from similar measures used by other companies.

Cautionary Statement Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws relating to the potential development of the Sage Plain Potash Project, including statements regarding economic potential, future production, permitting, and other matters discussed in the PEA. Forward-looking information is based on assumptions and involves known and unknown risks and uncertainties that may cause actual results to differ materially. Sage Potash does not undertake to update forward-looking information except as required by law. Investors are cautioned that the PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. The Company has not defined any mineral reserves for the Project. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Note all amounts are denominated in US dollars and metric tonnes.

*Refer to "Use of Non-GAAP Financial Measures" section of this news release for more information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267506