- WORLD EDITIONAustraliaNorth AmericaWorld

July 17, 2024

Saga Metals Corp. (“Saga” or the “Company”), a North American exploration company focused on critical mineral discovery in Canada, is pleased to announce that it has filed and obtained a receipt for its final long form prospectus dated July 11, 2024 (the “Prospectus”) in respect of its initial public offering (the “Offering”) from the securities regulatory authorities in British Columbia, Alberta and Ontario.

“This milestone marks a significant step forward for SAGA as we continue to expand our presence in the critical minerals sector,” stated Mike Stier, CEO & Director of Saga Metals Corp. He continued, “The TSXV listing is expected to enhance the Company’s visibility and accessibility to a broader base of investors, providing increased liquidity and support for our growth initiatives.”

Key Highlights for Investors:

- Final Prospectus: Receipt of the final prospectus signifies that Saga has met the necessary regulatory requirements and is poised for public trading.

- Conditional Approval: The conditional approval from the TSXV is a crucial step toward the official listing of Saga’s shares on the exchange.

- Strategic Growth: Listing on the TSXV aligns with Saga’s strategy to expand its investor base and secure the capital needed to advance its exploration projects in North America.

SAGA Metals Corp. is committed to maintaining high standards of corporate governance and transparency as it transitions to becoming a publicly listed company. This development will support the company’s ongoing efforts to discover and develop critical mineral resources in North America.

Please refer to the Prospectus, and the Company’s press release of July 15, 2024 (each available under the Company’s profile at www.sedarplus.ca) for more information about the Offering.

SAGA Metals Investment Highlights:

Focused on North America's Critical Mineral Strategy – SAGA Metals is strategically concentrating on North America's “Critical Mineral Strategy” with operations in two highly favorable jurisdictions: Labrador and Quebec, Canada.

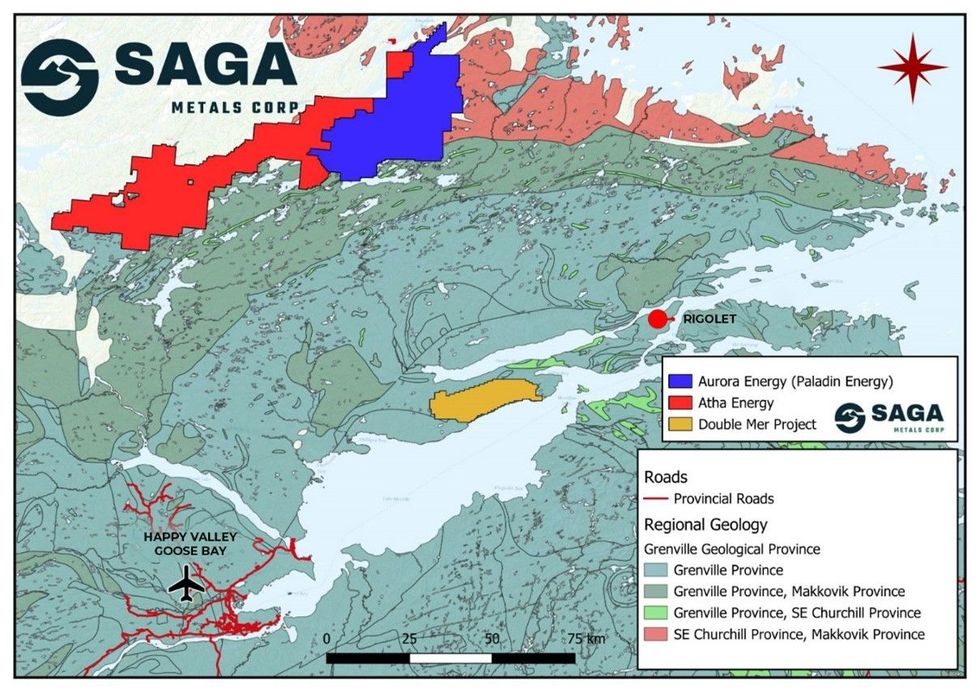

Map of SAGA Metals Projects

Diversified Critical Mineral Portfolio – SAGA’s portfolio spans five critical minerals across five projects of merit:

- Uranium: Double Mer Uranium Project, Labrador

- Lithium: Legacy Lithium Project and Amirault Lithium Project, James Bay, Quebec

- Titanium & Vanadium: Radar Titanium-Vanadium Project, Labrador

- Iron Ore: North Wind Iron Ore Project, Labrador

Key Project Highlights:

Double Mer Uranium Project

- Extensive exploration from 1970 to 2008 with considerable capital deployed in historical work on the property.

- Contains similarly linked geology to the Central Mineral Belt located just north of the property boundary and host to other notable Uranium projects including Atha Energy and Paladin Energy.

- 14 km strike of anomalous rock samples with results including 4,280ppm of Uranium and upwards of 21,000cps from the scintillometer.

- The Uranium radiometrics highlight an 18 km east-west linear trend averaging approximately 500 meters in width.

Regional map of the Double Mer Uranium Project in Labrador, Canada

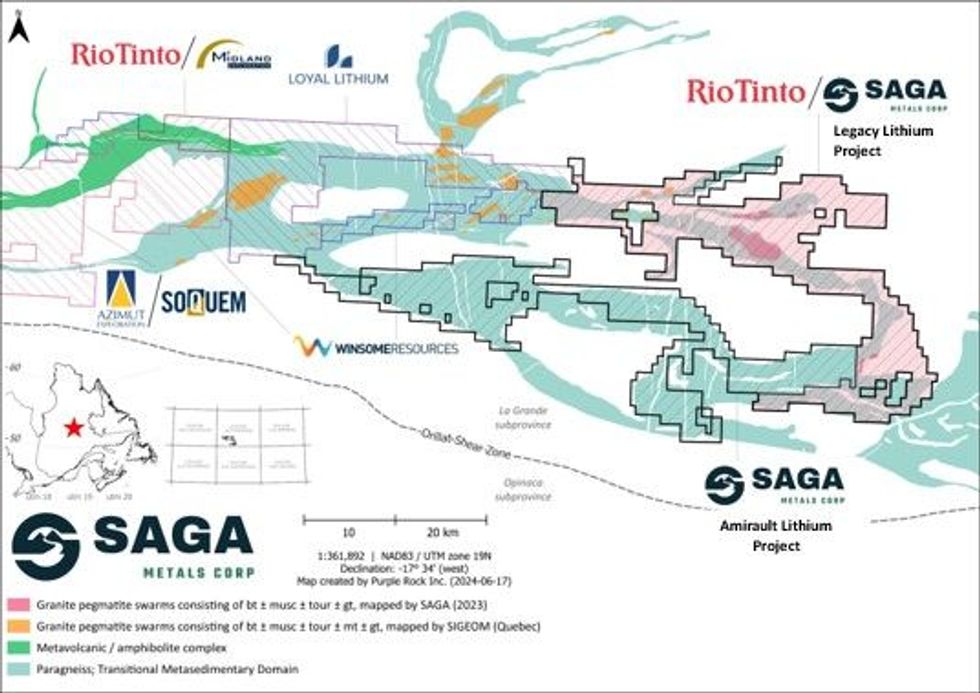

Legacy Lithium Project

- Partnership with Rio Tinto announced July 3, 2024: SAGA Metals Corp. Executes Option to Joint Venture with Rio Tinto Exploration Canada Inc. for Legacy Lithium Project

- The Legacy Lithium Project comprises 663 claims spanning 34,243 hectares, featuring 100 km of striking paragneiss and is located in Quebec’s Eeyou Istchee James Bay region.

- Key Terms of the Option Agreement with Rio Tinto:

- Under the Option Agreement, RTEC has the option to acquire an initial 51% interest (the “First Option”) in the Legacy Lithium Project over four years by meeting the following conditions:

- Cash Payments: Totaling C$410,190 on or before August 11, 2024.

- Exploration Expenditures: Totaling C$9,571,100, including a firm commitment of C$1,709,125 within the first 20 months.

- Additional Payments: C$273,460 to Saga (C$68,365 per year) and C$225,000 in aggregate to cover underlying claim acquisition amounts.

- After earning the initial 51% interest, RTEC has the option to increase its stake to 75% (the “Second Option”) over five years, following the four-year First Option term, by incurring an additional C$34,182,500 in exploration expenditures.

A map of the “Lithium Neighborhood” at the Legacy Lithium Project in Quebec

Amirault Lithium Project

- Acquisition positioned SAGA as the largest contiguous landowner in Eastern James Bay with 65,849 hectares

- Located adjacent to properties owned by Winsome Resources, Loyal Lithium, Azimut Exploration, and Rio Tinto

Radar Titanium & Vanadium Project

- Secondary project with a layered mafic intrusive body

- Numerous occurrences of massive magnetite showings

- Grades up to 6.63% titanium and 3,670 ppm vanadium

North Wind Iron Ore Project

- Secondary project with eight historic drill holes

- Part of New Millennium Iron’s 2013 resource estimate, grading over 20% iron oxide

Management and Future Prospects

SAGA boasts an experienced management team with expertise in capital markets and geology. The team focuses on maintaining a strong capital structure and acquiring quality projects based on robust geological assessments.

Upcoming Catalysts for Shareholders

Numerous catalysts are expected over the next 12 months as SAGA’s geological team has mobilized its summer exploration programs with news anticipated across all of SAGA’s projects in the coming weeks.

The Offering is being made on a best-efforts basis led by Research Capital Corporation, as sole agent and bookrunner (the “Agent”). Interested parties who wish to participate in the Offering should ask their investment advisor to contact the Agent for more information about the Offering and selling group participation at:

Jovan Stupar

email: jstupar@researchcapital.com; phone: 604-662-1808

Savio Chiu

email: schiu@researchcapital.com; phone: 778-373-4088

In connection with the Offering, SAGA has received conditional approval from the TSX Venture Exchange (the “TSXV”) for listing of the Company’s common shares subject, to the fulfillment of the TSXV’s final listing requirements. Once final approval is received, the Common Shares will commence trading under the symbol “SAGA”.

The Company anticipates closing of the Offering to occur on or about July 29, 2024, subject to satisfaction of certain closing conditions, including, but not limited to satisfaction of the approval conditions of the TSXV for the listing of the common shares, among other things.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The securities have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States, or to or for the account or benefit of any person in the United States, absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States, or in any other jurisdiction in which such offer, solicitation or sale would be unlawful.

To learn more about the Company’s projects visit the projects page here and corporate video here.

To access the company’s corporate presentation, select here.

A Media Snippet accompanying this announcement is available by clicking on this link.

About SAGA Metals Corp.

SAGA Metals Corp. is a North American mining company specializing in the exploration and discovery of critical minerals to advance the global green energy transition. The company's flagship asset is the Double Mer Uranium project, covering 25,600 hectares on the east coast of Labrador, Canada. Uranium radiometrics reveal an 18 km east-west linear trend averaging approximately 500 meters in width, with a confirmed 14 km section containing samples up to 4,281 ppm U3O8 and readings of 21,000 cps on a spectrometer.

SAGA Metals' primary additional asset is the Legacy Lithium Property located in Quebec's Eeyou Istchee James Bay region. This property is part of a partnership with Rio Tinto and includes the acquisition of the Amirault Lithium property. Together, these projects cover 65,849.20 hectares and share geological continuity with Rio Tinto, Winsome Resources, Azimut Exploration, and Loyal Lithium in the La Grande sub-province.

The company also holds two secondary assets focused on titanium, vanadium, and iron ore discovery in Newfoundland and Labrador, Canada.

For further information, please contact:

Saga Metals Corp.

Investor Relations

Tel: +1 (778) 930-1321

Email: info@sagametals.com

www.sagametals.com

Qualified Persons

Michael Cullen, P. Geo., and Rochelle Collins, P. Geo., of Mercator Geological Services Limited are each a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and have reviewed and approved the scientific and technical content of this news release regarding the Double Mer Uranium Property.

Kamil Khobzi, P. Eng., MBA, of Kamil Khobzi & Associates Inc. is a “qualified person” as defined under NI 43-101 and has reviewed and approved the scientific and technical content of this news release regarding the Legacy Lithium Property

The TSX Venture Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release. Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer Regarding Forward-Looking Statements

This news release contains forward-looking statements within the meaning of applicable securities laws that are not historical facts. Forward-looking statements are often identified by terms such as “will”, “may”, “should”, “anticipates”, “expects”, “believes”, and similar expressions or the negative of these words or other comparable terminology. All statements other than statements of historical fact, included in this release are forward-looking statements that involve risks and uncertainties. In particular, this news release contains forward-looking information pertaining to the proposed Offering, TSXV listing and the Company’s plans with respect to its mineral exploration properties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage, failure to satisfy closing conditions in respect of the Offering, risks and uncertainties involved in the mineral exploration and development industry, and the risks detailed in the Prospectus and available under the Company’s profile at www.sedarplus.ca, and in the continuous disclosure filings made by the Company with securities regulations from time to time. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by applicable law.

SAGA:CA

Sign up to get your FREE

Saga Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

03 September 2025

Saga Metals

Advancing a district-scale titanium-vanadium-iron discovery in Labrador with a diversified pipeline of uranium, lithium and iron assets

Advancing a district-scale titanium-vanadium-iron discovery in Labrador with a diversified pipeline of uranium, lithium and iron assets Keep Reading...

9h

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

16h

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Sign up to get your FREE

Saga Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00