RUA GOLD Corporation (CSE: RUA) (OTC: NZAUF) (WKN: A4010V) ("RUA GOLD" or the "Company") is pleased to provide an exploration update for the Reefton Project on the South Island of New Zealand .

- Preliminary results confirm the Pactolus system extends south for 550 meters along strike and is well mineralized on surface.

- The Company is analyzing the results to better understand the plunge and tenor of the ore shoots at this early stage of exploration.

- The Company has developed multiple new high-grade targets at past producing mines in the Murray Creek area for drill testing in Q2/2024.

Pactolus

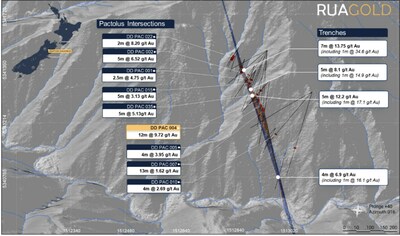

- Recall that Pactolus is a new, surface Greenfields discovery made by RUA GOLD in 2021. Pactolus has returned assays for three of six holes drilled on the system, highlighting:

- DD_PAC_035 intersecting 2 meters @ 5.13g/t Au

- DD_PAC_036 intersecting 2 meters @ 3.61g/t Au .

- These results compliment the surface trenching across outcropping mineralization:

- 5m @ 12.2 g/t Au (including 1m @ 17.1 g/t Au) and

- 4m @ 6.9 g/t Au (including 1m @ 16.1 g/t Au).

- Further work is needed to model the geometry of this zone to warrant additional drilling in this area. As a result, the company expects to refocus on the past-producing areas in Reefton in the near term.

RUA GOLD's forthcoming near-mine drilling program

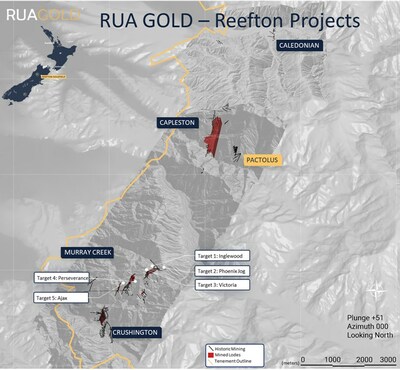

RUA GOLD plans to commence with 5 targets in the Murray Creek area as the first step in a comprehensive drilling campaign that will test targets in Murray Creek, Crushington, Capleston and Caledonian historic districts. These historic mines collectively produced ~700 koz at 25.2 g/t within a radius of ~20 kilometers. Three of the targets are highlighted:

Murray Creek Target 1: Down-dip extension of mine shoot:

Records show mining stopped by faulting, evidence of continuation at depth. Recent surface rock chips include 56.2, 48.0, 33.3, g/t Au , including some striking visible gold (Figure 3). Trenching of the lode on surface includes 3m @ 31.7 g/t Au incl. 2m @ 47.1 g/t Au .

Murray Creek Target 2: Near mine structural offset:

Targeting potential offset of Inglewood Mine group to the east, rock chips include 35.1, 34.5, and 27.8 g/t Au.

Murray Creek Target 3: Down-dip extension of mine shoot :

Records show mining ceased at 200 meters, yet this was the largest deposit in the Inglewood group.

Robert Eckford , CEO commented: "We are pleased to see consistent mineralization in the drilling from the Pactolus vein and see the potential for exciting new opportunities developing from the historic mine drill targets in the forthcoming near-mine program. Our team will continue drilling RUA GOLD's Reefton properties as our 2,500 meter drill program for 2024 rolls out. With the exceptional geology of the Reefton project and the highly experienced operating team on the ground, I am excited by the potential in this historic but under-explored high grade orogenic gold district".

More information can be found at the Company's website: www.ruagold.com .

Pactolus Summary

The recent 6-hole drill program (DD_PAC_035-040) has tested under the three trenches along the north-south trend of system. Trenching results over four outcrops at Pactolus illustrated in Figure 2 returned the following:

7m @ 13.75 g/t Au (including 1m @ 34.6 g/t Au, 1m @32 g/t Au) *

5m @ 8.1 g/t Au (including 1m @ 14.9 g/t Au)

5m @ 12.2 g/t Au (including 1m @ 17.1 g/t Au)

4m @ 6.9 g/t Au (including 1m @ 16.1 g/t Au)

*(Reported NI 43 101: Technical Report on the Reefton Project, New Zealand )

Four of the six drill holes intersected the targeted mineralized structure. Initial assay results for DD_PAC_35, 36, and 37 returned:

Table 1: Significant intercepts for 2024 drilling, calculated with a 1.5 ppm Au cut-off and up to 2-m internal dilution.

| Hole ID | From (m) | To (m) | Interval (m) | Au (ppm) | Including |

| DD_PAC_035 | 71 | 73 | 2 | 5.13 | 1m @ 8.44 g/t Au |

| DD_PAC_036 | 60 | 62 | 2 | 3.61 | 1m @ 4.92 g/t Au |

DD_PAC_037 returned no significant intercepts.

Preliminary results and observations confirm the Pactolus system extends south for 550m and is well mineralized on surface, but determining the plunge and tenor of the ore shoots is proving challenging. A further update is anticipated when results from the remaining drill holes are received in 4-6 weeks.

Table 2: Significant intercepts for Pactolus drilling, calculated with a 1.5 ppm Au cut-off and up to 2-m internal dilution.

| Hole ID | From (m) | To (m) | Interval (m) | Au (g/t) |

| DD_PAC_001 | 132.5 | 135 | 2.5 | 4.75* |

| DD_PAC_002 | 133 | 138 | 5 | 6.52* |

| DD_PAC_004 | 183 | 195 | 12 | 9.72* |

| DD_PAC_005 | 218 | 223 | 5 | 2.24* |

| DD_PAC_005 | 256 | 260 | 4 | 3.95* |

| DD_PAC_007 | 214 | 227 | 13 | 1.62* |

| DD_PAC_009 | 219 | 221 | 2 | 4.40* |

| DD_PAC_010 | 221 | 225 | 4 | 2.69* |

| DD_PAC_015 | 76 | 81 | 5 | 3.13* |

| DD_PAC_018 | 58 | 60 | 2 | 3.11* |

| DD_PAC_022 | 54 | 56 | 2 | 8.20* |

| DD_PAC_025 | 33 | 35 | 2 | 3.53* |

| DD_PAC_035 | 71 | 73 | 2 | 5.13 |

| DD_PAC_036 | 60 | 62 | 2 | 3.61 |

Overview of the Reefton Region

The Reefton Goldfields presents as a classic orogenic style gold deposit, with historic mining recovering high-grade gold in plunging gold bearing quartz reefs. RUA GOLD's systematic exploration has highlighted the potential for the rejuvenation of this district in renewed opportunities in the vicinity of historic high-grade gold deposits.

Historic Mine Evaluation, Proposed Drilling

RUA GOLD has completed a comprehensive evaluation of the historic mines on the Company's tenements in the Reefton Goldfield which produced ~700 koz at 25.2 g/t (see Appendix 2). 3D computer modelling of the geology, structure, and historical mine lodes, was completed as a precursor to drill testing of priority targets. Likely targets include testing down-dip and potential duplicate structures in the vicinity of the historic mines.

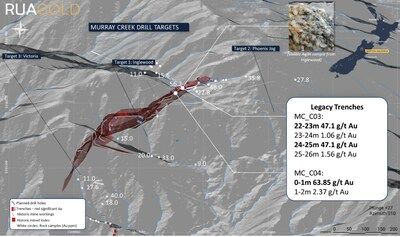

RUA GOLD plans to commence with 5 targets in the Murray Creek area as follows.

Murray Creek Target 1: Down-dip extension of mine shoot

Records show Inglewood mine stopped by faulting, evidence of continuation at depth. Recent surface rock chips include 56.2, 48.0, 33.3, 30.3, g/t Au, including some striking visible gold (see insert). Soil samples are up to 113 ppb Au. Trenching of the lode on surface includes:

MC_C03 3m @ 31.7 g/t Au (including 2m @ 47.1g/t Au )

MC_C04 12m @ 6.4 g/t Au (including 1m @ 63.9 g/t Au)

Murray Creek Target 2: Near mine structural offset

Targeting potential offset of Inglewood Mine group to the east, illustrated in ultra-detail magnetic data, coinciding with Au-As soil anomaly and mapped quartz veins. Rock chips along the jog include 35.1, 34.5, and 27.8 g/t Au from brecciated, highly sulfidic quartz samples. Soil geochemistry (max 172ppb gold) envelopes gold anomalism over the target area.

Trenching in the vicinity of the structural offset included:

MCCRAE05 3m @ 1.7 g/t Au

MC_C06 2m @ 2.9 g/t Au

Murray Creek Target 3: Down-dip extension of mine shoot

Records show mining ceased at 200m yet this was the largest lode in the Inglewood group. Historical records describe the ore directly associated with a dolerite dyke. Accurate mapping of the dyke (UAV magnetics) and 3D structural mapping show significant potential for continuation at depth.

Murray Creek Target 4: 250m north extensions of historic workings

RUA GOLD's mapping has delineated quartz and pug faulting along a syncline hinge that coincides with the north striking Perseverance historical workings. Rock samples returned 11-16.4 g/t Au, soil geochemical samples up to 195ppb Au envelope a north trending zone paralleling the Ajax-Golden Fleece historical mines.

Ajax Target 1: Potential jog/structural complexity

A jog in the magnetic and strong structural complexity show there may be an offset between the Golden Fleece mine group and Venus, very prominent soil gold geochemistry highlights surface expression of this target.

Grant of Deferred Share Units

The Company also announces that it has granted an aggregate of 875,476 deferred share units (" DSUs ") to the directors of the Company at a deemed price of $0.175 per DSU. The DSUs were granted in consideration for services provided by the directors for February 28 to March 31 , 2024. The DSUs were granted under the Company's Deferred Share Unit Plan adopted on April 17 , 2024. Each DSU entitles the holder to receive one share of the Company at the time the holder ceases to be a director of the Company.

About RUA GOLD

RUA GOLD (RUA.CSE) is a new entrant to the mining industry, specializing in gold exploration and discovery in New Zealand . With permits that have a rich history dating back to the gold rush in the late 1800's, RUA GOLD combines traditional prospecting practices with modern technologies to uncover and capitalize on valuable gold deposits.

The Company is committed to responsible and sustainable exploration, which is evident in its professional planning and execution. The Company aims to minimize its environmental impact and to execute on its projects with key stakeholders in mind. RUA GOLD has a highly skilled team of New Zealand professionals who possess extensive knowledge and experience in geology, geochemistry, and geophysical exploration technology.

For further information, please refer to the Company's disclosure record on SEDAR+ at www.sedarplus.ca .

Technical Information

Simon Henderson CP, AUSIMM, a qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the technical disclosure contained herein. Mr. Henderson has verified the data disclosed, including sampling, analytical, and test data underlying the information in the technical disclosure herein.

QAQC Soil Samples

A bulk sample of ~0.5–1 kg was collected in the field and taken back to RGL's office for preparation. Samples were dried in a customized incubator, set at 38°C, for a minimum of two days. Once the samples were fully dried, they were sieved to

A 50–100-g fine-sieved ( Brisbane for Au-TL43 analysis. The analysis consisted of 25-g sample digestion by aqua regia, followed by trace Au analysis by ICP-MS. The detection limit for Au by this method is 1 ppb. Approximately 5% of the samples were analyzed for a full multi-element suite using a 4-acid digest and ICP-MS finish.

ALS Brisbane is independent to RUA GOLD .

QAQC Drilling

The majority of drillholes were sampled in full, typically following 1-m sample intervals unless geological contacts (i.e. dolerite intrusions) dictated otherwise. NQ core was analyzed as whole core; therefore, only requiring cutting along sample intervals. PQ and HQ core were sampled as half core.

Drill core samples were sent to SGS Westport for sample preparation. Core was crushed to 75% passing 2 mm, and 1-kg split of material was pulverized (to 85% passing 75 µm). No split duplicates were collected during the crushing steps. Two scoops were taken from the pulverize bowl: one for laboratory analysis (~150 g) and the other for pXRF analysis (~100 g). The pulp reject is stored in Reefton.

Pulverized drill core samples were analyzed by 50-g fire assay with AAS finish at SGS Waihi (SGS Code FAA505). The detection limit for Au by this method is 0.01 ppm. As part of SGS' internal quality control, SGS conducted repeat analyses, also at a rate of ~5%.

Thirteen 3-g samples were also analyzed by screen fire assay (FAS30K) at SGS Waihi to establish the presence of nuggetty Au. Samples were screened to 75 µm.

Website: www.RUAGOLD.com

Cautionary Note Regarding Forward Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur and specifically include statements regarding: the Company's strategies, expectations, planned operations or future actions, including but not limited to exploration programs at its Reefton and Glamorgan projects; and the Company's expected receipt of permits or other regulatory approvals. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: general business, economic, competitive, political and social uncertainties; risks related to the effects of the Russia - Ukraine war; risks related to climate change; operational risks in exploration, delays or changes in plans with respect to exploration projects or capital expenditures; the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; changes in labour costs and other costs and expenses or equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, flooding or unfavourable operating conditions and losses, insurrection or war, delays in obtaining governmental approvals or financing, and commodity prices. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's CSE Form 2A – Listing Statement filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors.

Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Appendix 1: Full list of significant intercepts from the Pactolus drilling program.

Table 3: Significant intercepts for Pactolus program, calculated with a 1.5 ppm Au cut-off and up to 2-m internal dilution.

| Hole ID | From | To | Interval | Au (ppm) |

| DD_PAC_001 | 132.5 | 135 | 2.5 | 4.75 |

| DD_PAC_002 | 133 | 138 | 5 | 6.52 |

| DD_PAC_004 | 183 | 195 | 12 | 9.72 |

| DD_PAC_005 | 218 | 223 | 5 | 2.24 |

| DD_PAC_005 | 256 | 260 | 4 | 3.95 |

| DD_PAC_007 | 214 | 227 | 13 | 1.62 |

| DD_PAC_007 | 244 | 246 | 2 | 1.71 |

| DD_PAC_009 | 219 | 221 | 2 | 4.40 |

| DD_PAC_010 | 221 | 225 | 4 | 2.69 |

| DD_PAC_015 | 76 | 81 | 5 | 3.13 |

| DD_PAC_016 | 41 | 43 | 2 | 2.77 |

| DD_PAC_018 | 43 | 46 | 3 | 2.75 |

| DD_PAC_018 | 58 | 60 | 2 | 3.11 |

| DD_PAC_022 | 54 | 56 | 2 | 8.20 |

| DD_PAC_025 | 33 | 35 | 2 | 3.53 |

| DD_PAC_035 | 71 | 73 | 2 | 5.13 |

| DD_PAC_036 | 60 | 62 | 2 | 3.61 |

(Up to DD_PAC_025 reported in NI 43 101: Technical Report on the Reefton Project, New Zealand )

Appendix 2: Historic production from mining in the Reefton Goldfields.

| Shear Group | Mine Lode | Total Production (Au oz) | Recovered Grade (g/t) |

| Italian Gully | Golden Arch-Italian Gully-Tripoli | 1,093.1 | 31.8 |

| Capleston | Welcome-Hopeful | 88,620.3 | 61.4 |

| Fiery Cross | 27,955.1 | 34.8 | |

| Just in Time | 17,171.7 | 38.8 | |

| Reform-Imperial-South Hopeful | 1,070.6 | 19.6 | |

| Lone Star | 1,09.3 | 13.9 | |

| Murray Creek | Inglewood-North Star, Phoenix, Victoria | 33,877.2 | 19.9 |

| Golden Treasure-Comstock | 5,697.1 | 18.5 | |

| Band of Hope | 25.7 | 2.0 | |

| Perseverance | 19.3 | 10.4 | |

| Westland | 61.1 | 23.4 | |

| Ajax | Golden Fleece - Ajax Royal | 89,629.9 | 20.4 |

| Venus | 7,041.0 | 19.8 | |

| Crushington | Dauntless, Energetic-Wealth of Nations-Eclipse-Independent-Vulcan | 208,970.2 | 14.2 |

| Heather Bell | 9.6 | 4.9 | |

| Golden Ledge | 1,138.1 | 9.2 | |

| Keep-it-Dark | 182,597.0 | 17.0 | |

| Hercules-Nil Desperandum | 6,809.5 | 16.5 | |

| No. 2 South Keep it Dark - Pandora | 6,687.4 | 21.5 | |

| Specimen Hill | Specimen Hill | 1,205.7 | 16.3 |

| Pactolus | 498.3 | 141.3 | |

| Lady of the Lake | 3.2 | 9.8 | |

| Argus | 90.0 | 33.6 | |

| Larry Creek | Caledonian | 1,160.6 | 25.3 |

| Larry's No. 1 | | | |

| No. 2 South Larry's | 4,128.2 | 16.8 | |

| Kirwans Hill | Newhaven, Earl Brassey, Mark Twain, Lord Brassey | 11,011.6

| 15.2 |

Source: Barry, J.M., 1993. The History and Mineral Resources of the Reefton Goldfield.

Appendix 3: Locations and information on drill holes and trenches at Pactolus.

Table 5: Drill hole locations and hole details. Coordinates in NZTM2000; DD: Diamond drill hole, TR: Trench.

| Hole ID | Easting | Northing | Depth | Azimuth | Dip |

| DD_PAC_001 | 1512924 | 5341019 | 224 | 257 | -50 |

| DD_PAC_002 | 1512924 | 5341019 | 204.4 | 280 | -45 |

| DD_PAC_003 | 1512924 | 5341019 | 305.4 | 279 | -71 |

| DD_PAC_004 | 1512924 | 5341019 | 225 | 213 | -52 |

| DD_PAC_005 | 1512925 | 5341019 | 305.6 | 213 | -70 |

| DD_PAC_006 | 1512924 | 5341020 | 189.7 | 304 | -42 |

| DD_PAC_007 | 1512924 | 5341020 | 299 | 201 | -43 |

| DD_PAC_007A | 1512924 | 5341020 | 37.5 | 202 | -42 |

| DD_PAC_008 | 1513028 | 5340787 | 312.3 | 297 | -42 |

| DD_PAC_009 | 1513028 | 5340787 | 284.6 | 268 | -50 |

| DD_PAC_010 | 1513028 | 5340787 | 330.2 | 230 | -60 |

| DD_PAC_011 | 1512924 | 5341019 | 178.95 | 224 | -41 |

| DD_PAC_014 | 1512867 | 5340988 | 44.95 | 250 | -60 |

| DD_PAC_015 | 1512867 | 5340988 | 89 | 250 | -70 |

| DD_PAC_016 | 1512867 | 5340988 | 63.7 | 250 | -45 |

| DD_PAC_017 | 1512863 | 5340958 | 75.6 | 250 | -45 |

| DD_PAC_018 | 1512863 | 5340958 | 81.9 | 250 | -60 |

| DD_PAC_019 | 1512863 | 5340958 | 92.3 | 250 | -70 |

| DD_PAC_020 | 1512878 | 5340924 | 96.7 | 250 | -55 |

| DD_PAC_021 | 1512878 | 5340924 | 100 | 250 | -70 |

| DD_PAC_022 | 1512833 | 5341082 | 87.3 | 250 | -55 |

| DD_PAC_023 | 1512833 | 5341082 | 107.7 | 250 | -70 |

| DD_PAC_024 | 1512833 | 5341082 | 85.9 | 250 | -45 |

| DD_PAC_025 | 1512843 | 5341036 | 91.2 | 250 | -55 |

| DD_PAC_026 | 1512843 | 5341036 | 106.3 | 250 | -70 |

| TR_PAC_001 | 1512827 | 5340994 | 7 | 358 | 0 |

| TR_PAC_004 | 1512826 | 5340896 | 4 | 5 | 0 |

| TR_PAC_005 | 1512827 | 5340896 | 5 | 5 | 0 |

| TR_PAC_006 | 1512820 | 5340859 | 5 | 5 | 0 |

| TR_PAC_008 | 1512831 | 5340552 | 5 | 5 | 0 |

| DD_PAC_035 | 1512893 | 5340880 | 118.5 | 264 | -47 |

| DD_PAC_036 | 1512893 | 5340880 | 191.8 | 292 | -57 |

| DD_PAC_037 | 1512893 | 5340880 | 254.1 | 219 | -65 |

| DD_PAC_038 | 1512871 | 5340729 | 115 | 265 | -65 |

| DD_PAC_039 | 1512871 | 5340729 | 138.1 | 338.9 | -57.5 |

| DD_PAC_040 | 1512887 | 5340639 | 154.1 | 225 | -55 |

SOURCE Rua Gold Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2024/19/c2677.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2024/19/c2677.html