May 10, 2024

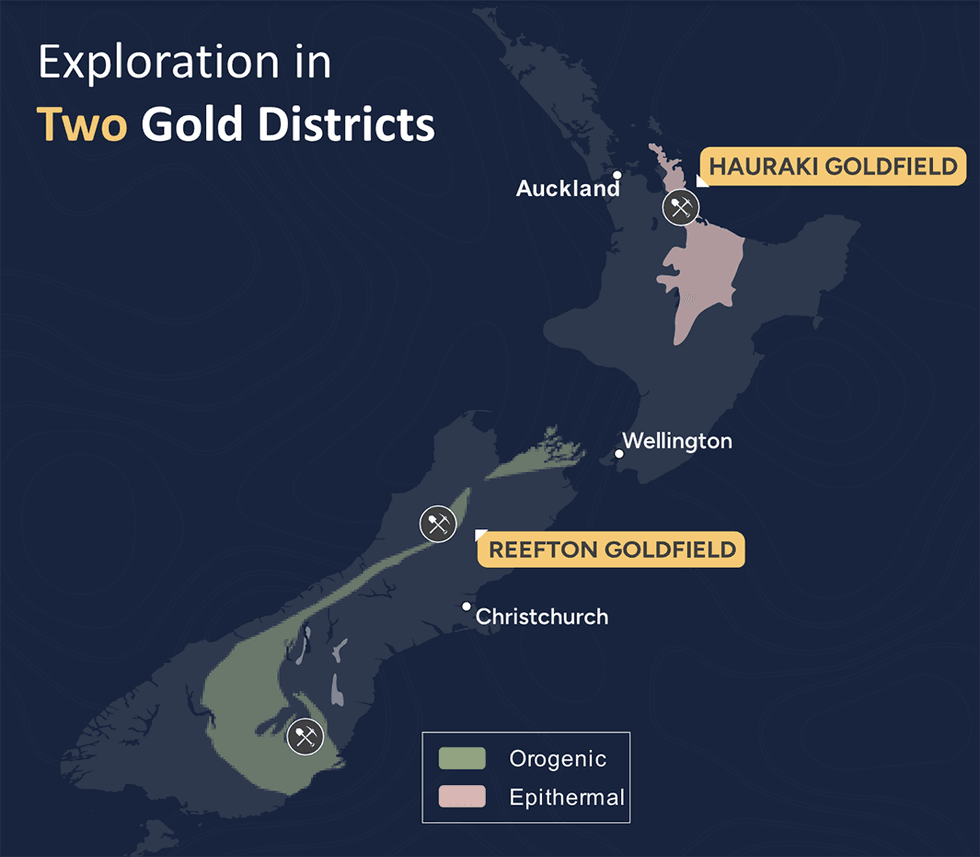

Rua Gold (CSE:RUA,OTC:NZAUF,WKN:A4010V) focuses on the Hauraki Goldfield and Reefton Goldfield - two prolific, historic gold-producing regions in New Zealand boasting previous high-grade gold production. New Zealand is a tier 1 mining jurisdiction with highly prospective geology, and a skilled workforce. The new government of New Zealand has committed to promoting economic growth through mining- and business-friendly policies, such as the Fast Track Approval Bill, which proposes quicker approval timelines for a range of projects, including mining.

New Zealand has a rich history of gold production from orogenic deposits (+9 Moz), epithermal sources (+15 Moz), and alluvial deposits (+22 Moz). The country has low sovereign risk with no corruption, making it an attractive destination for mining investment.

Rua Gold has launched a fully funded exploration program at its properties which includes a 2,500-meter diamond drill program focused on the Pactolus prospect at Reefton Goldfield. Pactolus has returned assays for three of six holes drilled on the system, with hole DD_PAC_035 intersecting 2 meters @ 5.13 grams per ton (g/t) gold. Additional work is required to accurately model this zone's geometry before proceeding with further drilling at this prospect. Consequently, the company anticipates redirecting its focus towards the previously productive areas in Reefton in the near future, which includes the Murray Creek, Crushington, Capleston and Caledonian historic districts. These historic mines collectively produced ~700 koz at 25.2 g/t within a radius of ~20 kms.

Company Highlights

- Rua Gold is a gold exploration company with two highly prospective land packages in New Zealand’s historic gold districts – Hauraki Goldfield and Reefton Goldfield.

- New Zealand is a tier 1 mining jurisdiction boasting highly promising geological formations and a significant history of gold production, with orogenic deposits (+9 Moz), epithermal sources (+15 Moz), and alluvial deposits (+22 Moz).

- The company’s two key assets include the Reefton Goldfield on New Zealand’s South Island and Glamorgan on New Zealand’s North Island.

- The new government is focused on stimulating economic growth, as evidenced by the recent Fast Track Approval Bill, which proposes fast-track approvals for a range of projects, including mining.

- Rua Gold has high-quality orogenic and epithermal gold prospects, boasting historical production grades ranging from 16 to 50 g/t gold.

- Rua Gold is fully permitted and fully financed with significant near-term catalysts. The company has launched an exploration program at its two properties. Drilling is already ongoing at the company’s properties in the Reefton district.

- A seasoned board and management team is at the helm of Rua Gold, with extensive regional knowledge and a proven track record of successful discoveries. With full financing and permits in place, the company is well-positioned to capitalize on growth prospects.

This Rua Gold profile is part of a paid investor education campaign.*

Click here to connect with Rua Gold (CSE:RUA) to receive an Investor Presentation

RUA:CNX

The Conversation (0)

13h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

13h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

14h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

14h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00