June 15, 2025

FMR Resources Limited (ASX:FMR) (FMR or Company) is pleased to announce it has entered into a conditional Binding Term Sheet giving it the right to earn up to a 60% interest in a highly prospective copper-gold-molybdenite project in central Chile (Transaction). The Company will joint venture (JV) into selected tenements (the JV Tenements or Concessions) within the Llahuin Project (Llahuin or the Project) held by Southern Hemisphere Mining Ltd (SUH) which overlie the Southern Porphyry Target.

Highlights

- Large Cu-Au-Mo porphyry target untested at depth

- Coincidental datasets suggest substantial copper porphyry system

- Shallow historic drilling confirms porphyry mineralisation above target

- Drilling of targets to commence early Q4 2025

- Oliver Kiddie joins FMR as Managing Director

- Firm commitments received for $2.2m capital raising at $0.16 through a placement to existing and new sophisticated investors

- Mark Creasy to join the FMR register as major shareholder

The Southern Porphyry JV gives FMR exposure to a potential Company-making discovery. Coincidental datasets captured across the Southern Porphyry target area suggest a large, untested copper porphyry system below historic exploration. With proven fertility along a ~6km corridor at Llahuin, including historic shallow copper porphyry mineralisation directly above the Southern Porphyry target, this JV delivers FMR drill-ready targets for Q4 2025. The Company looks forward to updating shareholders as we progress towards maiden drilling of these exciting targets.

In conjunction, FMR is pleased to announce the appointment of Oliver Kiddie as Managing Director. Mr Kiddie is a geologist with over 20 years’ experience across exploration, resource definition, project development, and production throughout Australia and internationally. He has extensive experience in base metal and gold exploration through senior management, executive, and directorship positions, including Dominion Mining, European Goldfields, the Creasy Group, and Legend Mining.

Oliver Kiddie said: “I am very excited to be joining the FMR team as the Company expands its exploration portfolio with the Llahuin Project in Chile. I look forward to leading the Company through the next stage of growth and working with the experienced SUH team as the compelling Southern Porphyry drill targets are tested in Q4 this year, with the clear aim of a Company-making discovery.”

Project Description

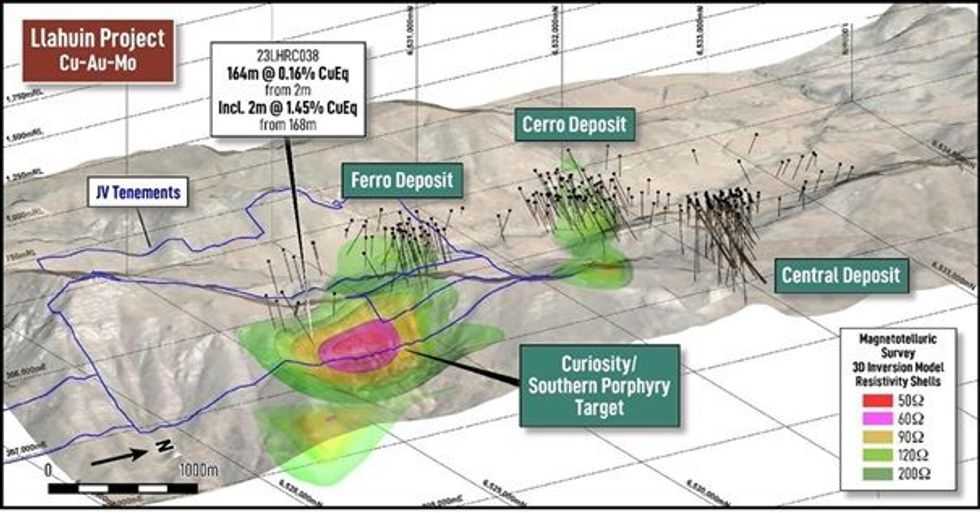

Porphyry-style Cu-Au-Mo mineralisation identified to date at the Llahuin Project is largely hosted in three main mineralised zones - the Central Porphyry Zone, Cerro do Oro and Ferrocarril, which occur along a +2.5 km N-S strike (open north and south, with a total strike length of up 6 km). These zones are coincident with a north-south trending valley, potentially reflecting weathering of more regressive units or a structure.

Llahuin was initially acquired in July 2011 by SUH through an intermediary from Antofagasta plc. Drilling completed across the project to date comprises 296 holes for 64,503m with a total of 62 holes for 11,927m completed on the JV Tenements, of which 9,156m reports to the Ferrocarril zone and are therefore not relevant to the Southern Porphyry Target. Drilling has resulted in the delineation of Mineral Resources which do not form part of the JV and do not form part of the transaction (see Figures 1 and 7).

In addition to drilling SUH has completed extensive geochemical and geophysical surveys at Llahuin, including detailed magnetics (MAG), induced polarisation (IP), and magnetotellurics (MT). These datasets have indicated a “blind” porphyry-style target at the southern end of the Llahuin Project named the Southern Porphyry Target. This target is defined by a coincident magnetic anomaly, IP resistivity anomaly, and MT resistivity anomaly. The target is modelled as a circular feature 1.5km – 2km in diameter and centred approximately 1,000m below surface (see Figures 1, 2, 3, 4, and 5).

Click here for the full ASX Release

This article includes content from FMR Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

9h

Is Now a Good Time to Invest in Copper? Experts Tout Bullish Fundamentals

Copper prices surged to an all-time high in January after a tumultuous 2025. Although there was some panic buying in the sector at a couple of points last year, prices began to trade on market fundamentals in the third and fourth quarters, driven by significant supply disruptions.At this year's... Keep Reading...

10 February

Nine Mile Metals Intersects 44 Meters of Copper Mineralization and Provides Drill Program Update

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to provide the details of drill hole WD-25-05 in addition to a summary of the 2025 drill program completed in December at the Wedge Project.Drillhole WD-25-05:DDH WD-25-05 collared... Keep Reading...

09 February

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00