- WORLD EDITIONAustraliaNorth AmericaWorld

August 20, 2023

Up to 87% Li Recoveries and 3.60% Li2O Con Grades on Ore-Sort Material (Updated to include JORC Table 1, no other changes)

Battery and critical metals explorer and developer Pan Asia Metals Limited (ASX: PAM) (‘PAM’ or ‘the Company’) is pleased to report very successful metallurgicaltest-work results for flotation of lithium mica concentrates from ‘ore-sort’ product derived from the RK lithium prospect.

HIGHLIGHTS

- Flotation test-work on ‘ore-sort’ products materially improves Li recoveries

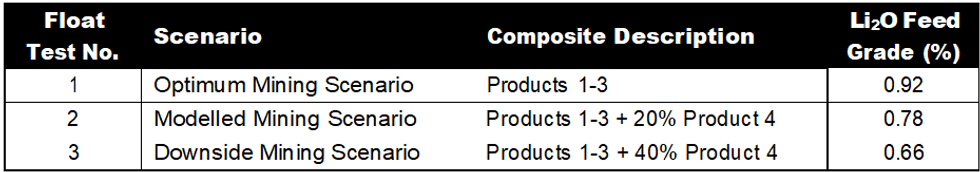

- Ore-sort feed grade of 0.92% Li2O shows recoveries of 77% - 87% producing Li2O concentrates of 2.80% - 3.60% in PAM’s ‘Optimum Mining Scenario’

- Feed grades remain above 0.78% Li2O for PAM’s ‘Modelled Mining Scenario’ which incorporates 20% waste material as dilution

- Modelled Mining Scenario produces a 3.0% Li2O concentrate with 78% Li recoveries

- Test-work confirms that the RK Lithium Project has the potential to achieve high Li recoveries and high Li2O concentrate grades

- With the high Li2O feed grades and Li recoveries achieved, PAM has the potential to be as competitive as the best lepidolite based LCE processors in China

Pan Asia Metals Managing Director, Paul Lock, said: “This is an incredibly pleasing result, our previously reported ore sorting results in November, 2022, demonstrated an increase in the modelled ore feed grade from 0.50% Li2O to 0.92% Li2O – positioning PAM with one of the highest grade lepidolite feed grades in the global peer group. The modelled volume of concentrate feed is reduced by over 60%, with the reject material below the current Mineral Resource cut-off grade of 0.25% Li2O. This means PAM will be processing a materially higher grade ore than that reflected in the RK Mineral Resource, which equates to a considerable reduction in capital and operating costs on a per tonne LCE basis. This means PAM will require less beneficiation capacity (lower capex) and PAM will be processing less product (lower opex). The result being reported today further improves PAM’s position, with the Optimum Mining Scenario producing a 3.0% Li2O con with 87% Li recoveries or a 3.6% Li2O con with 77% Li recoveries, which should be achievable in certain fresh ore mining situations. PAM’s Modelled Mining Scenario introduces 20% dilution and still achieves a 3.0% Li2O con with 78% Li recoveries, which is a great outcome. As PAM is operating in a very low cost environment PAM expects to be as competitive as the best lepidolite based LCE processors in China, aka, those situated at the bottom of the Wood Mackenzie sourced cost curve in PAM’s presentation.”

Project Overview

The RK Lithium Project (RKLP) is one of PAM’s key assets. RKLP is a hard rock lithium project with lithium hosted in lepidolite/mica rich pegmatites chiefly composed of quartz, albite, lepidolite and muscovite, with minor cassiterite and tantalite as well as other accessory minerals.

Previous open pit mining extracting tin from the weathered pegmatites was conducted into the early 1970’s.

PAM’s objective has been to continue drilling with the aim of increasing and upgrading the existing Mineral Resource, which will then be used as part of a Pre-Feasibility Study that will consider various options to determine the technical and economic viability of the project including the LCE production profile as well as associated by-products.

Peer group studies indicate that lithium carbonate and lithium hydroxide projects using lepidolite as their plant feedstock have the potential to be placed near the bottom of the cost curve. Lepidolite has also been demonstrated to have a lower carbon emission intensity than other lithium sources.

Metallurgical Test-work Details

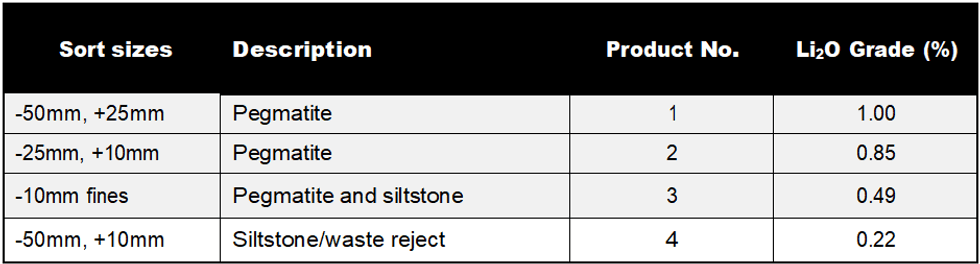

The test-work was conducted by Nagrom on three separate composite samples comprised of fresh mineralisation derived from ore sorting testwork conducted on HQ core (63mm diameter) from drillhole RKDD006 (see Table 1). This testwork was reported in PAM’s ASX announcement “Exceptional Ore Sorting Results Confirmed” dated November 22, 2022.

Technical Discussion

Three composite samples for the flotation testwork were formulated from the sorted products as shown in Table 2. Each composite sample weighed 16.1kg.

The beneficiation-flotation process undertaken on the composite samples consists of milling to a particle size of 80% passing 0.15mm followed by desliming using a hydrocyclone to remove -0.020mm material. The flotation process on the + 0.02mm feed sample consists of one rougher, one scavenging and three cleaning flotation steps. Reagent dosages were identical for all three tests and consisted of Na2CO3 @ 400g/t, Calgon @ 120g/t and YM 7-1 @ 510g/t.

Click here for the full ASX Release

This article includes content from Pan Asia Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00