August 07, 2024

Asian Battery Metals PLC (ABM or the Company, ASX: AZ9) is pleased to announce interim results and modifications of its ongoing 2024 regional reconnaissance and exploration program. The program is designed to systematically evaluate the project’s potential for Cu-Ni mineralisation in an area outside the original and main Oval Prospect through the application of a suite of exploration techniques as well as an initial investigation of the newly discovered Copper Ridge mineralisation.

HIGHLIGHTS

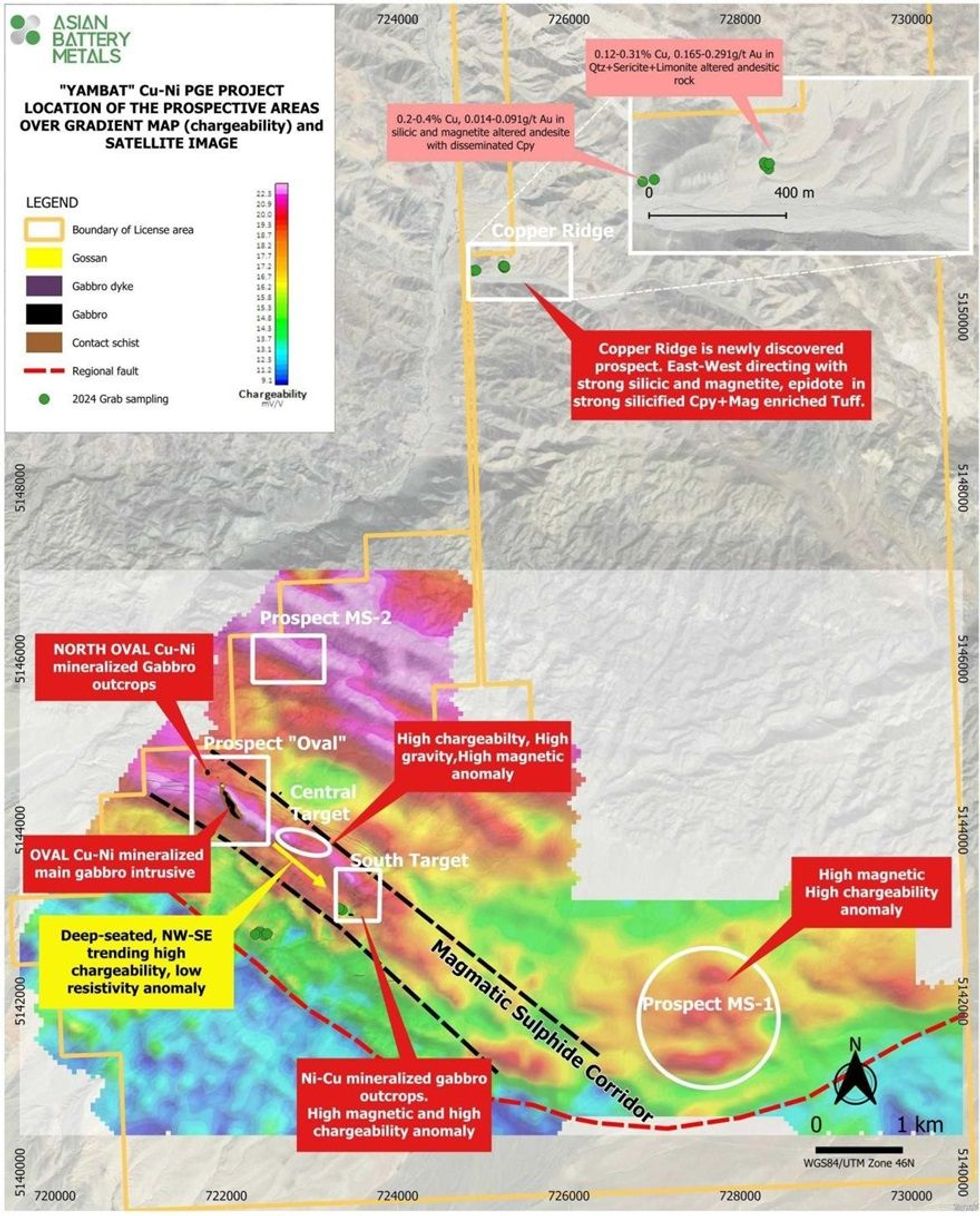

While the Oval Cu-Ni Prospect exploration program continues, the Company has recently received results from geophysical exploration programs, ground mapping and sampling. The exploration has identified four additional exploration targets in the Yambat (Oval Cu-Ni) Project.

The Oval Prospect drilling program totals 2,500m with approximately 1,320m of this program now completed. Results for this programme will be announced when assays come to hand.

The Geophysical Studies and subsequent groundproofing have confirmed:

Indication of a broader magmatic copper-nickel system beyond the Oval Cu-Ni Prospect with:

- A new outcrop of mineralised gabbro containing sulphide blebs being identified at the South Zone, 1.7km Southeast of Oval mineralised gabbro.

- An expansion of the previously reported Ni-Cu mineralised gabbro outcrop at the North Oval area. This expansion indicates a significant NW extension of the main Oval Ni-Cu mineralisation.

A discovery of copper-gold mineralisation in the northern part of the tenement following detailed mapping of an area 7km to the north of the Oval Prospect. The newly named Copper Ridge is a different style of mineralisation characterised by:

- A 30m wide by 400m long zone of silicified, magnetite- altered andesite with significant disseminated chalcopyrite mineralisation has been delineated before dipping under alluvial cover to the east. Assay results from rock chip sampling yielded maximum values of 0.29 ppm Au, 0.4% Cu, and greater than 15% Fe.

Detailed geophysical studies and scout drilling are now planned for these new regional targets in this field season.

Gan-Ochir Zunduisuren, Managing Director, commented: “The 2024 regional reconnaissance program has resulted in a major advancement of the geological knowledge in what we consider to be one of the emerging copper and nickel exploration districts in Mongolia. The program is comprised of mapping, surface geophysical study, and soil and rock sampling programs across our tenement. Interim results indicate a larger exploration area fertile for magmatic copper and nickel sulphide system beyond the Oval prospect. In addition, the ABM team has made a new exciting discovery at the Copper Ridge target during the early phase of the program. Currently, the company is continuing its regional exploration program and a scout drilling program in parallel with the Oval Prospect drilling program.”

The 2024 reconnaissance and exploration program has the following key components:

- Outcrop mapping: A detailed geological mapping program will be undertaken to delineate exposed rock formations, identify associated structural controls and mineralisation indicators, and possibly extend the known mineralised zone/gabbro/ at the surface level.

- Completion of the geophysical survey program: employing Pole-Dipole Induced Polarization (PDIP), Controlled Source Audio Frequency Magnetotelluric (CSAMT), and Audio-Frequency Magnetotelluric methods at the Oval and MS1 prospects within the Yambat project.

- Field Reconnaisence: Verify geophysical anomalies on site and collect geochemical samples from areas exhibiting interesting alteration or mineralisation.

Detailed Geological Outcrop Mapping

Detailed outcrop mapping was conducted across a 5.77km2 area within the western sector of the 106.06km2 project area at a scale of 1:2000. The Project is located in the Yesonbulag soum, Gobi-Altai province, Mongolia. The mapping concentrated on delineating Ni-Cu bearing mafic units, establishing lithological contacts, characterising alteration mineralogy, and identifying structural trends to guide subsequent exploration of mineralised zones.

The primary mineralisation is associated with the “Oval” gabbro intrusive body, with subordinate later-stage hydrothermal vein-type mineralisation observed within gabbroic dykes in the mapping area. In the initial discovery area, the Oval gabbro is entirely overlain by overburden, although strongly mineralised gabbro is exposed in the North Oval region and to the southeast at the South Target area.

Click here for the full ASX Release

This article includes content from Asian Battery Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00