LCA was Conducted in Accordance with ISO Standards and Critically Reviewed by Independent Experts

American Manganese Inc (TSXV:AMY)(OTCQB:AMYZF)(FSE:2AM) ("Company"), doing business as RecycLiCo Battery Materials, is pleased to announce the results of a life cycle assessment (LCA) completed by Minviro Ltd. ("Minviro"), a UK-based and globally recognized sustainability and life cycle assessment consultancy, on the Company's lithium-ion battery recycling-upcycling process

An LCA is a standardized, scientific method for quantifying the direct and embodied environmental impacts associated with a particular product or process. By considering all material and energy inputs such as scope 1, 2 and 3 CO2 emissions. The LCA was conducted in accordance with ISO-14040:2006 and ISO-14044:2006 standards and a critical review was conducted on the LCA by independent experts. The LCA was carried out with a combination of data provided by RecycLiCo and public databases.

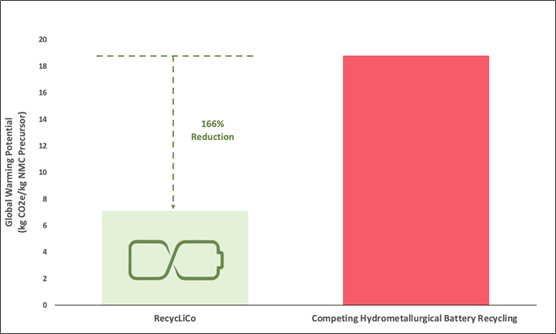

The report assesses the Company's process against competing hydrometallurgical recycling methods, on the basis of producing one kilogram of NMC precursor material, as follows:

| RecycLiCoTM Process (A) | Other Hydrometallurgical Methods (B) | Percentage Variation (B-A)/A | Unit | |

| Global Warming Potential | 7.1 | 18.8 | 166% | kg CO2 eq. |

| Acidification Potential | 0.03 | 0.6 | 2117% | Mol H+ eq. |

| Minerals + Metal Depletion | 6.3E-05 | 7.30E-04 | 1058% | kg Sb eq. |

| Fossil Fuel Depletion | 102 | 18.2 | -82% | MJ |

"Global Warming Potential" refers to the potential CO2 equivalent emissions made by a particular recycling method, in producing one kilogram of NMC precursor material. As shown in the table, competing hydrometallurgical recycling methods will likely produce 166% more CO2 equivalent emissions when compared to the RecycLiCo process. To put this into context, such a variance is about the same as 17,000 tons of CO2 per GWh of NMC battery material recycled, which is roughly equivalent to the amount of emissions made by 3,700 vehicles in a year on average.1

Minviro also found that the RecycLiCo process, when compared against the industry average for primary extraction methods (i.e. mining), results in a 35% reduction in CO2 equivalent emissions for NMC precursor production and a 74% reduction for lithium hydroxide production.

"I am pleased to report that the LCA results confirm RecycLiCo's lower environmental impact to produce NMC precursor and lithium hydroxide, when compared to primary raw material extraction methods or competing hydrometallurgical recycling," said Larry Reaugh, the Company's President and CEO. "To collectively achieve true decarbonization as an industry, we must not cut corners at any stage of the lithium-ion battery supply chain and should instead recognize the most efficient and environmentally friendly technologies as an industry benchmark."

Minviro is a London-based and globally recognized consultancy and technology company specializing in carrying out life cycle assessments in the technology metal space. The company provides quantitative environmental and climate impact data for mineral resource projects, battery manufacturers and OEMs to make environmentally informed decisions (www.minviro.com).

American Manganese Inc, doing business as RecycLiCo Battery Materials, is a battery materials company focused on recycling and upcycling lithium-ion battery waste. With minimal processing steps and over 99% extraction of lithium, cobalt, nickel, and manganese, the patented, closed-loop hydrometallurgical process creates valuable lithium-ion battery materials for direct integration into the re-manufacturing of new lithium-ion batteries.

On behalf of Management

American Manganese Inc.

Larry W. Reaugh

President and Chief Executive Officer

Telephone: 778 574 4444

Email: lreaugh@amymn.com

www.americanmanganeseinc.com

www.recyclico.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain "forward-looking statements", which are statements about the future based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements by their nature involve risks and uncertainties, and there can be no assurance that such statements will prove to be accurate or true. Investors should not place undue reliance on forward-looking statements. The Company does not undertake any obligation to update forward-looking statements except as required by law.

1 Calculations are made by the Company and based on statistics found at https://www.epa.gov/greenvehicles/greenhouse-gas-emissions-typical-passenger-vehicle

SOURCE: American Manganese Inc.

View source version on accesswire.com:

https://www.accesswire.com/708496/RecycLiCo-Battery-Materials-Announces-Life-Cycle-Assessment-Results-for-Lithium-ion-Battery-Recycling-Upcycling-Process