March 19, 2023

Ramelius Resources Limited (ASX:RMS) (Ramelius) and Breaker Resources NL (ASX:BRB) (Breaker) are pleased to announce that they have entered into a Bid Implementation Agreement (BIA), pursuant to which Ramelius will offer to acquire all the issued ordinary shares of Breaker by way of an all-scrip off-market takeover offer (the Offer).

Highlights

- Ramelius to acquire Breaker Resources NL (Breaker), 100% owner of the Lake Roe Gold Project (Lake Roe) in Western Australia, via a recommended all-scrip off-market takeover offer (Offer)

- Located in Australia’s premier gold province and with a current total Mineral Resource estimate of 32 Mt @ 1.6 g/t for 1.7 million ounces1, Lake Roe provides additional scale through regional consolidation with Ramelius’ Rebecca Project2, boasting almost 3 million ounces in combined Mineral Resources, to support a potential new production centre

- Ramelius, a top 10 Australian gold producer, has the financial capacity, operational experience and exploration expertise to continue expanding the existing Mineral Resource and to develop Lake Roe, in order to maximise the value of the asset for both sets of shareholders

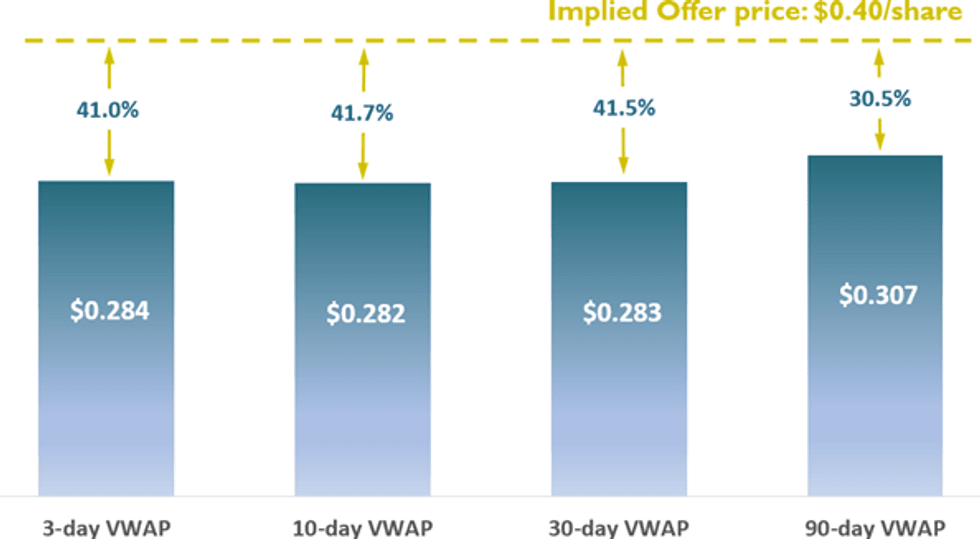

- Breaker shareholders to receive an implied Offer price of $0.403 per share (Offer Price), equating to 1 Ramelius share for every 2.82 Breaker shares held. This Offer Price represents premiums of:

- 41.0% to Breaker’s 3-day VWAP of $0.284 per share;

- 41.7% to Breaker’s 10-day VWAP of $0.282 per share;

- 41.5% to Breaker’s 30-day VWAP of $0.283 per share; and

- 30.5% to Breaker’s 90-day VWAP of $0.307 per share.

- The Offer Price implies a total undiluted equity value for Breaker of $130.7 million4

- Breaker’s Directors unanimously recommend Breaker shareholders accept the Offer, in the absence of a superior offer. Furthermore, all Breaker Directors have made (and consented to its inclusion herein) Statements of Intent to accept the Offer for all the shares they own or control (representing ~4% of Breaker’s issued shares5), in the absence of a superior offer

- Breaker major shareholders, Electrum and Paulson, each representing 9.95% of Breaker shares therefore accounting for 19.92% of Breaker, have signed pre-bid acceptance agreements to accept within 5 days of the Offer opening, subject to a superior offer

- The Offer is conditional upon achieving more than 50.1% acceptanceRamelius will host a conference call at 8:00am AWST / 10:00am AEST/ 11:00am AEDT on Monday 20th March 2023. To listen in live, please click on the link below and register your details: https://s1.c-conf.com/diamondpass/10029687-b1k7i0.html

Under the terms of the Offer, Breaker Shareholders will receive 1 Ramelius share for every 2.82 Breaker shares held (Offer Consideration). The Offer Consideration values each Breaker share at $0.40 (Offer Price), based on the 3-day volume weighted average price (VWAP) of Ramelius shares up to and including 17 March 2023 of $1.127, and implies a total undiluted equity value for Breaker of approximately $130.7 million.

The options held by the Breaker Option holders will, if not exercised into ordinary shares before the Offer closes, will be acquired via a Private Treaty with Ramelius where such options will be valued using traditional option valuation methodologies.

The premiums represented by the Offer Price against Breaker’s 3 day and other historical VWAPs are shown in Figure 1 below.

Support from Breaker Board and Major Shareholders

Breaker’s Directors have unanimously recommended that Breaker shareholders accept the Offer, in the absence of a superior offer. Furthermore, Breaker Directors have consented to Statements of Intent to accept the Offer for all the shares they own or control (representing ~4% of Breaker’s issued shares6), in the absence of a superior offer.

Breaker’s two largest shareholders, Electrum Strategic Opportunities Fund and Paulson & Co, with a combined shareholding of approximately 19.92% have both supported the offer by signing pre-bid agreements to accept within 5 business days of the Offer opening, in the absence of a superior offer.

Click here for the full ASX Release

This article includes content from Breaker Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BRB:AU

The Conversation (0)

29 June 2022

Breaker Resources

Transitioning From Explorer to Developer in Western Australia

Transitioning From Explorer to Developer in Western Australia Keep Reading...

6h

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

7h

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

9h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

03 February

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

03 February

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

03 February

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00