The 4,000m drilling campaign aims to unlock district-scale potential by testing a possible extension of Aris' producing vein system in Colombia's premier high-grade gold corridor

Quimbaya Gold Inc. (CSE: QIM,OTC:QIMGF) (OTCQB: QIMGF) (FSE: K05) ("Quimbaya" or the "Company") is pleased to announce the commencement of its inaugural diamond drill campaign at the 100%-owned Tahami South Project in Antioquia, Colombia. The fully permitted 4,000-meter program marks Quimbaya's transition from surface exploration to drill-testing in one of the country's most prolific gold-producing districts.

Highlights

Tahami South is located adjacent to Aris Mining's Segovia Mine, one of Colombia's highest-grade and most productive gold operations.

The project covers a series of mapped epithermal gold-silver veins that trend through both the Segovia Mine and onto Quimbaya's ground.

Despite extensive artisanal activity and positive surface sampling, the property has never seen diamond drilling.

Quimbaya's 2025 fieldwork outlined multiple drill-ready targets with strong geochemistry, hydrothermal alteration, and structural control.

Drilling began in early August 2025, with initial results anticipated in Q4.

A Strategic First Drill Test in Colombia's Premier Gold District

Tahami South lies within the Colombia's premier high-grade corridor, a region known for high-grade quartz epithermal gold systems. Recent work by Quimbaya has confirmed widespread alteration, stockwork veins, and placer-style artisanal mining, all indicators of a potentially fertile gold system.

"The old adage in exploration holds true: the best place to find a mine is next to a mine," said Alexandre P. Boivin, CEO of Quimbaya Gold. "We're the first company to deploy modern exploration on this part of the Segovia trend. Our systematic work, including soil geochemistry, channel and rock sampling, stream sediments sampling and structural modelling, has built a robust case for drill testing. We're now turning that data into action."

Drill Targets and Geological Context

The initial program will test multiple zones across a structural corridor interpreted to be a continuation of the Segovia vein system. Planned holes will target:

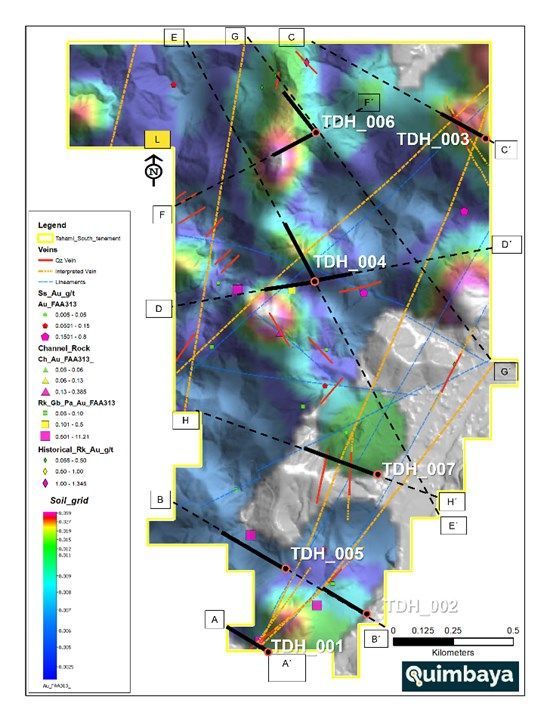

Structural intersections mapped across sections A-A', B-B', C-C', E-E' and H-H'

Zones with strong sericitic alteration, quartz veins, hydrothermal breccias, and gold-bearing stockworks

Areas proximal to active artisanal workings, suggesting near-surface mineralisation

Surface sampling has returned:

Rock chip assays up to 11.21 g/t Au

Panel rock assays up to 23.3 g/t Ag

Auger soils up to 59 ppb Au and MMI soils up to 37.1 ppb Au

Multi-element pathfinder anomalies (As, Cu, Pb, Zn) coincident with structural targets

"This program is the culmination of months of disciplined geoscience," said Ricardo Sierra, VP Exploration. "We've mapped out structural trends, alteration zones, and artisanal footprints that all suggest a large-scale epithermal system. Now, we're finally testing it below surface."

Figure 1. Planned drill platforms (TDH -001 to TDH-007) overlaid on gold-in-auger soil anomalies (Au g/t) and rock sample assay values (Au g/t) at the Tahami South Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11347/261779_f9d44764a4c268ae_001full.jpg

Next Steps:

Drilling will continue through Q3 2025 with initial assay results expected in Q4. Follow-up drilling is being planned in parallel to expand on any intercepts and test new targets defined through ongoing mapping and geological exploration.

Qualified Person

The technical information in this news release has been reviewed and approved by Ricardo Sierra, a Qualified Person as defined by National Instrument 43-101.

About Quimbaya

Quimbaya aims to discover gold resources through exploration and acquisition of mining properties in the prolific gold mining districts of Colombia. Managed by an experienced team in the mining sector, Quimbaya is focused on three projects in the regions of Segovia (Tahami Project), Puerto Berrio (Berrio Project), and Abejorral (Maitamac Project), all located in Antioquia Province, Colombia.

Contact Information

Alexandre P. Boivin, President and CEO apboivin@quimbayagold.com

Sebastian Wahl, VP Corporate Development swahl@quimbayagold.com

Quimbaya Gold Inc.

Follow on X @quimbayagoldinc

Follow on LinkedIn @quimbayagold

Follow on YouTube @quimbayagoldinc

Follow on Instagram @quimbayagoldinc

Follow on Facebook @quimbayagoldinc

Cautionary Statements

Certain statements contained in this press release constitute "forward-looking information" as that term is defined in applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, but not always, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends", "expects" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". Forward-looking statements herein include statements and information regarding the Offering's intended use of proceeds, any exercise of Warrants, the future plans for the Company, including any expectations of growth or market momentum, future expectations for the gold sector generally, the Colombian gold sector more particularly, or how global or local market trends may affect the Company, intended exploration on any of the Company's properties and any results thereof, the strength of the Company's mineral property portfolio, the potential discovery and potential size of the discovery of minerals on any property of the Company's, including Tahami South, the aims and goals of the Company, and other forward-looking information. Forward-looking information by its nature is based on assumptions and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Quimbaya to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These assumptions include, but are not limited to, that the Company's exploration and other activities will proceed as expected. The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: future planned development and other activities on the Company's mineral properties; an inability to finance the Company; obtaining required permitting on the Company's mineral properties in a timely manner; any adverse changes to the planned operations of the Company's mineral properties; failure by the Company for any reason to undertake expected exploration programs; achieving and maintaining favourable relationships with local communities; mineral exploration results that are poorer or better than expected; prices for gold remaining as expected; currency exchange rates remaining as expected; availability of funds for the Company's projects; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; the Offering proceeds being received as anticipated; all requisite regulatory and stock exchange approvals for the Offering are obtained in a timely fashion; investor participation in the Offering; and the Company's ability to comply with environmental, health and safety laws. Although Quimbaya's management believes that the assumptions made and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. Readers are cautioned not to place undue reliance on forward-looking information as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Forward-looking information contained in this news release is expressly qualified by this cautionary statement. The forward-looking information contained in this news release represents the expectations of Quimbaya as of the date of this news release and, accordingly, is subject to change after such date. Except as required by law, Quimbaya does not expect to update forward-looking statements and information continually as conditions change.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/261779