Partnership with Leading Colombian Mining Group to Formalize Artisanal Mining Production and Accelerate Exploration

Quimbaya Gold Inc. (CSE: QIM) (OTCQB: QIMGF) (FSE: K05) ("Quimbaya Gold" or the "Company") is pleased to announce the signing of a binding Letter of Intent with Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF), establishing a 50:50 joint venture aimed at formalizing existing small-scale mining operations located within the Company's Tahami Project, located in the Segovia Gold District of Antioquia, Colombia.

This collaboration seeks to integrate artisanal mining operations into a formalized structure to create mutually beneficial partnerships while supporting and empowering the host communities. Importantly, this initiative complements Quimbaya's ongoing exploration efforts, including its planned 4,000-meter drilling campaign at Tahami South, by fostering stronger community relations and facilitating access to key areas. Both parties are working diligently to finalize a definitive agreement as soon as possible, subject to customary regulatory and corporate approvals.

Joint Venture Highlights

50:50 Production Partnership: Equal profit sharing between Quimbaya and Denarius (via Zancudo Metals Corp.). Denarius will provide technical and financial support so that the artisanal miners can legalize their production within the mining legalization program.

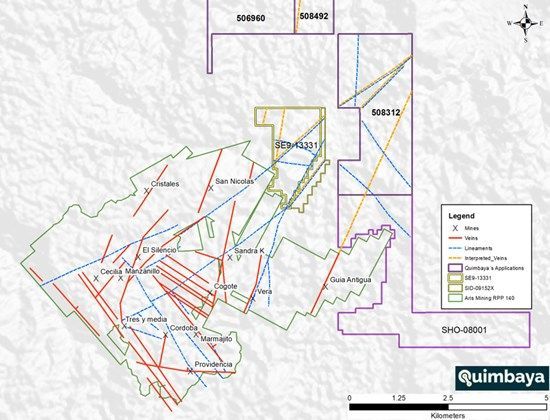

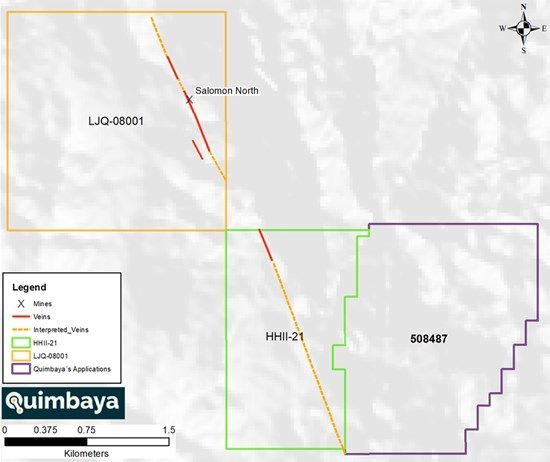

Joint development targeted on the Tahami South and Tahami North areas within the Tahami Project. Exploitation will focus on concessions SHO-08001, SE9-13331, LJQ-08001 and HHII-21 owned by Quimbaya.

Formalization of Existing Activities: The partnership aims to formalize current artisanal mining operations, aligning with successful models in the region.

Support for Exploration: By formalizing artisanal mining activities, the joint venture enhances community engagement, supporting Quimbaya's ongoing drilling and exploration initiatives.

Upcoming Cash Flow Opportunity: Upon finalizing the definitive agreement, efforts will commence to generate cash flow from the existing small-scale mining operations.

Complementary Strategy: This joint venture complements Quimbaya's exploration objectives, ensuring continued focus on making a high-grade discovery at Tahami.

Figure 1. Location map of the Tahami South Project, adjacent to Aris Gold's Segovia mine.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11347/251048_6abcb253d488a8a7_001full.jpg

Strategic Importance

This agreement allows Quimbaya to tap into a proven model of success already active in the Segovia-Remedios Mining District ("DMSR" by its initials in Spanish), where formalized artisanal mining contributes to Aris Mining's neighboring gold production. By partnering with Denarius - led by Serafino Iacono, a key figure behind the rise of Gran Colombia Gold (now Aris Mining), which was the largest underground gold and silver producer in Colombia for many decades and with current gold production of over 200,000 ounces per year from three main mines in the high-grade DMSR - Quimbaya gains access to a team with deep experience in turning artisanal mining into structured, profitable operations that benefit both communities and shareholders.

Figure 2. Location Map of the Tahami North Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11347/251048_6abcb253d488a8a7_002full.jpg

"This is a pivotal step for Quimbaya," said Alexandre P. Boivin, President and CEO of Quimbaya Gold, " as partnering with one of the most experienced exploration and mining teams in Colombia will not only allow Quimbaya to quickly leverage this existing opportunity, but also to deliver on our community objective of helping formalize artisanal miners, while we continue advancing our broader exploration and drilling plans to make a high-grade gold discovery on the Tahami South property."

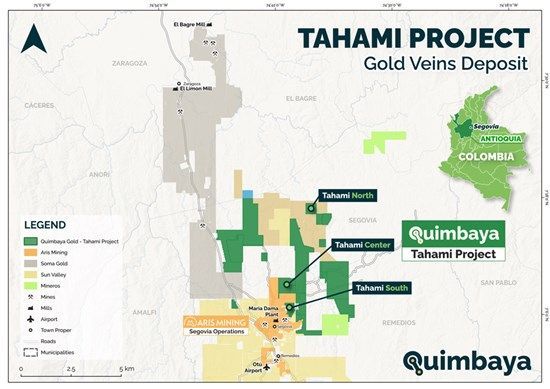

About the Tahami Project

Located adjacent to Aris Mining's flagship Segovia Operations-one of the highest-grade underground gold producers globally-the Tahami Project spans over 17,000 hectares across a district-scale vein system that shows analogies with the DMSR, with historic artisanal activity and substantial exploration upside. The area is supported by existing infrastructure, a favorable mining jurisdiction, and a strong tradition of gold production.

Figure 3. General map of the Tahami Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11347/251048_6abcb253d488a8a7_003full.jpg

Qualified Person statement - Ricardo Sierra BSc. Geology, MAusIMM (3078246)

Quimbaya's disclosure of technical and scientific information in this press release has been reviewed and approved by Ricardo Sierra (AusIMM), the Vice President Exploration for the Company, who is a Qualified Person as defined in National Instrument 43-101.

Completion of Corporate Continuance to British Columbia

The Continuance was approved by the shareholders of the Company at the annual general and special meeting of shareholders held on March 28, 2025 (the "Meeting"). The principal effects of the Continuance are set out in the management information circular for the Meeting dated February 14, 2025 (the "Circular"). Copies of the Circular and charter documents for the Continuance are available on SEDAR+ under the Company's profile at www.sedarplus.ca.

About Quimbaya Gold Inc.

Quimbaya Gold Inc. is a Canadian junior exploration company focused on discovering gold resources through the exploration and acquisition of mining properties in Colombia's prolific mining districts. The Company is actively advancing three projects in the Antioquia Province: the Tahami Project in Segovia, the Berrio Project in Puerto Berrio, and the Maitamac Project in Abejorral. Managed by an experienced team with deep local knowledge, Quimbaya is committed to creating value for its shareholders through strategic exploration and development initiatives.

Contact Information

Alexandre P. Boivin, President and CEO

apboivin@quimbayagold.com

+1-647-576-7135

Jason Frame, Manager of Communications

jason.frame@quimbayagold.com

Quimbaya Gold Inc.

Follow on X @quimbayagoldinc

Follow on LinkedIn @quimbayagold

Follow on Instagram @quimbayagoldinc

Follow on Facebook @quimbayagoldinc

Cautionary Statements

Certain statements contained in this press release constitute "forward-looking information" as that term is defined in applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends", "expects" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". Forward-looking information by its nature is based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Quimbaya to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These assumptions include, but are not limited to: the joint venture will be completed on the terms set forth in the letter of intent, the parties will perform their obligations under the joint venture and the results of the joint venture will be as expected. Although Quimbaya's management believes that the assumptions made and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. Readers are cautioned not to place undue reliance on forward-looking information as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Forward-looking information contained in this news release is expressly qualified by this cautionary statement. The forward-looking information contained in this news release represents the expectations of Quimbaya as of the date of this news release and, accordingly, is subject to change after such date. Except as required by law, Quimbaya does not expect to update forward-looking statements and information continually as conditions change.

Neither the Canadian Securities Exchange nor its regulation services provider accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/251048