April 27, 2023

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to provide the following activities report for the quarterly period ending 31 March 2023 (the “Quarter”).

HIGHLIGHTS

- Completion of Phase 2 drilling program at the Lana Corina Copper and Molybdenum Project with significant intersections received during the Quarter including:

- Hole CMLCD010 169m @ 1.21% CuEq1 (from 239m); and

- Hole CMLCD013 72m @ 0.91% CuEq2 (from 352m).

- High-grade molybdenum zone confirmed at depth and extended 700m down plunge:

- 35m @ 1,704ppm Mo (0.84% CuEq) (570-605m), including:

- 4m @ 8,845ppm Mo (3.48% CuEq) (589-593m); and

- 1m@ 15,000ppm Mo (6.09% CuEq) (591-592m).

- Hole CMLCD011 extended mineralisation 100m south, confirming T10 target area, with an intersection of:

- 100m @ 0.38% CuEq2 (334-434m); including:

- 28m @ 0.55% CuEq (345-373m).

- Phase 2 drilling program targeted extensions of known copper mineralisation in previously reported drilling including:

- 104m @ 0.81% CuEq in CMLCD001 from 155m3;

- 257m @ 1.10% CuEq in CMLCD002 from 170m4;

- 173m @ 1.09% CuEq in CMLCD003 from 313m5;

- 81m @ 1.16% CuEq in CMLCD005 from 302.1m6; and

- 113m @ 0.68% CuEq in CMLCD009 from 331m7.

- Lana Corina mineralised corridor extended to >3km long, with mapping and surveys confirming continuity of mineralisation to the northeast (Vista Montana Prospect)8.

- Completion of a detailed 50m by 100m geochemical survey with 321 samples taken9.

- Five new high-priority targets for copper mineralisation generated at the Vista Montana Prospect10.

- Culpeo increased its ownership of the Lana Corina Project to 20% following the satisfaction of certain conditions of the earn-in agreement11.

Operating Activities

Lana Corina Copper and Molybdenum Project

Drilling Continues to Intersect Significant Copper Mineralisation

During the Quarter, the Company completed the Phase 2 drilling program at the Lana Corina Copper and Molybdenum Project in Chile (“Lana Corina” or the “Project”).

The Phase 2 drilling program was designed to expand the mineralised footprint at the Project, which remains open in all directions and at depth. The significant results from the Phase 2 drilling program (ASX announcement 16 January 2023) include:

- 104m @ 0.74% Cu & 73ppm Mo (0.81% CuEq) in CMLCD001 from 155m3;

- 257m @ 0.95% Cu & 81ppm Mo (1.10% CuEq) in CMLCD002 from 170m4;

- 173m @ 1.05% Cu & 50ppm Mo (1.09% CuEq) in CMLCD003 from 313m5;

- 81m @ 1.06% Cu & 145ppm Mo (1.16% CuEq) in CMLCD005 from 302.1m6; and

- 113m @ 0.60% Cu & 122ppm Mo (0.68% CuEq) in CMLCD009 from 331m7.

Geochemical Survey Identifies Multiple Surface Targets at Lana Corina

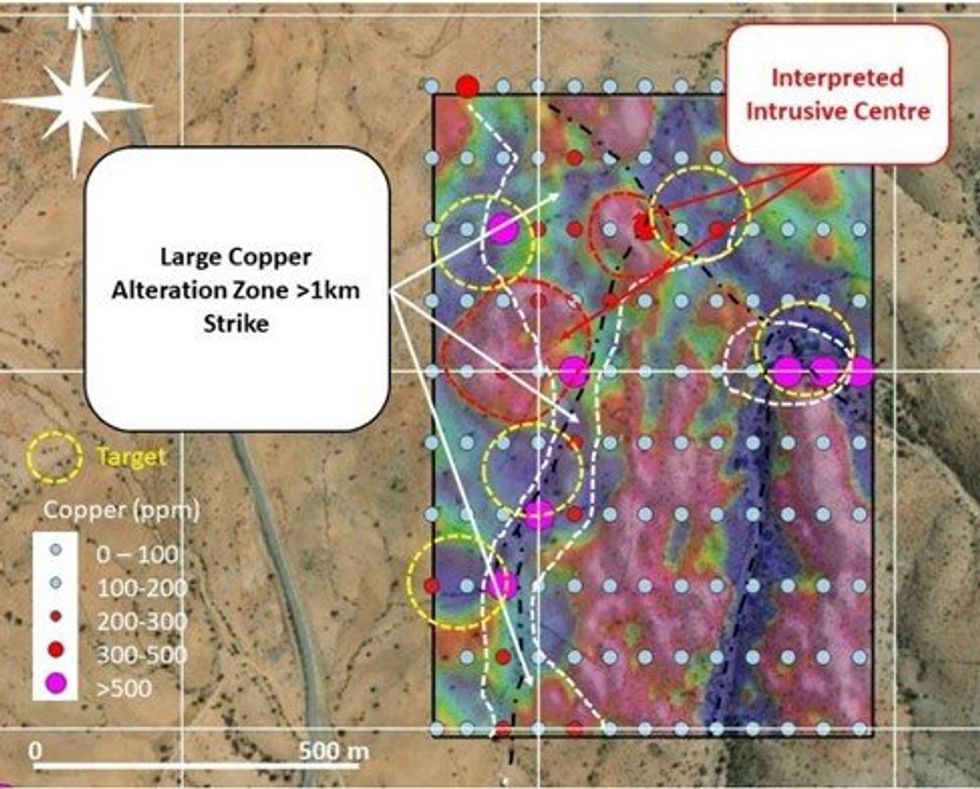

The Company completed a soil geochemical survey at the Vista Montana Prospect within the Lana Corina Project, resulting in the identification of five new high-priority targets within a >3km-long copper alteration zone defined by the geochemistry survey (Figure 1). This increases the overall strike length of the Cu-mineralised trend at Lana Corina to over 3km.

The soil geochemistry program was undertaken on a 50m x 100m grid and consisted of 321 samples in total. The results indicate that the overall pattern of the Cu, Cu + Mo, Cu/Mn and alkali elements suggest a copper bearing alteration zone is present at Vista Montana and is over three times the size of the Lana Corina mineralised zone defined from drilling to date (Figure 2).

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

2h

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drilling Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia is taking part in a ministerial meeting hosted by the US aimed at exploring a strategic critical minerals... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00