Prismo Metals Inc. (CSE: PRIZ) (OTCQB: PMOMF) ("Prismo") is pleased to announce that it has signed a definitive agreement (the "Agreement") with Infinitum Copper Corp. (TSXV: INFI) (OTCQB: INUMF) ("Infinitum") to acquire a 75% interest in the Hot Breccia porphyry copper-skarn project (the "Project" or "Hot Breccia") located in the Arizona Copper Belt which is home to some of the largest copper deposits in the world.

The Project consists of 227 mining concessions that lie about four kilometers from the historic Christmas mine which recorded production of about 481.6 Mlbs of copper from 20.2 M tons at a grade of 1.2% Cu plus significant gold and silver (Sources: Arizona Geological Society Spring Field Trip Guide in 2014). The Company has not been able to verify the production information and it is not necessarily indicative of the mineralization on the Hot Breccia property. It is believed that the Hot Breccia property may contain high grade skarn mineralization similar to that originally mined at the Christmas mine and the historical information is being used by the Company solely to plan and guide future exploration.

Dr. Gibson, President and CEO of Prismo, stated that, "This acquisition agreement gives Prismo exposure to a copper system in the world class Arizona copper belt with possible precious metal values. We anticipate beginning exploration work at the project quickly and expect to be drilling before the end of the year. Prismo has enough cash on hand to meet property payments and minimum exploration expenditures on all its projects, including Hot Breccia, through 2024."

The Project is currently subject to an Option Agreement between Infinitum and Walnut Mines LLC, a Tucson, Arizona company ("Walnut"). Walnut provided data from several drill holes completed by Bear Creek Mining, a subsidiary of Kennecott Copper Co., on a portion of the property in the 1970's and 80's. Although the data is not complete and not NI 43-101 compliant, several intercepts of high-grade mineralization were reported as detailed below.

Under the terms of the Agreement, Prismo will pay $350,000 in cash and issue 500,000 common shares of Prismo to Infinitum, in addition to assuming certain earn-in obligations of Infinitum under the Option Agreement with Walnut, in order to acquire a 75% ownership interest in Hot Breccia.

Earn-In Obligations to Walnut:

| As at | Work Commitments | Property Payments | Share Payments |

| January 31 | To be satisfied by Prismo | To be made by Prismo | To be made by Infinitum |

| 2024 | $500,000 | $165,000 | 250,000 shares |

| 2025 | $1,000,000 | $100,000 | 500,000 shares |

| 2026 | $1,750,000 | $275,000 | 875,000 shares |

| 2027 | $2,000,000 | - | 750,000 shares |

| Total | $5,250,000 | $540,000 | 2,375,000 shares |

Upon satisfaction of the earn-in obligations and the Option being exercised, Prismo and Infinitum will enter into a joint venture agreement whereby Prismo will be the initial operator of the project. After all earn-in obligations are satisfied, Prismo will have acquired 75% of the Hot Breccia Property, subject to a 2% NSR royalty to Walnut.

Kennecott drilled seven holes from 1972 to 1981 and Phelps Dodge drilled two holes on and near the current property in the same era.

All drill holes intersected hydrothermal alteration within the volcanic rocks that overlie the typically better mineralized Paleozoic carbonate rocks with increasing alteration intensity downwards. The carbonate host units have several copper intercepts reported to exceed 1% copper and elevated zinc.

Kennecott reported highlights:

OC-1: 77' with 0.54% Cu at 2,100'

OCC-7 60' of 1.4% Cu, 4.6% Zn at 2900'

OCC-8: 25' with 1.73% Cu and 0.11% Zn at 2,305' and 15' with 1.4% Cu and 0.88% Zn at 2,350'

Phelps Dodge drill hole PD 2 reported:

1,270 feet of variably mineralized skarn with several intercepts over 1% copper and a high of 3.16% copper

The source for the drill hole data above is Keating, L. DSc, CPG (2021): "The HotBx Claims, Winkelman, Pinal County, Arizona". Data package prepared for Infinitum Copper Corp. by Walnut Mines LLC.

The drill data presented in this press release is incomplete and is not qualified under NI 43-101, but is believed to be accurate. The Company has not verified the historic data presented and it cannot be relied upon, and it is being used solely to aid in exploration plans.

Drill hole data for holes from the Kennecott program

| Hole | Easting | Northing | Elev. (ft) | Azim | Incl | Depth (ft) | |

| OC-1 | 526,901 | 3,653,535 | Unknown | Vert | - | 2406 | |

| OC-2 | 526,090 | 3,653,577 | Unknown | Vert | - | +970? | |

| OC-3 | 527,117 | 3,653,763 | Unknown | Vert | - | +970? | |

| UnknownOC-5 | 525,869 | 3,653,946 | Unknown | Vert | - | +500? | |

| OCC-6 | 526,890 | 3,653,709 | 2,520 | Vert | - | 3,704 | |

| OCC-7 | 527,078 | 3,653,356 | 2,500 | Vert | - | 3,587 | |

| OCC-8 | 526,957 | 3,653,368 | 2,500 | Vert | - | 2,908 | |

Coordinates in UTM NAD27 estimated from drill logs.

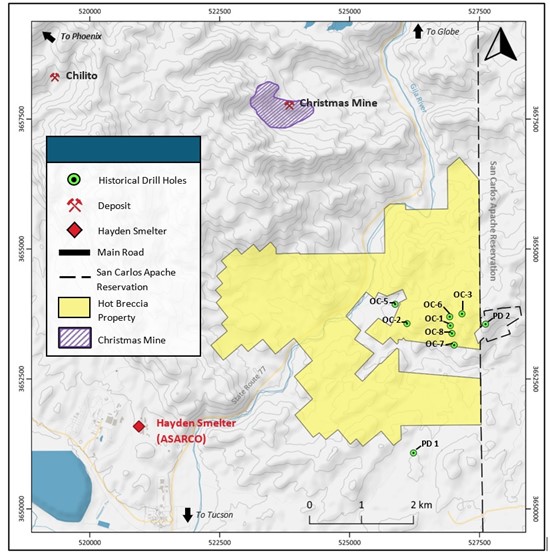

Location of the Hot Breccia property withing the southern Arizona copper belt.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7434/152847_bbd142fcf48f58f9_002full.jpg

Location of the Hot Breccia claim package southeast of the Christmas mine.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7434/152847_fig2.jpg

Cross section through the Christmas mine showing mineralized material defined by Freeport (from Arizona Geological Society Field Trip Guide, 2014)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7434/152847_fig3.jpg

Agentis Capital Mining Partners provided financial and capital markets advisory services to Prismo with regards to the transaction described herein.

Prismo Metals has entered into an agreement with LFG Equities Corp. to provide strategic advice and digital media and marketing services to the company. LFG, a Toronto-based company, will provide strategic advice, content development, media buying and distribution, and marketing services through social media channels and on-line media placements to the company. LFG's principals currently own 251,000 common shares of the Company. Under the terms of the agreement, LFG will be paid a monthly fee of $2,500 and receive 150,000 stock options in the company, each option exercisable at a price per share equal to the closing price of the Company's stock on the CSE on January 30, 2022 per share for a period of two years. The options have been granted in accordance with the terms of the Company's Long Term Incentive Plan and are subject to certain vesting conditions. Prismo will also reimburse LFG for all pre-approved expenses relating to LFG's engagement.

All references to dollars or $ in this press release are in Canadian dollars.

Dr. Craig Gibson, PhD., CPG., a Qualified Person as defined by NI-43-01 regulations and President, CEO and a director of the Company, has reviewed and approved the technical disclosures in this news release.

About Prismo

Prismo (CSE: PRIZ) is junior mining company focused on precious metal exploration in Mexico and Arizona.

ON BEHALF OF THE BOARD

Craig Gibson, Chief Executive Officer and Director

Prismo Metals Inc.

1100 - 1111 Melville St., Vancouver, British Columbia V6E 3V6

craig.gibson@prismometals.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements other than statements of historical fact, including without limitation, statements regarding the potential of the Hot Breccia project, anticipated content, commencement and exploration program results, required permitting, exploration programs and drilling, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. Although the Company believes that such statements are reasonable, by their nature, forward-looking statements involve assumptions, known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, and therefore it can give no assurance that such expectations will prove to be correct.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, the state of the financial markets for the Company's equity securities, the state of the commodity markets generally, variations in the nature, the analytical results from surface trenching and sampling program, including diamond drilling programs, the results of IP surveying, the results of soil and till sampling program. the quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the inability of the Company to obtain any necessary permits, consents or authorizations required, including CSE acceptance, for its planned activities, the inability of the Company to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, the potential impact of COVID-19 (coronavirus) on the Company's exploration program and on the Company's general business, operations and financial condition, and other risks and uncertainties. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company's mineral properties.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the CSE policies) accepts responsibility for this release's adequacy or accuracy.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/152847